- Everyday Alpha

- Posts

- This Quiet Climber Just Hit a 52-Week High — But Almost No One’s Watching

This Quiet Climber Just Hit a 52-Week High — But Almost No One’s Watching

Hello and welcome to Everyday Alpha, the daily newsletter showcasing a different stock opportunity every day the market is open. We give you laser-focused content to save you time and energy so you can make educated investment decisions quickly.

Never Miss a Stock Alert Again!

We now send our daily picks via text too — so you’ll get the same high-conviction ideas, even if you miss the email.

Armanino Foods of Distinction, Inc

July 29 – Pre‑market

Ticker: AMNF | Sector: Packaged Foods | Market Cap: ~ $264.4M

30‑Second Take

Why now? If you’re risk-tolerant and seeking long-term value from a stock with prudent financial control and a sound growth trajectory, AMNF is worth a second look.

Volume and price were both moving upwards during the last few days of trading last week, indicating that interest is building.

Q1 earnings saw Armanino reporting the highest first quarter profits in its 100+ year history, with income before taxes growing by 70% year-over-year.

The earnings release also detailed how the company was streamlining operations, outlined several successful cost-cutting measures, and floated the idea of future acquisitions and entrance into new markets to drive additional growth.

Each of these strategies is a clear indicator of a company building momentum and scaling sustainably.

Our take? This small-cap stock has sound leadership, is financially prudent, and is committed to long-term growth.

With AMNF still flying under the radar, now is an ideal time to consider getting in on the ground floor and locking in long-term value.

Strategic Edge (Sponsored)

Market volatility, policy shifts, and economic tension are leaving many investors overwhelmed.

But buried under the chaos are clear signals of opportunity — if you know where to look.

That’s why we created a free, exclusive guide highlighting 7 stocks positioned for growth as 2025 progresses.

This report includes:

Actionable research, not vague predictions

Key indicators we believe could drive momentum

Even in uncertain times, preparation separates winners from watchers.

Download your copy today and get one step closer to smarter, faster trades.

Trade Setup

Time frame: Swing to medium-term

Edge type: Momentum breakout

Snapshot Table

Metric | Value | Current Stance |

|---|---|---|

Price | $8.37 | Below average |

52‑week range | $5.35 - $8.54 | Below average |

Short interest | 0.23% | Below average |

Next catalyst | Q2 earnings, expected July - August |

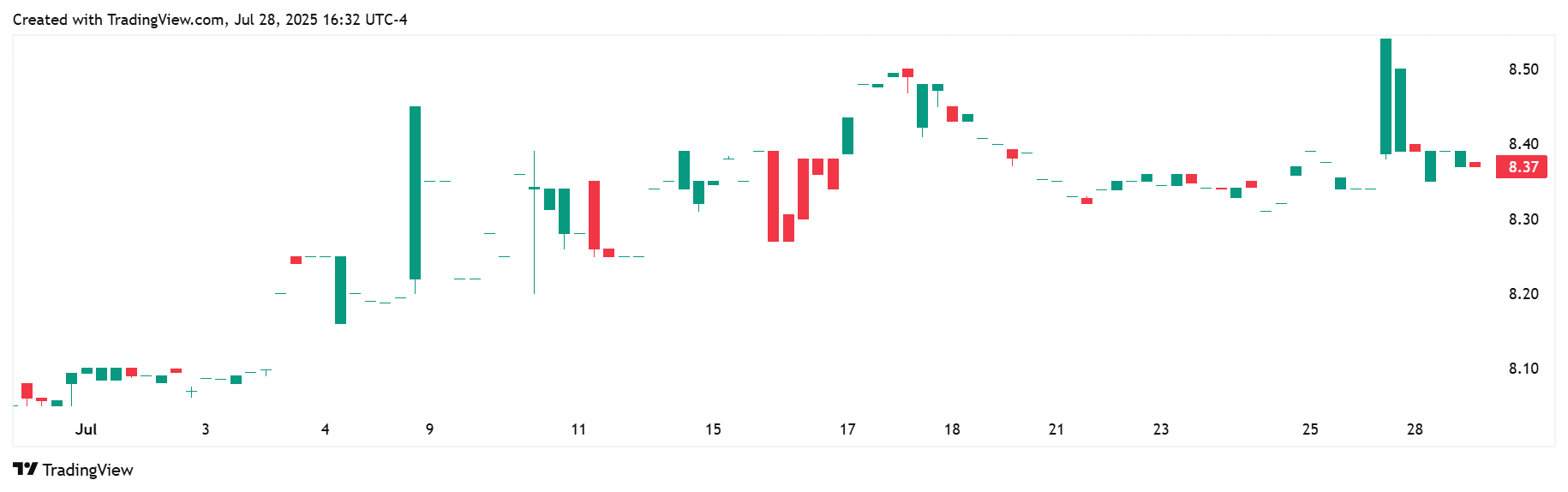

Chart

1-Month Synopsis: Over the past month, AMNF stock advanced around 4%, edging from $8.10 to $8.50 and touching a fresh 52-week high.

