- Everyday Alpha

- Posts

- This Gold Producer Is Finally Getting Its Moment

This Gold Producer Is Finally Getting Its Moment

Gold is back in the spotlight, and not all winners are already crowded trades.

This is a case where higher prices meet real production, and the setup still feels early.

AI Window Closing (Sponsored)

If you own ZERO of the Next Magnificent Seven stocks.

Original Mag Seven turned $7,000 into $1.18 million.

But these seven AI stocks could do it in 6 years (not 20).

Now, the man who called Nvidia in 2005 is revealing details on all seven for FREE.

Find Out More Now Before It's Too Late.

Never Miss a Stock Alert Again!

We now send our daily picks via text too — so you’ll get the same high-conviction ideas, even if you miss the email.

Aris Mining Corporation

January 20 – Pre‑market

Ticker: ARMN | Sector: Gold/Basic Materials | Market Cap: ~$3.67B

30‑Second Take

Aris Mining is executing just as gold heats up again.

The yellow metal pushed to fresh record highs yesterday (Monday) as geopolitical risk re-entered the conversation and markets began pricing in renewed trade friction.

When gold breaks out like this, the first move is usually the metal itself. The second move is where things get interesting.

That’s when investors start looking for producers that can turn higher prices into immediate cash flow.

Aris fits that moment perfectly.

It's already profitable, already producing, and already improving margins. Every incremental move higher in gold prices hits the bottom line straight away.

The secret? It doesn’t look exciting at first glance, which creates an opportunity. No flashy exploration hype. No meme-stock energy.

Just straightforward execution in a sector where discipline matters.

Trade Setup

Timeframe: Medium term

Edge Type: Earnings leverage to rising gold prices + valuation catch-up

This is a classic paid-to-wait setup. ARMN isn’t a momentum chase or a breakout gamble.

It’s a producer with real output, real cash flow, and direct sensitivity to gold prices that are already pushing higher. That gives you earnings torque without needing anything heroic to go right.

The edge here comes from lag in expectations.

Gold Rotation (Sponsored)

Gold makes up just 0.5% of U.S. household savings, well below its historical average of 2%.

If demand simply returns to normal levels, we could see a 4X surge in gold buying.

Add to that central banks buying gold at record pace, a gold mining renaissance in America, and Warren Buffett potentially revealing a massive stake, and we’re looking at gold prices skyrocketing.

The small miners tied to new gold discoveries could see up to 100X gains.

I’ve identified the top four miners for this gold mania—get in now before the gold rush hits.

[See My Top 4 Picks for the Gold Boom]

