- Everyday Alpha

- Posts

- This Small Cap Security Play is Turning Safety Into a High Margin Success Story

This Small Cap Security Play is Turning Safety Into a High Margin Success Story

Not every winning trade comes from the flashiest sector. Sometimes it’s the steady operators in unglamorous niches that quietly rack up the gains.

One security name is doing just that, compounding through recurring contracts, steady demand, and a chart that's starting to look interesting.

Elite Picks Revealed (Sponsored)

Imagine looking back a year from now and realizing you passed on five stocks with breakout potential.

That’s exactly what you’ll find inside the 5 Stocks Set to Double special report.

These aren’t random picks — they’ve been filtered from thousands to spotlight the few with the best chance at +100% or more in the coming year.

Past editions have uncovered life-changing moves, up to +673%¹.

Free access ends tonight, and when it’s gone, it’s gone.

Don’t let this be the one you regret missing.

[Download your free copy now]

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Never Miss a Stock Alert Again!

We now send our daily picks via text too — so you’ll get the same high-conviction ideas, even if you miss the email.

Napco Security Technologies, Inc

September 22 – Pre‑market

Ticker: NSSC | Sector: Security & Protection Services / Industrials | Market Cap: ~$1.49B

30‑Second Take

Interesting and Under The Radar

Sometimes the most interesting setups hide in unglamorous corners.

Security systems and access controls aren’t exactly cocktail-party talk, but that’s what makes this small-cap standout worth a look.

It’s been quietly outperforming the S&P, driven by recurring service revenue and steady demand from institutions that can’t afford to skimp on safety.

With earnings momentum behind it and the chart showing relative strength, this looks like a medium-term growth + momentum hold.

In other words, it’s the kind of trade that doesn’t need hype to deliver.

Trade Setup

Time frame: Short to medium term

Edge type: Growth + momentum hold

Action: NSSC has been carving out a clear uptrend while the broader market chops around, and its recurring revenue model gives the story staying power.

The setup isn’t about catching a quick pop; it’s about riding the relative strength through the next couple of earnings cycles.

When it comes to timeframe, you're looking at a sweet spot of three to nine months.

That window gives room for the earnings momentum to play out, for institutional demand to keep feeding the chart, and for any market wobble to underline the defensive side of security spending.

Options Winning Map (Sponsored)

Volatility can wreck portfolios—or create opportunity.

The difference is whether you know how to play it.

That’s why we’ve put together a simple, step-by-step guide to options trading.

Inside, you’ll find income tactics for any climate, discount stock-buying setups, and rapid-growth strategies that pros use daily.

It’s everything you need to trade smarter, not riskier.

[Grab your free guide today] and take control of market chaos.

Poll: Which emotion rules your investing the most? |

Snapshot Table

Metric | Value | Current Stance |

|---|---|---|

Price | $42.63 | Low |

52‑week range | $19.00 - $44.24 | Low |

Short interest | 7.99% | High |

Next catalyst | Growth in school safety demands coupled with enterprise investment against physical and cyber threats |