Trading has been solid with little volatility and picked up towards the end of the month with a spurt of interest, increase in volume and uptick in pricing.

Bull Case

Core thesis: Armanino Foods of Distinction, Inc. is a niche food manufacturer specializing in premium frozen and refrigerated Italian-inspired products for retail, foodservice, and industrial markets.

Best known for its flagship pesto sauces, the company also produces pastas, meatballs, and plant-based offerings under the Armanino brand.

Headquartered in California, Armanino combines old-world recipes with modern production to deliver quality, convenience, and flavour.

With a debt-free balance sheet, strong cash flow, and a longstanding commitment to dividend payments, the company has quietly built a loyal customer base and a track record of consistent profitability—making it a standout in the frozen specialty foods sector.

Catalysts: AMNF has increased its sales and margins over the last year, with Q1 income spiking by 70% YoY.

In addition to setting a new record for the company, this increase is made all the more impressive when considered in light of the other measures taken to control costs, trim margins, and lay the groundwork for long-term growth.

With a $12 million stock buyback program underway, a healthy operating margin of 29.5% and a new CEO confirmed, this small-cap stock is pushing to make a break from the OTC market.

Its upcoming Q2 earnings could be another decisive step in that direction.

Valuation upside: Since this stock trades OTC, there is no premium for investor analysis; however, it is projected to add around 9% over the next three months.

Technical tailwind: If you're risk-tolerant, this stock has solid fundamentals and momentum on its side.

Hidden Surge (Sponsored)

While many are busy chasing the usual AI trends, a bigger opportunity is quietly brewing—and most are missing it.

Imagine a major shift in how and where AI is built, opening up incredible wealth opportunities for those in the know.

I’ve found 9 AI companies primed to lead this change.

These aren’t the tired “AI hype” stocks; they’re companies with real US operations, proven revenue growth, and deep AI integration.

I’ve put all the details in a FREE report: "Top 9 AI Stocks For This Month."

Inside you’ll discover:

• A hidden chip maker set to power domestic AI manufacturing

• A cloud provider ready for explosive growth due to relaxed regulations

• A data analytics leader positioned to win government contracts

The smart money is watching—and once they move, these stocks could soar.

Don’t be the last to catch this wave.

Act fast - opportunity waits for no one!

Bear Case

Key risk: AMNF trades on the OTC market, meaning there's low liquidity.

This often leads to wide bid-ask spreads, making it difficult to buy or sell shares at a fair price, and increasing the potential for price slippage.

With no analyst coverage, decision-making is based on the company's own disclosures.

Macro/sector headwinds: As a food manufacturer, Armanino is heavily reliant on stable input costs related to items such as dairy and grain.

Any fluctuation in the price of those raw materials, due to inflation or trade tariffs, could put margins under renewed pressure.

Competitive threat: Despite its 100-year history, Armanino Foods of Distinction is a small player in a highly competitive and commoditized food industry, particularly in the specialty frozen and Italian-style food segment.

This makes it especially vulnerable to product innovation and price promotions from larger, well-capitalized food companies such as Nestlé and Kraft Heinz.

These larger players can undercut pricing or outcompete AMNF in shelf space, promotions, and distribution deals.

Private label growth is another consideration, with several retailers known to be increasingly promoting their own store-brand frozen and pasta products, often at lower prices.

Crowded-trade concern: AMNF has a tiny float, and insiders hold a significant portion of the stock.

If any one large investor decides to sell or rotate out, the stock could drop sharply due to the lack of buyers.

Quick Checklist

✅ Thesis still valid after today’s close

✅ Volume confirms move above key levels

✅ Catalyst date double-checked (July 28, 2025)

Deep‑Dive Links

That’s all for today’s Everyday Alpha. We’ll have a new pick for you every morning before the market opens, so stay tuned!

Best Regards,

—Noah Zelvis

Everyday Alpha