- Everyday Alpha

- Posts

- Unlock High-Growth Crypto Opportunities with This Emerging Growth Play

Unlock High-Growth Crypto Opportunities with This Emerging Growth Play

The crypto mining sector is heating up, and one company is capturing attention with rapid growth and operational breakthroughs.

With double-digit growth in the last month, read on to find out why this stock should be on your radar.

Keep This Stock Ticker on Your Watchlist

They’re a private company, but Pacaso just reserved the Nasdaq ticker “$PCSO.”

No surprise the same firms that backed Uber, eBay, and Venmo already invested in Pacaso. What is unique is Pacaso is giving the same opportunity to everyday investors. And 10,000+ people have already joined them.

Created a former Zillow exec who sold his first venture for $120M, Pacaso brings co-ownership to the $1.3T vacation home industry.

They’ve generated $1B+ worth of luxury home transactions across 2,000+ owners. That’s good for more than $110M in gross profit since inception, including 41% YoY growth last year alone.

And you can join them today for just $2.90/share. But don’t wait too long. Invest in Pacaso before the opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Never Miss a Stock Alert Again!

We now send our daily picks via text too — so you’ll get the same high-conviction ideas, even if you miss the email.

Cipher Mining Inc.

September 03 – Pre‑market

Ticker: CIFR | Sector: Capital Markets / Financial Services | Market Cap: $3.2B

30‑Second Take

Why now? If you’ve been waiting for a compelling entry point to present itself with a Bitcoin adjacent status, consider Cipher Mining.

The industrial-scale data center developer is executing ahead of its expansion schedule—particularly at its pivotal Black Pearl project—and making strides in strengthening its financial foundation with a significant capital raise, resulting in a substantial increase in liquidity.

Investor interest is mounting as prominent institutions significantly tilt their portfolios toward CIFR, while analyst sentiment remains upbeat, with a strong buy consensus building.

Taken together, these developments suggest that Cipher Mining is building tangible momentum both operationally and financially, positioning it attractively for investors seeking exposure to bitcoin mining and high-performance computing infrastructure.

Trade Setup

Time frame: Swing to medium-term

Edge type: Momentum breakout

Profit Map (Sponsored)

The market rewards those who act early.

That’s why our team has just released an all-new report—5 Stocks Set to Double.

These picks were chosen because they stand out with:

Rock-solid fundamentals for confidence

In the past, this exact type of report has uncovered stocks that posted triple digit runs of +175%, +498%, even +673%.¹

The new report is free—but only until midnight tonight.

[Download your free copy here before time runs out]

Don’t just settle for growth. Aim for massive.

