- Everyday Alpha

- Posts

- This Value Trade Refuses to Cool Off

This Value Trade Refuses to Cool Off

While much of retail still feels fragile, value-focused names are proving surprisingly resilient.

This one has already caught the market’s attention, and the setup suggests the story is far from over. Meet you at the checkout?

Next Winners (Sponsored)

After reviewing thousands of companies, analysts isolated the 5 Stocks Set to Double based on accelerating performance, improving fundamentals, and strong technical signals.

This newly released report breaks down why these five picks may be positioned for significant moves in the coming year.

While results cannot be guaranteed, past reports uncovered gains reaching +175%, +498%, and +673%.

Access is free until midnight.

See the 5 Stocks Set to Double. Free Access.

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Never Miss a Stock Alert Again!

We now send our daily picks via text too — so you’ll get the same high-conviction ideas, even if you miss the email.

Citi Trends, Inc.

December 25 – Pre‑market

Ticker: CTRN | Sector: Apparel Retail/Consumer Cyclical | Market Cap: ~340.07M

30‑Second Take

Value retail is where consumer demand is proving most resilient right now.

As prices stay elevated and spending remains selective, shoppers are trading down and hunting for value, not cutting back entirely.

That shift is already playing out on the tape. This stock is up 59.62% year to date, not on hype, but as the market slowly reprices a business that has stabilized after a tough reset.

Inventory discipline is improving, the balance sheet is cleaner, and the core customer is still spending.

Despite the rally, expectations remain reasonable for a small-cap turnaround story.

Treat this less like a blow-off move and more like the early innings of a re-rating if value retail continues to take a big share into 2026.

Trade Setup

Time frame: Medium term

Edge type: Re-rating momentum driven by value retail tailwinds

This is not a quick earnings flip.

It’s a medium-term hold built around a gradual re-rating as the market grows more comfortable with value-focused retail and the company’s operational reset.

The strong year-to-date move suggests institutional interest is building, but this still trades like a forgotten small-cap rather than a fully appreciated turnaround.

The edge comes from staying with the trend while fundamentals catch up to price, especially if consumer trade-down behaviour remains intact through 2026.

Tech Edge (Sponsored)

A rapid acceleration in AI deployment across the U.S. is creating fresh opportunities for forward-looking investors.

A free breakdown uncovers 9 companies demonstrating measurable growth and deep alignment with this next wave of AI demand.

These aren’t speculative plays—they are firms with proven traction and expanding AI footprints.

Early movers may see the greatest advantage.

Download the Free Report

Poll: How often do you check your bank balance? |

Numbers at a Glance

Metric | Value | Current Stance |

|---|---|---|

Price | $40.75 | Below average |

52‑week range | $16.82 - $49.50 | Below average |

Short interest | 5.08% | Average |

Next catalyst | Updated retail sales data |

Chart

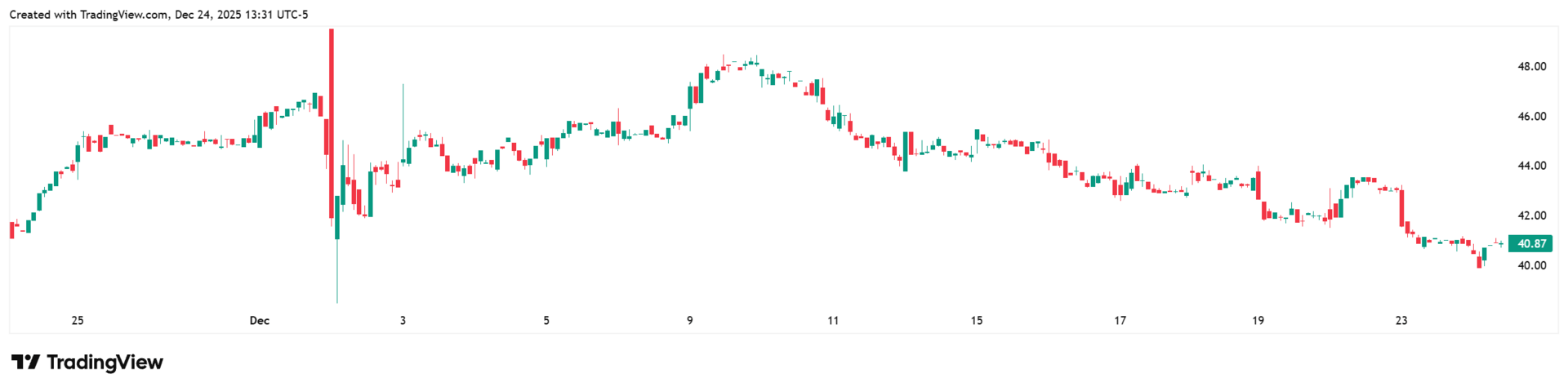

1-month trading summary: The last month of 2026 has written a story of digestion, not drama.

