- Everyday Alpha

- Posts

- Time to Hit the Gas: This Underdog May Be Revving Up for a Big Run

Time to Hit the Gas: This Underdog May Be Revving Up for a Big Run

Specialty vehicles and RVs are hitting the fast lane, and so is your investment opportunity.

With strong consumer demand, resilient municipal spending, and momentum building, now's the time to consider a growth story ready to rev up your portfolio.

Market Edge Now (Sponsored)

The difference between “nice returns” and life-changing gains often comes down to timing—and information.

Our latest research has identified 5 stocks positioned for massive growth.

These companies combine strong fundamentals with technical setups that suggest the potential for explosive upside.

Past editions of this same report have included stocks that went on to gain +175%, +498%, even +673%.¹

While the past can’t predict the future, the track record speaks volumes.

For a limited time, you can download the full 5 Stocks Set to Double report—absolutely free.

[Get your free copy before midnight tonight]

Smart investors know: when the window is short, action beats hesitation.

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Never Miss a Stock Alert Again!

We now send our daily picks via text too — so you’ll get the same high-conviction ideas, even if you miss the email.

REV Group, Inc

September 16 – Pre‑market

Ticker: REVG | Sector: Farm & Heavy Construction Machinery / Industrials | Market Cap: $3.00B

30‑Second Take

This small cap is picking up speed: You know that feeling when you stumble across something solid before the crowd? That’s the vibe here.

REV Group is suddenly looking less like a sleepy industrial and more like that underrated player everyone wishes they’d bought sooner.

Revenue’s been accelerating and is up double digits in specialty and nearly 10% in RVs, while earnings growth is outpacing much of the market.

Add in strong institutional buying and the fact that small- and mid-caps are finally waking up after years on the sidelines, and this story has room to run.

You’re getting growth at a discount compared to the S&P 500, which is rare air right now.

Here’s where it gets even more interesting: small- and mid-cap stocks are finally breaking out after years of underperformance, and REVG is well placed to ride that wave.

With Wall Street waking up to its earnings power and a backdrop of renewed small-cap strength, REV Group looks like one of those under-the-radar names that could quietly crush the broader index in the quarters ahead.

If you’re looking for a name that could sneak into your portfolio and surprise to the upside, this one’s worth a closer look.

Trade Setup

Time frame: Position trade (multi-quarter hold)

Edge type: Growth-at-a-discount play

Early Entry Edge (Sponsored)

Most traders panic when markets whipsaw up and down.

The pros? They use options to turn volatility into profit.

We’ll show you how with our free ebook, Mastering Options Trading: A Beginner’s Guide.

You’ll learn strategies for capturing gains whether stocks rise, fall, or chop sideways.

Plus, discover how to generate extra income and buy top names at bargain prices.

[Claim your free copy here] and start trading like a pro.

