- Everyday Alpha

- Posts

- When Fear Meets Fission: This Pullback Might Be Your Entry Point

When Fear Meets Fission: This Pullback Might Be Your Entry Point

Some investors have dumped this clean-tech hopeful after a massive equity raise, but not all selloffs are created equal.

Sometimes, fear hands you the kind of entry long-term believers dream about. Could that be you?

Explosive Picks Now (Sponsored)

When market volatility spikes, opportunity follows.

These 5 stocks are showing the kind of signals that often lead to 100%+ returns in the months ahead.

Get the full list — free for a limited time.

Offer ends MIDNIGHT TONIGHT.

[Download your free report now.]

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Never Miss a Stock Alert Again!

We now send our daily picks via text too — so you’ll get the same high-conviction ideas, even if you miss the email.

NANO Nuclear Energy Inc.

October 09 – Pre‑market

Ticker: NNE | Sector: Specialty Industrial Machinery / Industrials | Market Cap: ~$2.06B

30‑Second Take

Shares of this next-gen nuclear hopeful fell into freefall yesterday (Wednesday) after management announced a $400 million equity placement.

This knee-jerk selloff comes hot on the heels of days of gains, so if you're bold, this could be the opening that you've been waiting for.

The equity cash will help advance the development of the company’s microreactor technology, and while investors are fretting about dilution, let's be realistic.

NANO Nuclear isn’t yet generating revenue. Funding through equity is the only logical way forward at this stage.

All things told, this selloff looks more emotional than fundamental, and that could set up an early-stage entry point for those who believe in the nuclear microreactor story.

If you’ve been waiting for a cleaner entry into the small-reactor revolution, this might be it.

Trade Setup

Timeframe: Medium term

Edge Type: Contrarian momentum reset

After this week’s sharp drop, NNE is entering a phase where investor conviction is set to be tested.

The setup here is ideal if you’re the kind of investor who isn’t swayed by short-term panic and can see a longer-term rebound as sentiment stabilizes.

9 AI Pace (Sponsored)

The U.S.–China trade battle isn’t just about tariffs.

It’s reshaping the future of AI.

Export restrictions on advanced AI chips are forcing the industry to pivot.

And while one group of companies takes the hit, another group is stepping into the spotlight.

Our analysts just uncovered 9 AI-focused stocks ready to benefit from this seismic shift.

Strong growth, U.S. operations, and ready-to-scale infrastructure give them a unique edge.

[Claim your free copy of “Top 9 AI Stocks for This Month” here.]