After pushing up towards the high-40s, CTRN cooled off and gave back some of its gains, settling into a steadier rhythm around the low-40s.

That pullback can be interpreted as healthy profit-taking rather than panic selling.

Buyers have continued to show up on dips, and the price has stayed well above the levels where this rally really began.

In plain English? This stock is catching its breath after a strong run, without losing its footing.

For a medium-term setup, this kind of consolidation is exactly what you want to see.

Bull Case

When value retail coincides with operational discipline: Citi Trends is a value retailer built for the consumer environment we’re actually in, not the one others are desperately hoping will come back stat.

As household budgets stay tight, the reality on Main Streets across America is that shoppers are prioritizing affordability, and that plays directly into this company’s sweet spot.

Management has already done the hard, unglamorous work.

Inventory is leaner, costs are more controlled, and the balance sheet is in far better shape than it was before its strategic transformation started to stick.

That sets the stage for operating leverage to work in reverse as traffic stabilizes and margins recover.

The market may still be treating this like a fragile turnaround, but the price action suggests confidence is quietly returning.

With strong sales momentum, a clear plan of action, and a management team committed to disciplined execution, City Trends just needs to keep doing what value retailers do best when times are tight: sell everyday essentials at prices people trust.

Small wins, big moves: The next leg higher doesn't need a miracle; it just needs more step-by-step progress as the transformation continues.

Improving quarterly comparable sales is the obvious one. Even modest progress here will reinforce the idea that value-focused retail is still taking share.

Margin recovery is another key driver as tighter inventory management and lower markdown pressure flow through the income statement.

On top of that, any signs of sustained consumer trade-down, especially if inflation stays sticky into next year, keep this business squarely in the right place at the right time.

Finally, continued balance sheet stability gives management flexibility, and that tends to be when small-cap retailers start to get re-rated rather than ignored.

Price targets: There's not much difference between the high and low targets, with the more pessimistic analysts setting the bar at $52.00, while the most ambitious see an upside of $59.00.

A trend in the making: Despite recent consolidation, the broader trend remains firmly intact.

The stock is holding well above its key moving averages, and the pullback has been orderly rather than aggressive.

Momentum has cooled without breaking, which is often what you see before a trend resumes.

Bear Case

When cheap stops being cheerful: This business lives on volume and discipline, not fat margins, so there’s little room for sloppy execution.

If inventory creeps up, promotions get heavier, or traffic quietly drifts lower, the market will not be patient.

Value retail works best when it’s boring and well run. If it stops being either, the stock will feel it quickly.

The discount aisle is getting crowded: Value retail is full of familiar names. Names like Ross Stores, Burlington Stores, and TJX Companies dominate off-price retail with scale and buying power.

At the lower end, Dollar General competes with the same cost-conscious shoppers for everyday essentials. The difference is expectations.

Those larger players are priced for consistency and execution at scale, but there is always the danger they’ll start to become even more aggressive on pricing if sales slide.

Even value retail can find itself swimming against the tide: Value retail is in the right place, but it is not risk-free.

Inflation may be easing, but everyday costs remain high, which keeps pressure on the core customer.

Wage growth is uneven, credit conditions remain tight, and any rise in unemployment hits discretionary spending first, even at the value end of the market.

On top of that, retail remains highly competitive, with constant pricing pressure and little room for mistakes.

If the consumer finally slows in a meaningful way, even the best-positioned value retailers will feel it.

A crowd is building in the discount aisle: Value retail has worked hard this year, and money has flowed into anything that benefits consumers trading down.

If that theme starts to look tired, or if inflation meaningfully cools and spending rotates back toward higher-end retail, this stock could get caught in a broader exit.

In that scenario, fundamentals may matter less in the short term than sentiment, and recent gains could unwind faster than expected.

Quick Checklist

✅ Thesis still valid after today’s close

✅ Volume confirms move above key levels

✅ Catalyst date double-checked (December 24, 2025)

Deep‑Dive Links

That’s all for today’s Everyday Alpha. We’ll have a new pick for you every morning before the market opens, so stay tuned!

Best Regards,

—Noah Zelvis

Everyday Alpha