- Everyday Alpha

- Posts

- This Gold Royalty Powerhouse Is Beating the Market—and Most Investors Haven’t Noticed

This Gold Royalty Powerhouse Is Beating the Market—and Most Investors Haven’t Noticed

Hello and welcome to Everyday Alpha, the daily newsletter showcasing a different stock opportunity every day the market is open. We give you laser-focused content to save you time and energy so you can make educated investment decisions quickly.

Never Miss a Stock Alert Again!

We now send our daily picks via text too — so you’ll get the same high-conviction ideas, even if you miss the email.

Triple Flag Precious Metals Corp.

July 30 – Pre‑market

Ticker: TFPM | Sector: Precious Metals and Mining | Market Cap: ~ $4.8B

30‑Second Take

Why now? The precious metals sector is a major draw for investors right now as gold prices continue to set new all-time highs.

TFPM presents a stellar opportunity to increase your precious metals exposure with a strong year-to-date performance and plenty of room still to run.

The stock is up 57.76% on the year-to-date, with strong financials and earnings growth. Q1 2025 earnings jumped +82% YoY, and Q2 set a new revenue record (full Q2 results will be released on August 06 after the market closes).

With an IBD Composite Rating of 99, it’s currently in the top 1% of all stocks on a mix of earnings, sales, and margins, but it remains something of an underachiever when it comes to grabbing headlines and investor attention.

If you're keen to diversify into precious metals, TFPM is an excellent value mix with clear growth potential.

Surge (Sponsored)

Market volatility, policy shifts, and economic tension are leaving many investors overwhelmed.

But buried under the chaos are clear signals of opportunity — if you know where to look.

That’s why we created a free, exclusive guide highlighting 7 stocks positioned for growth as 2025 progresses.

This report includes:

Actionable research, not vague predictions

Key indicators we believe could drive momentum

Even in uncertain times, preparation separates winners from watchers.

Download your copy today and get one step closer to smarter, faster trades.

Trade Setup

Time frame: Swing to medium-term

Edge type: Momentum breakout

Snapshot Table

Metric | Value | Current Stance |

|---|---|---|

Price | $23.55 | Below average |

52‑week range | $13.94 - $25.45 | Below average |

Short interest | 0.61% | Below average |

Next catalyst | Q2 earnings, August 06 |

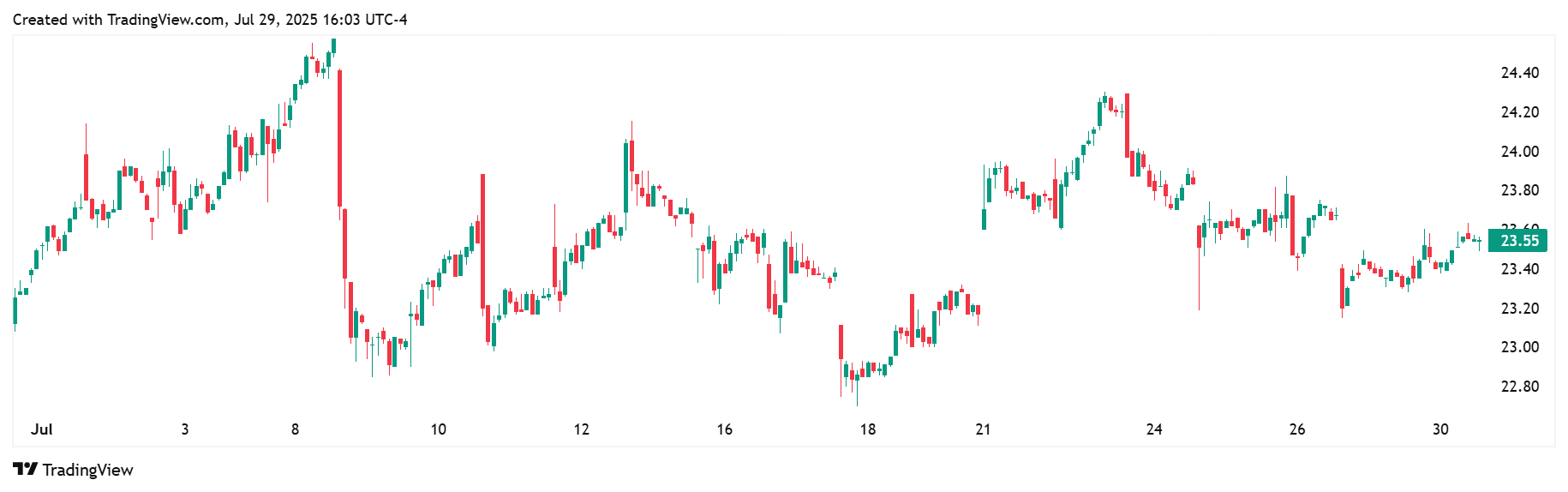

Chart

1-Month Synopsis: Stock prices have risen around 1.43% over the last month, with trading ranging from a low of $23.08 to a high of $24.57 within that period.