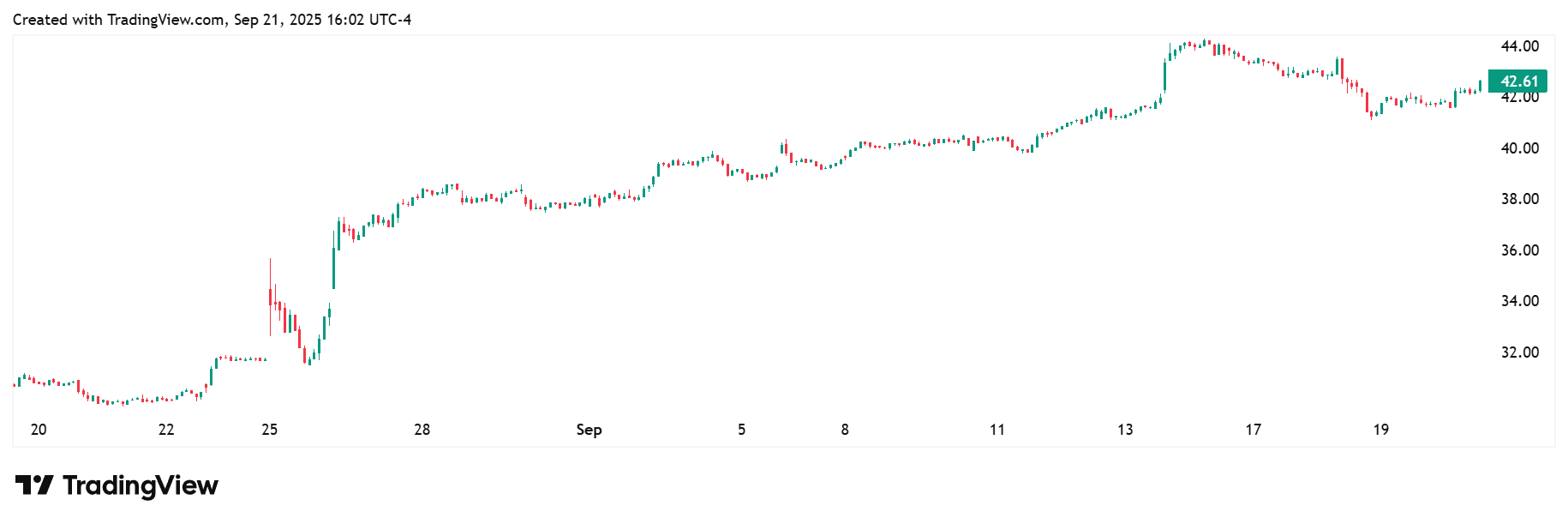

Chart

August – September trading: Napco was trading quietly in the low-$30s in early August before a surge of momentum triggered by its late-August earnings beat triggered a push towards the $44 range.

For the month overall, NSCC achieved an impressive 35.42% gain.

For investors, this period has underlined NSSC’s defensive edge and price potential, as well as its ability to surprise to the upside.

Bull Case

Holding down the fort: Napco isn’t building the next social app or AI chip.

It’s in the practical business of keeping schools, businesses, and institutions secure with the design and manufacture of alarm systems, access control, and locks.

What makes it compelling for investors is that a growing chunk of its revenue now comes from recurring service contracts, not just one-off hardware sales.

That stream is sticky, high-margin, and continues to expand at a double-digit clip. The most recent quarter showed that strength in action, with revenue and earnings both topping expectations.

Add in steady equipment sales that look to be stabilising, a strong balance sheet, and tailwinds from heightened demand for security solutions across the U.S., and the bull case is clear: this is a small-cap with defensive fundamentals and a scalable model that can quietly compound for years while the market chases flashier names.

Security will never go out of style: What really moves the needle next for this little security player is a handful of near-term sparks.

School safety has become a national talking point, and districts are under pressure to upgrade locks, alarms, and access control systems.

This is precisely the kind of gear Napco makes.

On top of that, businesses and institutions are spending more to harden their buildings against both physical and cyber threats, creating a steady stream of demand for integrated security solutions.

Layer in regulatory requirements around fire and building codes, and you’ve got a baseline of mandatory spending that doesn’t go away in a downturn.

All of this gives Napco a cushion: even if consumer-facing sectors wobble, security remains a “must-have” line item, which helps the company’s recurring revenue keep compounding and gives investors a clearer path to upside.

Analysts are upgrading their recommendations: With the Q4 FY2025 earnings comfortably beating expectations, analysts are beginning to upgrade their ratings.

The current price targets range from a low of $36.00 to a high of $45.00.

Technical tailwind: There’s a quiet but important tailwind shaping NSSC’s future trajectory: relative strength.

While plenty of small caps have been chopping sideways, Napco has been holding its ground in the low-$40s and building a solid base right above support.

That kind of consolidation after an earnings beat usually means sellers are running out of steam and buyers are quietly stepping in.

If it can push through the $43–$44 zone with volume, you've got a clean breakout setup with room to run.

In other words, the stock isn't yet flashing fireworks, but the technical backdrop is lining up for the next leg higher.

Bear Case

Sluggish sales could spook investors: Here’s the flip side of the story. For all its strength in recurring revenue, Napco still leans on hardware sales, and that side of the business has been sluggish.

If equipment demand fails to rebound, it could drag on growth and make the earnings beats harder to sustain.

Margins look great on the service stream, but they’re thinner elsewhere, so any wobble there could spook investors.

Add in the fact that this is a small-cap stock (meaning lower liquidity and sharper swings when sentiment turns), and you’ve got a setup where a few soft quarters or missed contract wins could quickly take the shine off.

In short, the risk is that the defensive narrative holds, but the growth story stalls.

Patchy supply chains and construction slowdowns: The headwinds here are more subtle than the tailwinds but just as real.

Hardware sales are still tied to the construction and real estate cycle, so if commercial building slows or financing costs stay high, the order flow can dry up fast.

Security spending may be non-discretionary in schools and government, but in smaller businesses, it often gets pushed down the priority list when budgets tighten.

Add in the fact that supply chains for electronic components remain patchy and costs can spike, and Napco doesn’t have the scale of a Honeywell or Johnson Controls to absorb those shocks easily.

In short, the macro backdrop isn’t all bad, but higher rates, construction slowdowns, and lingering supply issues could weigh on growth and blunt some of the tailwinds.

Competitive threat: The biggest competitive threat facing Napco is scale.

Giants like Honeywell, Johnson Controls, and ASSA ABLOY all play in the same sandbox with deeper pockets, broader product lines, and stronger distributor networks.

If those players push harder into the mid-market where Napco thrives, they could squeeze margins and make it tougher for Napco to win contracts or sustain growth.

Quick Checklist

The cliché classic:

✅ Thesis still valid after today’s close

✅ Volume confirms move above key levels

✅ Catalyst date double-checked (September 21, 2025)

Deep‑Dive Links

That’s all for today’s Everyday Alpha. We’ll have a new pick for you every morning before the market opens, so stay tuned!

Best Regards,

—Noah Zelvis

Everyday Alpha