- Everyday Alpha

- Posts

- This Long Island Manufacturer is Revving up Its Growth Credentials in a Shifting Auto Market

This Long Island Manufacturer is Revving up Its Growth Credentials in a Shifting Auto Market

As the U.S. auto aftermarket evolves, select suppliers are capitalizing on rising demand and margin expansion.

Strategic product launches and shareholder-friendly moves are fueling growth momentum for this very attractive alpha stock.

Never Miss a Stock Alert Again!

We now send our daily picks via text too — so you’ll get the same high-conviction ideas, even if you miss the email.

Standard Motor Products, Inc.

August 20 – Pre‑market

Ticker: SMP | Sector: Auto Parts / Consumer Cyclical | Market Cap: $844.32M

30‑Second Take

Why now? Standard Motor Products is traveling below the radar, but the setup right now is compelling.

The company has posted three straight quarters of accelerating revenue growth, with the latest quarter showing a 27% sales increase and EPS growth of over 31%. That’s not easy to find in a cyclical, industrial-leaning business.

What makes SMP especially attractive now is valuation versus momentum.

Trading around 12x earnings, it’s priced more like a slow-growth auto supplier, yet the numbers suggest a business entering a higher-growth phase as demand for aftermarket auto parts rises.

Add in improving margins and a strong balance sheet, and you’ve got growth at a value price.

In a market chasing AI names at sky-high multiples, SMP represents an overlooked opportunity with solid fundamentals, reasonable valuation, and technical strength.

For investors looking for under-the-radar exposure with room to run, now is a smart entry point.

Growth Under Trump (Sponsored)

The new administration is already disrupting markets—and investors are watching closely.

A new report identifies 6 unexpected stocks that could surge as policy and spending shift.

These picks share traits with past winners like First Solar (+196%) and Amplify ETF (+277%) post-election.

The full list is available now, free

[Click here to access “Presidential Profits” instantly.]

Trade Setup

Time frame: Swing to medium-term

Edge type: Momentum breakout

Snapshot Table

Metric | Value | Current Stance |

|---|---|---|

Price | $38.30 | Average |

52‑week range | $21.38 - $40.18 | Average |

Short interest | 3.91% | Average |

Next catalyst | Q3 earnings, expected November 05 |

Chart

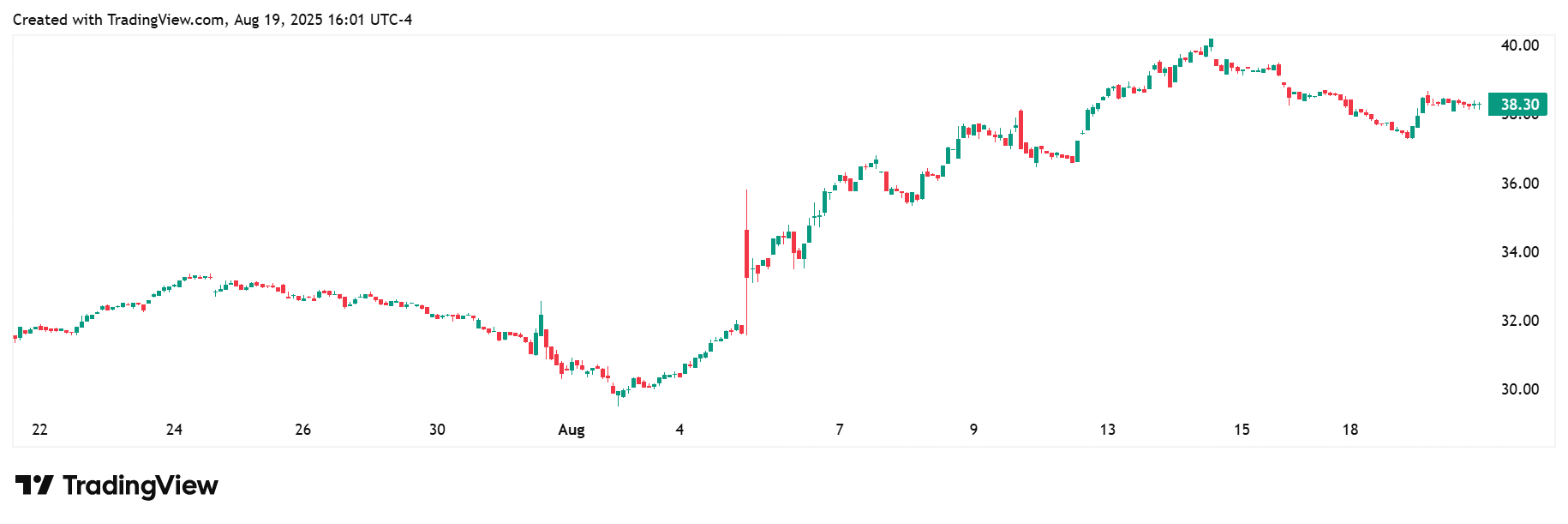

1-Month Synopsis: SMP stock has gained 22.22% in the last month, with gains powered by a late-July launch of new turbocharger kits and related components.