Despite those peaks and troughs, the TFPM has held strong support above $22 and has remained near its 52-week high range of $25 throughout.

Bull Case

Core thesis: Triple Flag Precious Metals is a precious metals royalty and streaming company.

It does not mine gold or silver itself but instead provides financing to mining companies in exchange for a percentage of their future metal production or revenues.

It currently manages over 230 assets in more than 30 countries and has partnership agreements with major miners like Barrick and Evolution Mining.

Thirty streams are currently in the production phase, with a further 207 in development or exploration.

Unlike traditional mines, TFPM has low operational and capital risk, is not subject to fluctuating costs and the risks associated with mining, and benefits from high-margin, predictable cash flows.

Catalysts: TFPM’s revenue and profits are directly tied to the price of gold and silver. With gold trading near all-time highs, Triple Flag is recording record earnings growth and revenues.

Unlike traditional miners, TFPM has fixed costs and no operating expenses at the mine level—so when metal prices rise, its profit margins expand significantly.

Both gold and silver prices have increased by more than 25% since the beginning of 2025, with gold trading above $3,400/oz and silver breaking through $35/oz.

This trend is set to continue with J.P. Morgan giving a gold price target of $3,675/oz by Q4, which could give an outsize boost to TFPM.

Valuation upside: Analyst price targets range from a low of $23.00 to a high of $29.00.

Technical tailwind: TFPM has recently staged a breakout from a flat base pattern near all-time highs, a move supported by substantial volume and price momentum.

This price action suggests the stock is attracting renewed institutional buying interest with clear potential for further upside.

Trade Shift (Sponsored)

The escalating U.S.-China trade tensions are reshaping the AI landscape.

Companies like Nvidia are facing significant revenue hits with the U.S. imposing new export restrictions on advanced AI chips to China.

This shift opens doors for U.S.-based AI companies poised to fill the gap.

I’ve identified 9 under-the-radar AI stocks with:

Deep AI integration across their core operations

Strong U.S. manufacturing capabilities

Infrastructure ready to capitalize on policy shifts

Access our FREE report, "Top 9 AI Stocks for This Month" to discover these opportunities before the broader market catches on.

Bear Case

Key risk: Triple Flag Precious Metals’ performance is closely tied to the commodities cycle. While its model is low-risk operationally, it’s not immune to external shocks or sector-wide headwinds.

Any decline in gold and silver prices, due to an unexpected dip in inflation, for example, will impact TFPM. As it has no mines of its own, the company has limited control over the underlying mining operations on which it collects royalties.

Changes in those businesses caused by factors such as strikes or operational issues will impact revenue from that stream.

Macro/sector headwinds: Flat or falling gold prices are the major headwind to monitor. If inflation cools faster than expected or the Fed cuts rates aggressively, demand for gold as a hedge may weaken.

Dollar strength or rising real yields could also pressure precious metals, compressing the stock’s royalty revenue and likely dampening investor enthusiasm.

Competitive threat: There are several other precious metals royalty and streaming companies also benefiting from the gold bull cycle.

Rivals like Franco-Nevada (FNV) and Wheaton Precious Metals (WPM) have much bigger market caps and broader portfolios with diversification across multiple precious metals.

Their size means they can pursue more aggressive growth strategies and leverage their wider reach to secure more favorable terms with miners, potentially locking out Triple Flag.

Crowded-trade concern: With the gold cycle bullish and TFPM benefiting from that upswing, the stock is likely to attract short-term momentum investors.

If gold weakens or consolidates, TFPM may sell off harder than its fundamentals justify—not due to company-specific issues, but because the trade got too crowded.

Those short-term investors are primed to make a fast exit on any change in the gold rush tide.

Quick Checklist

✅ Thesis still valid after today’s close

✅ Volume confirms move above key levels

✅ Catalyst date double-checked (July 29, 2025)

Deep‑Dive Links

That’s all for today’s Everyday Alpha. We’ll have a new pick for you every morning before the market opens, so stay tuned!

Best Regards,

—Noah Zelvis

Everyday Alpha