Poll: Which decade do you think taught investors the hardest lessons? |

Snapshot Table

Metric | Value | Current Stance |

|---|---|---|

Price | $47.02 | Low |

52‑week range | $15.16 - $60.51 | Average |

Short interest | 27.93% | High |

Next catalyst | Microreactor development updates |

Chart

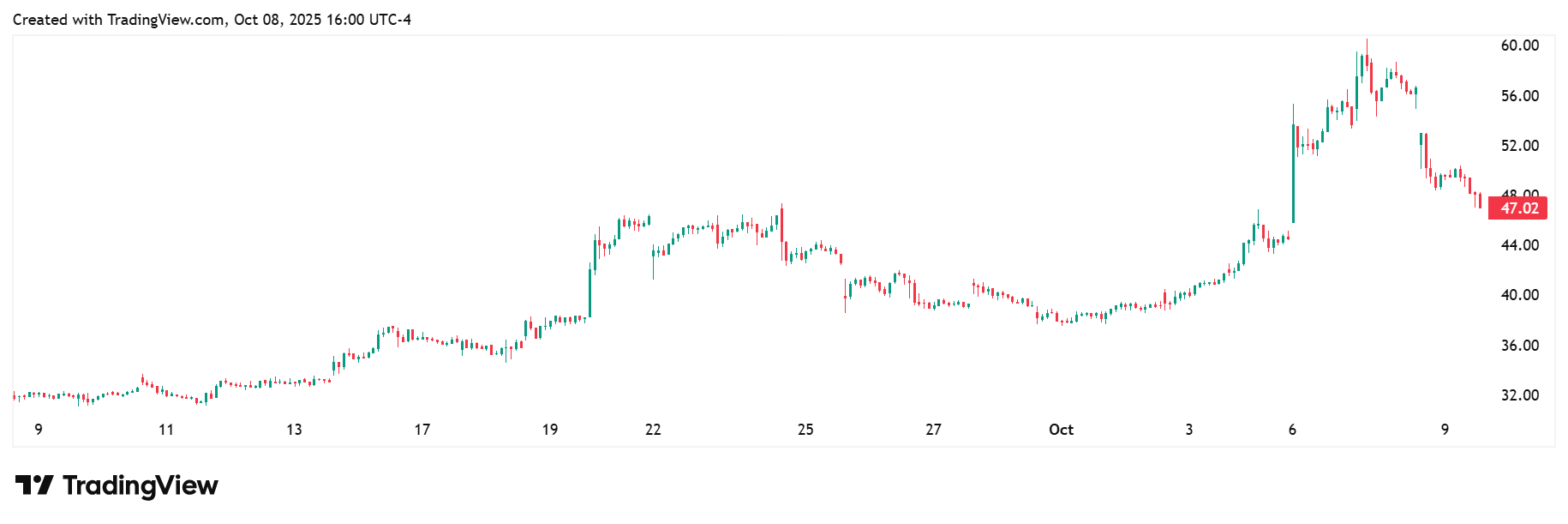

1-month trading summary: NNE has sailed through some stormy seas in the last month, and the stock price has risen and fallen with those waves.

After drifting higher through mid-September on optimism in the nuclear sector, the stock hit resistance near recent highs and began to cool off.

Momentum shifted sharply this week, with a 12.68% drop tied to the planned equity raise, leaving shares roughly 18% lower over the month.

It’s classic early-stage volatility, where enthusiasm meets funding reality.

However, that pullback could reset the risk-reward ratio and push the stock back towards bargain territory if you can look past the near-term turbulence.

Bull Case

Does this rebrand have your name written all over it? Here’s the thing. Nuclear power isn't just having a comeback; it's having a rebrand.

NANO Nuclear is part of that new wave, working on portable microreactors that are small enough to power remote sites, military bases, or entire communities off the grid.

That's the kind of technology that could revolutionize the energy industry.

The bull case? Simple: if NANO can prove out its designs and move toward commercialization, it's at the forefront of a trillion-dollar clean energy megatrend.

Sure, they’re pre-revenue, but so was every other disruptor before they changed their industry. You don’t buy this one for what it is today; you buy it for what it could become.

And if you like your bets with a dash of science fiction and a long runway, this one’s got your name written all over it.

The next leg up: The next leg up for NANO Nuclear hinges on execution and validation.

Wall Street will be watching for concrete progress on its ZEUS and ODIN microreactor prototypes, as well as any government or defense partnerships that lend credibility and funding support.

There's also the potential for DOE or military contracts, which would instantly shift sentiment from speculative to severe.

As clean energy headlines heat up heading into winter, any signal that NANO is transitioning from concept to construction could spark a fresh surge in the stock.

Price Targets: NNE has gained more than 100% year-to-date, but some analysts have been slow to react.

The current high price target is $50.00, and the low price target is $40.00.

Technical signals point to ‘buy the dip’: Technically, this chart still looks alive and kicking. The stock is trading above all its major moving averages, a rare sign of strength for a small-cap after a selloff.

The RSI sits at 69.73 (still a buy), signalling strong underlying momentum rather than weakness.

Translation? Buyers are still in control, and this pullback feels more like a reset than a retreat. If the stock can stabilize here, the setup screams “buy the dip” rather than “run for cover.”

Bear Case

Walking the bear case tightrope: No revenue, high burn. That’s the tightrope NNE walks.

The $400M raise buys time, but without commercial proof or clear timelines, the risk is dilution fatigue before meaningful progress lands.

Add in regulatory hurdles, long development cycles, and the constant need for fresh funding, and you’ve got a story that could test even patient investors.

The competitor factor: NNE is facing off against some formidable players in the advanced nuclear sector.

Think BWX Technologies, X-energy, and NuScale Power. These firms already have deeper funding, government links, and technical validation.

NANO’s edge is agility and innovation, but it’s playing in a league dominated by giants with head starts and political connections.

A bumpy road ahead: Nuclear energy may be back in vogue, but the road is still bumpy. Regulatory red tape, high upfront costs, and lengthy project timelines can hinder momentum.

Add in volatile uranium prices and shifting government priorities regarding renewables, and sentiment can shift rapidly.

Understanding the crowded trade: Nuclear has become the new buzzword in clean energy, and momentum traders have piled in fast.

That means even solid news can spark exaggerated swings as hot money chases exits. If sentiment turns, today's next big thing could become tomorrow's also ran.

Quick Checklist

✅ Thesis still valid after today’s close

✅ Volume confirms move above key levels

✅ Catalyst date double-checked (October 08, 2025)

Deep‑Dive Links

That’s all for today’s Everyday Alpha. We’ll have a new pick for you every morning before the market opens, so stay tuned!

Best Regards,

—Noah Zelvis

Everyday Alpha