Early August saw a second surge, this time fueled by the Q2 earnings release, which beat analyst expectations and included an upward revision of the whole year's guidance.

The highest point of the month was on August 13, as investors digested the earnings release.

This period coincided with a new 52-week high of $40.18 and Wall Street analysts upgrading their stock guidance from a ‘buy’ to ‘strong buy’ rating, along with an 'A' grade for value.

Bull Case

Core thesis: With a legacy dating back more than a century, Standard Motor Parts has a long-established reputation for excellence.

It manufactures and distributes premium replacement parts for the automotive aftermarket and provides customizable solutions for vehicle control and thermal management.

This includes over 80,000 parts for import and domestic vehicles, covering all vehicle platforms, including gas, diesel, hybrid, and electric.

The company has more than 6,500 workers across 54 manufacturing, distribution, engineering, and office facilities located in North America, Europe, and Asia.

The Long Island City, NY firm has been largely overlooked, and it's currently undervalued for a business with accelerating growth and improving margins.

With product expansion, a disciplined balance sheet, and low institutional coverage, SMP offers investors a unique mix of value and growth.

In short, it’s a well-run industrial entering a stronger cycle at a bargain multiple, with upside as recognition and coverage catch up.

Catalysts: SMP is riding a wave of bullish momentum propelled by accelerating fundamentals and strategic execution.

It has reported three straight quarters of growth and is aggressively broadening its aftermarket footprint.

It couples operational excellence with shareholder-friendly initiatives, including a $20 million stock repurchase program.

Valuation upside: Price targets currently fit within a narrow range, which runs from a low of $45.00 to a high of $49.00.

Technical tailwind: The stock recently broke out to a new 52-week high on strong earnings momentum, supported by rising relative strength ratings and steady institutional accumulation.

Technical indicators, including moving averages and MACD, advise a buy, with further upside likely.

Fresh Insights (Sponsored)

Stock market is buzzing with opportunities, and I’ve got the insider scoop just for you.

I’ve handpicked the Top Seven Stocks for this quarter, offering you a clear roadmap for growth as the year progresses.

Here’s what makes this guide indispensable:

High-Growth Sectors: Key industries poised to boom this summer.

In-Depth Analysis: Simplified insights to make wise investment decisions.

Expert Picks: Data-driven, not just guesses, for reliable potential.

Profit-Boosting Opportunities: Position your portfolio for a strong finish in 2025.

This isn’t merely a list; it’s your chance to seize the market’s hottest opportunities before they pass you by.

Bear Case

Key risk: While SMP’s recent growth is encouraging, investors should be careful not to overstate its sustainability.

Auto parts demand is tied to macro conditions, and rising interest rates, weaker consumer spending, or a slowdown in miles driven could soften replacement part demand quickly.

The company also faces pricing pressure from larger competitors and foreign suppliers, which could eat into margins.

Another concern is cyclicality. Aftermarket parts businesses often thrive when vehicles age, but that trend can reverse as new car sales recover, leaving SMP exposed.

Macro/sector headwinds: Tariff pressures and rising input costs are significant concerns for automotive businesses of all stripes.

Levies of up to 25% are squeezing production costs, while broader economic uncertainties mean new vehicle sales and after-market demand are cloudy.

Competitive threat: Chinese manufacturers are successfully capturing significant U.S. aftermarket share by pursuing an aggressive pricing policy, often 30–60% lower than what domestic manufacturers can offer.

This is made possible by e-commerce platforms and transshipment tactics to circumvent tariffs and is the most significant competitive threat facing Standard Motor Products at this stage.

Crowded-trade concern: Trading around $38, SMP has had a strong run on recent earnings surprises, but any stumble in execution could hit shares disproportionately, given its relatively low liquidity and institutional coverage.

Quick Checklist

✅ Thesis still valid after today’s close

✅ Volume confirms move above key levels

✅ Catalyst date double-checked (August 19, 2025)

Deep‑Dive Links

That’s all for today’s Everyday Alpha. We’ll have a new pick for you every morning before the market opens, so stay tuned!

Best Regards,

—Noah Zelvis

Everyday Alpha