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

If you had to lock your money away for 20 years, where would you park it? |

Snapshot Table

Metric | Value | Current Stance |

|---|---|---|

Price | $8.33 | Below average |

52‑week range | $1.86 - $8.78 | Below average |

Short interest | 20.18% | Average |

Next catalyst | Q3 earnings, expected October - November |

Chart

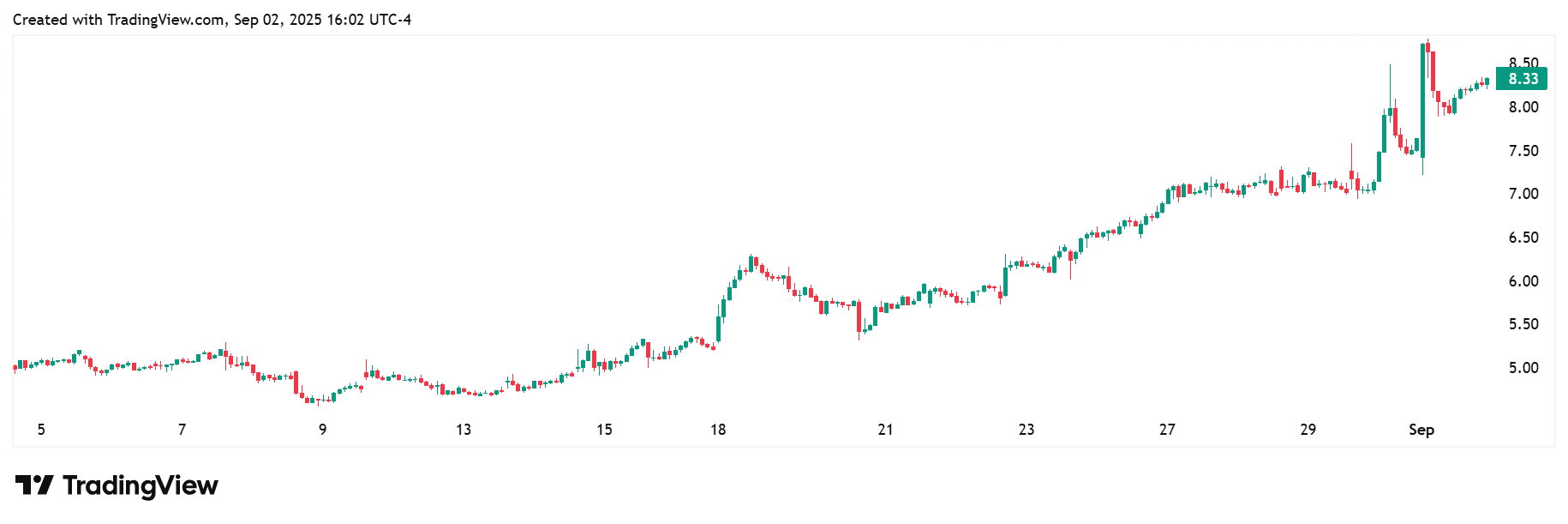

1-Month Synopsis: Over the past month, Cipher Mining has demonstrated a textbook case of earnings-driven momentum aligning with strategic execution and bullish analyst sentiment.

The stock has gained more than 66% during the period, thanks to a strong quarterly report, released early August.

The earnings served to restore investor confidence and validated management's growth narrative.

They set the stage for a broader appreciation of its scale ambitions, triggering an upward trajectory and a new all-time high of $8.78 on September 02.

This period also saw the stock given a helping hand by Canaccord’s new $9 target.

That sentiment boost likely influenced retail and institutional buyers, pushing the stock into breakout territory.

Bull Case

Core thesis: Cipher Mining develops and operates industrial-scale data centers for bitcoin mining and HPC hosting.

The company aims to be a market leader in innovation, including growth in bitcoin mining, data center construction, and as a hosting partner to the world's largest high-performance computing (HPC) companies.

Over the course of 2025, the company has emerged as one of the most compelling growth stories in the digital infrastructure space, strategically positioned at the intersection of Bitcoin mining at scale and high-performance computing.

Catalysts: Cipher has rapidly expanded its operational footprint, with Black Pearl Phase I already online ahead of schedule and a near-term ramp toward 23.5 EH/s self-mining capacity—placing it among the most efficient, cost-competitive miners in North America.

It is on track to deliver ~23.5 EH/s of additional self-mining capacity by the end of the third quarter.

At the same time, the upcoming Black Pearl Phase II infrastructure will enable it to monetize access to power quickly, whether via HPC tenants or bitcoin mining.

This operational scale is matched by a dramatically improved balance sheet, bolstered by a $172.5 million convertible note offering.

Valuation upside: The analyst price target runs from a low of $6.00 to a high of $9.00.

Technical tailwind: CIFR is enjoying a strong technical tailwind, with the stock trading above its 50- and 200-day moving averages and supported by bullish momentum across multiple indicators.

Bear Case

Key risk: The major bear case key risk for Cipher comes from the inherent volatility associated with Bitcoin markets and its capital-intensive business model as it pursues growth at scale.

Founded in 2021, Cipher’s execution capability, especially in the area of high-performance computing expansion, is also something of an unknown quality at this stage.

Any delay or regulatory roadblock could quickly erode margins, strain liquidity, and destabilize investor confidence.

Macro/sector headwinds: Cipher Mining faces a complex blend of macro and sector-specific headwinds.

These include the persistent volatility of Bitcoin prices amid broader economic uncertainty; increasingly punitive tariffs and regulatory scrutiny affecting hardware procurement; mounting competition for limited energy resources; and heightened environmental, social, and governance pressure stemming from the industry’s carbon, noise, and e-waste footprint.

These forces could well converge in a perfect storm to compress margins, raise capital intensity, and challenge the company’s expansion and profitability narrative.

Competitive threat: The Bitcoin mining landscape is hyper-competitive. Traditional rivals like Riot Platforms, Hut 8, and HIVE Digital Technologies are continually expanding capacity and optimizing efficiency, putting pressure on margins and market share.

Newer entrants and cloud-based mining platforms like ZA Miner and AIXA Miner have introduced alternative models with lower capital requirements and AI-driven operational optimization, appealing to cost-conscious investors.

Crowded-trade concern: Concentrated institutional ownership and heavy bullish positioning could lead to potential volatility.

A sudden shift in sentiment or market conditions could trigger rapid unwinding, amplifying price swings.

Quick Checklist

✅ Thesis still valid after today’s close

✅ Volume confirms move above key levels

✅ Catalyst date double-checked (September 02, 2025)

Deep‑Dive Links

That’s all for today’s Everyday Alpha. We’ll have a new pick for you every morning before the market opens, so stay tuned!

Best Regards,

—Noah Zelvis

Everyday Alpha