- Everyday Alpha

- Posts

- When AI Met E-Commerce: This Smart Retail Engine Is Gaining Serious Traction

When AI Met E-Commerce: This Smart Retail Engine Is Gaining Serious Traction

The next wave of e-commerce isn’t about flashier websites. It’s about smarter selling.

One fast-rising player is proving that when you mix data, automation, and global reach, the results can be game-changing. Are you ready to add to cart?

Early Positioning (Sponsored)

The ROAS King of AI marketing, powering Fortune 1000 brands with predictive performance. Backed by Adobe & Fidelity Ventures.

RAD Intel’s award-winning AI predicts which ads and creators perform before brands spend a dollar. $50M+ raised, 4,900% valuation growth, Nasdaq ticker $RADI reserved.

Backed by Adobe, Fidelity Ventures, and insiders from Google & Amazon. $0.81/share pricing ends Nov 20 — lock in before the surge.

Lock $0.81 Shares

Never Miss a Stock Alert Again!

We now send our daily picks via text too — so you’ll get the same high-conviction ideas, even if you miss the email.

Pattern Group, Inc.

November 13 – Pre‑market

Ticker: PTRN | Sector: Software – Application/Technology | Market Cap: ~$3.5B

30‑Second Take

If you've been following the growing buzz around AI-powered marketing, Pattern Group is one of those names making serious noise.

It’s not a household name yet, but it’s fast gaining legendary status amongst the brands in the know.

Pattern’s platform brings together e-commerce analytics, brand management, and digital distribution into a single data-driven engine.

It’s starting to turn heads for how efficiently it scales consumer brands online.

With online retail rebounding and brands desperate for smarter, faster ways to reach customers and sell more products, Pattern’s model is stepping into the spotlight at just the right moment.

Right now, this is a story all about momentum, so you’ll need to move at a similar pace.

Trade Setup

Timeframe: Short to medium term

Edge Type: Momentum-driven swing opportunity

Pattern’s setup is all about riding the wave of accelerating sentiment.

With AI and e-commerce names back in focus, this is a clever play if you’re keen for exposure at the intersection of retail and data without chasing overextended tech giants.

Final Call (Sponsored)

Analysts just revealed 5 breakout stocks that could reshape the next market cycle.

Each one shows rare alignment of growth and momentum signals that suggest big potential upside.

The full analysis is free to download today—but only for a few more hours.

If you’ve been searching for next-generation opportunities before they go mainstream, now’s your chance.

[Download your free report instantly.]

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Trivia: Who was the first woman to head the U.S. Treasury? |

Snapshot Table

Metric | Value | Current Stance |

|---|---|---|

Price | $178.20 | Below average |

52‑week range | $12.00 - $20.10 | Below average |

Short interest | 1.90% | Below average |

Next catalyst | New brand partnerships & integrations |

Chart

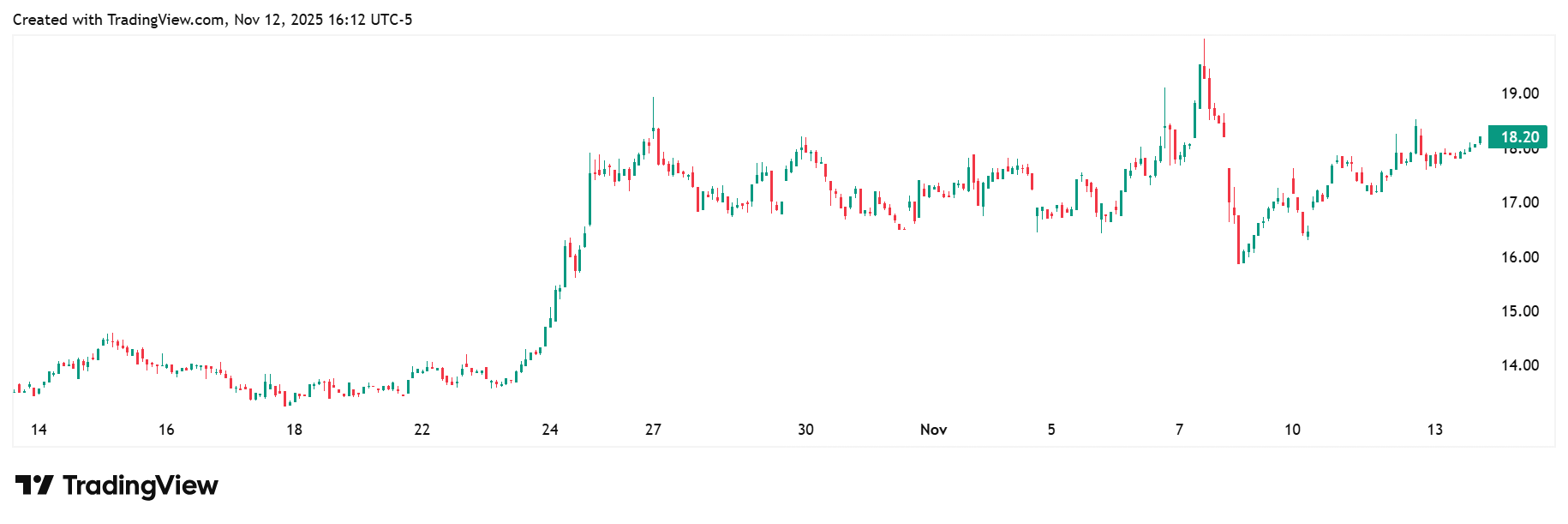

1-month trading summary: Over the past month, Pattern Group’s stock has jumped 33.07%, climbing from around $13.50 to roughly $17.93.