Poll: In 50 years, what will people laugh at us for investing in? |

At A Glance

Metric | Value | Current Stance |

|---|---|---|

Price | $60.25 | Average |

52‑week range | $ 25.76 - $64.47 | Average |

Short interest | 4.87% | Above average |

Next catalyst | Q4 earnings |

Chart

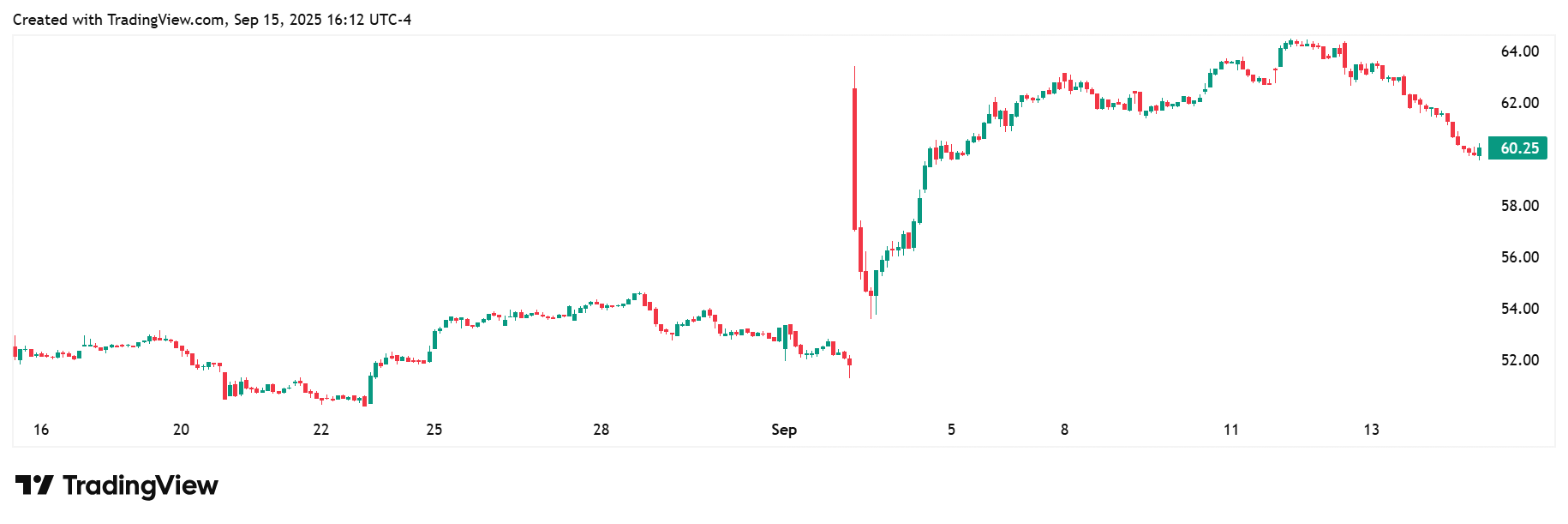

A month to remember: REV Group has been quietly ripping. Up more than 17.5% between August and September, the stock opened around $52, dipped a bit, then shot higher as investors latched onto its revenue momentum.

Unlike peers that spike and fade, this one has held those gains and that’s a clear sign that big money isn’t just flirting, it’s committing.

The climb wasn’t smoke and mirrors. An earnings beat, four straight quarters of accelerating revenue, and a top spot in its industry rankings are real reasons for optimism.

Bull Case

Revving up a growth story: REVG sits at the crossroads of durable demand and accelerating growth. With everything from fire trucks and RVs to specialty vehicles, this isn’t a one-trick pony.

Multiple profit engines and a hefty order backlog insulate it against downturns in any one segment.

Add in rising institutional ownership, and you’ve got a solid floor under the story.

The real kicker? Investors are rotating into small- and mid-caps after years of ignoring them, and REVG looks like one of the healthier names in that group.

It’s trading at lower multiples than the S&P 500, but with better earnings momentum. That’s a classic growth-at-a-discount setup.

What’s fueling REV’s momentum? REVG has the pedal to the metal with four consecutive quarters of revenue acceleration.

Net income is up 44%, plus there’s steady demand for emergency vehicles, resilient RV spending, and ongoing infrastructure projects.

Analyst upgrades and sector buzz are adding more fuel.

Valuation upside: Analyst price targets range from a low of $64.00 to a high of $68.00.

Technical tailwind: After rallying by over 99% in the last six months, REV is holding comfortably above the 20-, 50-, 100-, and 200-day moving averages.

It is trading with technical conviction, creating a momentum tailwind that could attract even more buyers as it establishes new support zones at higher levels.

Bear Case

Beware cyclical markets: Momentum only matters while it lasts. REV’s recent run is built on strong specialty and emergency vehicle orders plus steady RV demand, but (spoiler alert) these markets are cyclical.

If consumer confidence slips, if credit tightens, or if municipal budgets shrink, orders could dry up fast.

Macro headwinds are a concern: If rates stay high, RV financing slows. If inflation keeps biting into steel, labor, or supply chains, margins get squeezed.

This isn’t a party of one: While REV has execution, rivals like Thor, Winnebago, and Oshkosh have deeper pockets and wider reach. They’ll be ready to pounce if REV stumbles.

The crowded-trade problem: Institutional money is already flowing in. Great on the way up, dangerous on the way down.

Small-cap rallies can reverse just as violently when the hot money heads for the exits.

Quick Checklist

✅ Thesis still valid after today’s close

✅ Volume confirms move above key levels

✅ Catalyst date double-checked (September 15, 2025)

Deep‑Dive Links

That’s all for today’s Everyday Alpha. We’ll have a new pick for you every morning before the market opens, so stay tuned!

Best Regards,

—Noah Zelvis

Everyday Alpha