Poll: Which cost surprises you every single time? |

Numbers at a Glance

Metric | Value | Current Stance |

|---|---|---|

Price | $18.10 | Below average |

52‑week range | $3.50 - $18.31 | Below average |

Short interest | 1.24% | Above average |

Next catalyst | Spot gold strength |

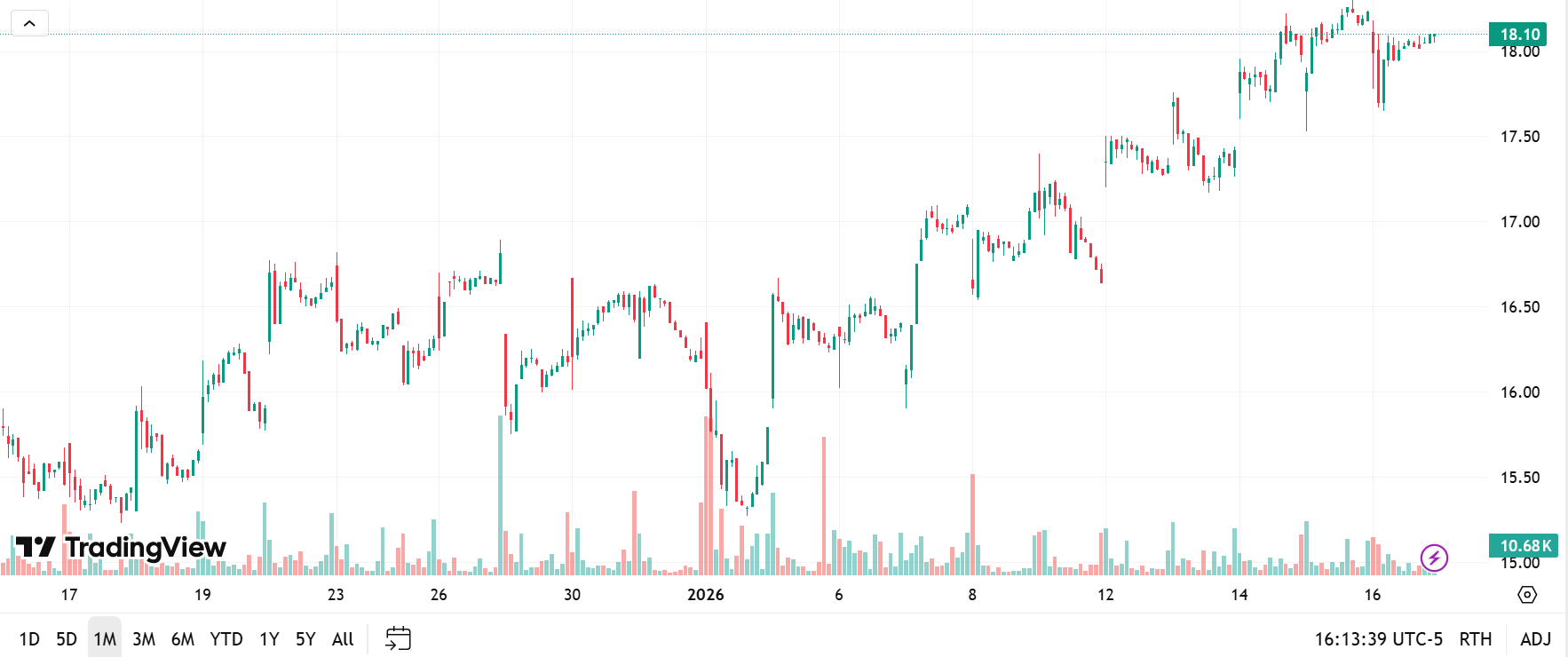

Chart

1-month trading summary: ARMN is up almost 15% over the past month, pushing toward the top end of its recent range before cooling slightly.

That pullback matters. After a strong run, the stock hasn’t unraveled or given back gains aggressively.

Instead, it’s consolidating near highs, which is often what constructive price action looks like when buyers stay in control.

In simple terms, momentum has improved, but the move doesn’t look exhausted yet.

Bull Case

Turning higher gold prices into real cash flow: Aris Mining is a leverage play on gold that doesn’t rely on hype, hope, or heroic assumptions.

This is a miner that’s already doing the hard part. It’s producing, generating cash, and steadily improving operations.

That matters because in this part of the cycle, the market is starting to reward companies that can convert higher gold prices into earnings now, not five years from now.

The upside comes from operating leverage. Costs are largely fixed, so every move higher in gold prices flows straight through to margins.

As realized prices rise, earnings power expands quickly, even if production growth remains modest.

There's also a quiet rating angle. Aris still trades like a "prove it" story, despite having moved beyond that phase operationally.

If execution continues and gold stays supportive, the multiple doesn't need to get ambitious. It just needs to stop being skeptical. That’s often where the best upside hides.

When steady execution meets a hot gold tape: Aris doesn’t need a single headline event to work. The catalysts here are cumulative, and that’s what makes them powerful.

First, higher realized gold prices.

As current spot prices flow through to quarterly results, earnings and cash flow should start surprising on the upside, even without significant production changes.

Second, continued operational consistency. Each clean quarter chips away at the market’s lingering skepticism and reinforces that this is a business, not a story stock.

Finally, capital allocation. As cash flow builds, investors will start paying closer attention to balance sheet strength, reinvestment discipline, and the optionality of shareholder returns.

None of these is flashy. Together, they're exactly how re-ratings happen.

Price targets: The current price target for ARMN is $17.00, slightly below its current trading price.

Momentum is improving without looking stretched: Aris has shifted from basing to trending over the past month, with higher highs and higher lows stacking up.

The recent pause near the top of the range is more digestion than distribution.

Volume hasn’t spiked on down days, and the stock is holding onto most of its recent gains, which suggests buyers are still in control.

If gold remains firm, the technical setup supports continuation rather than a sharp reversal.

Bear Case

Gold gives back gains or execution slips: The risk here isn’t complicated, and that’s what makes it real.

Aris Mining is working because gold prices are strong and operations are performing well. If either of those change, the story cools quickly.

A sharp pullback in gold would compress margins and take the shine off the earnings leverage investors are starting to notice.

At the same time, this is still a miner operating in a complex jurisdiction, so any operational disruption, cost inflation, or permitting friction could reignite the market’s old skepticism.

This isn’t a disaster scenario, but it is a reminder that the upside depends on discipline and a supportive tape.

Trying to outshine a sea of gold producers: Aris operates in a crowded mining landscape where capital can rotate quickly.

Peers include mid-tier producers like B2Gold, IAMGOLD, and Endeavour Mining, all of which offer scale, liquidity, and exposure to rising gold prices.

The difference is in positioning. Many of these names already reflect stronger sentiment and higher expectations.

Aris still trades like it has something to prove, which cuts both ways. It carries more execution risk, but also more room for a rerating if it keeps delivering.

When the gold tide pulls back: Gold is supportive right now, but the backdrop can change quickly.

If inflation cools faster than expected, real rates rise, or risk appetite snaps back into growth assets, gold could lose momentum. When that happens, capital often exits miners faster than it entered.

There’s also the usual sector baggage. Cost inflation, labor pressure, energy inputs, and political risk can all eat into margins, even in a strong gold environment.

Gold enthusiasm can flip fast: Gold is hugely popular again, and that’s a double-edged sword.

As more capital crowds into the trade, short-term positioning can get stretched. When that happens, even good operators can see their stocks sold indiscriminately if gold pulls back or headlines shift.

Aris Mining Corporation isn’t a poster child for speculative excess yet, but it won’t be immune if the gold trade becomes overcrowded.

This setup works best when enthusiasm builds gradually, not all at once.

Quick Checklist

✅ Thesis still valid after today’s close

✅ Volume confirms move above key levels

✅ Catalyst date double-checked (January 19, 2026)

Deep‑Dive Links

That’s all for today’s Everyday Alpha. We’ll have a new pick for you every morning before the market opens, so stay tuned!

Best Regards,

—Noah Zelvis

Everyday Alpha