The surge kicked off in mid-October and gathered speed ahead of its November 5 earnings report, suggesting savvy investors were positioning early for good news (spoiler alert: they bet right).

Even with a slight dip as November rolls on, the overall trend remains strong with solid signs of renewed confidence as we move into the most crucial shopping period of the year.

Bull Case

Claiming the high ground: Pattern Group occupies an enviable position. As a platform designed to help online retailers sell more at scale, it sits at the crossroads of AI and commerce.

And that's precisely where retail growth is happening right now.

Pattern’s tech helps brands optimize pricing, marketing, and logistics across online channels using real-time data, which gives it a significant advantage in an increasingly algorithm-driven retail world.

As consumer brands battle for visibility and efficiency, Pattern is becoming the behind-the-scenes engine powering their online performance.

What makes this story exciting is how tangible the growth opportunity feels. This isn’t speculative AI; it’s applied intelligence driving measurable sales improvements.

Add in a rapidly expanding client base and a proven record of scaling brands globally, and you’ve got a business that feels both modern and grounded.

In short, it’s the kind of mix that’s rare in the current market.

Brimming with potential: The next few months are already jam-packed with potential sparks for Pattern.

Last week’s Q3 earnings report already hinted at accelerating growth, but management’s upbeat commentary on AI integration and global expansion could pave the way for an even stronger 2026 outlook.

Any new client wins or partnership announcements, particularly in high-margin consumer categories, would reinforce the idea that Pattern’s growth engine is still in high gear.

On top of that, if the broader market continues to favor AI-linked efficiency plays over pure tech bets, Pattern could see more institutional money rotate into it.

Even modest follow-through buying after earnings could be enough to push the stock to new highs, especially given the tight consolidation we're seeing now.

Price targets: The average price target is $20.78. The low is $17.00 and the high is $23.00.

Constructive tailwinds could set the scene for the next leg higher: Pattern has been trading in a tight band just below recent highs, signaling healthy consolidation rather than exhaustion.

The 14-day RSI at 57.77 supports that view. Momentum is firm but not stretched, giving bulls room to push higher without fear of overbought conditions.

The 20-day moving average is rising steadily, sitting just below current prices and acting as a natural area of support.

Bear Case

Is there a risk the shine could fade? Every good story has a few plot twists, and for Pattern, the most significant risk is that execution hiccup.

Its whole appeal rests on helping brands sell smarter and faster, but if those same brands start questioning the results or tightening budgets, the shine could fade fast.

The company’s AI engine is only as strong as the clients feeding it data, and a stumble in onboarding or retention would quickly cool the current enthusiasm.

Pattern’s got momentum now, but the fight for shelf space online is brutal.

If consumer demand softens or sentiment shifts away from growth names, this could go from breakout to breather in a hurry.

A crowded market getting even busier: Pattern’s playing in a crowded but exciting sandbox. On one side, you’ve got Shopify powering independent e-commerce, and on the other, giants like Amazon and Walmart Connect.

Then there are specialist analytics firms like CommerceIQ and Profitero, each carving out niches in the “insight-to-action” space.

Pattern competes on its hybrid model, but if the big players decide to turn up the heat or offer similar analytics tools at scale, that differentiation could shrink faster than expected.

Turbulent headwinds cast a shadow: Even the best growth stories can hit turbulence when the broader market shifts.

For Pattern, rising interest rates or any renewed pressure on consumer spending could pinch e-commerce budgets just as brands start to lean back into digital expansion.

If retail sales flatten, companies may pull back on the kind of performance tools Pattern sells, slowing its growth engine.

There’s also the wider AI hangover risk. After a year of massive enthusiasm, markets are starting to demand proof of real returns from anything AI-related.

If investors lose patience with the pace of monetization in this space, Pattern could get caught in that crossfire even if its fundamentals stay solid.

Too many passengers could make for a bumpy ride: If Pattern keeps showing up on breakout screens and AI-focused watchlists, momentum traders could pile in, making the ride a lot bumpier.

The sweet spot here is that early-stage awareness phase: enough attention to drive liquidity, not so much that it turns into a hype chase.

Keeping an eye on volume spikes and social chatter will be key. When everyone wants in, think about trimming.

Quick Checklist

✅ Thesis still valid after today’s close

✅ Volume confirms move above key levels

✅ Catalyst date double-checked (November 12, 2025)

Deep‑Dive Links

That’s all for today’s Everyday Alpha. We’ll have a new pick for you every morning before the market opens, so stay tuned!

Best Regards,

—Noah Zelvis

Everyday Alpha