- Everyday Alpha

- Posts

- This Energy Stock Is Back in Motion and It’s Not Just Riding the Oil Spike

This Energy Stock Is Back in Motion and It’s Not Just Riding the Oil Spike

Energy is back on the board, and the market is rotating fast. When that happens, refiners with real cash flow tend to move first and ask questions later.

This setup isn’t about chasing hype. It’s about owning a profitable energy business while the tape finally plays along.

Don’t Miss Out (Sponsored)

Liquidity is rising, institutions are investing, and regulations are becoming friendlier.

The foundation is set for what could be a major market move.

Investors who act now may benefit most.

A 250-page digital system reveals how to grow crypto wealth safely, without risky speculation or constant stress.

Download now and claim $788 in bonuses—including the #1 crypto pick this cycle.

Access the Crypto Guide

Never Miss a Stock Alert Again!

We now send our daily picks via text too — so you’ll get the same high-conviction ideas, even if you miss the email.

HF Sinclair Corporation

January 08 – Pre‑market

Ticker: DINO | Sector: Oil & Gas Refining & Marketing/Energy | Market Cap: ~$8.86B

30‑Second Take

Oil prices have zipped higher this week, refiners are seeing margins re-inflate, and the market is rotating back into real cash-generating businesses after months of chasing shinier stories.

HF Sinclair isn’t a wildcat driller or a levered bet on oil prices.

It’s a refiner with strong free cash flow, disciplined capital returns, and a balance sheet that gives it room to breathe even if crude cools off.

Trade Setup

Time frame: Short to medium term

Edge type: Momentum + cash flow leverage

Energy has broken out of its recent slump, and HF Sinclair is a clean way to express that move without swinging at the sector's most volatile part.

Act Now (Sponsored)

The untold, true story of how a dark financial force is quietly reshaping America’s economy—and deciding who wins and who gets wiped out.

Millions are already paying the price—12,400 daily, according to Goldman Sachs—while a small group positions themselves for massive gains.

Which side will you be on?

[Stream The Final Displacement Free]

Poll: Which time of day do you feel most like yourself? |

Snapshot Table

Metric | Value | Current Stance |

|---|---|---|

Price | $48.18 | Average |

52‑week range | $24.66 - $56.58 | Average |

Short interest | 6.86% | Average |

Next catalyst | Oil & Energy developments |

Chart

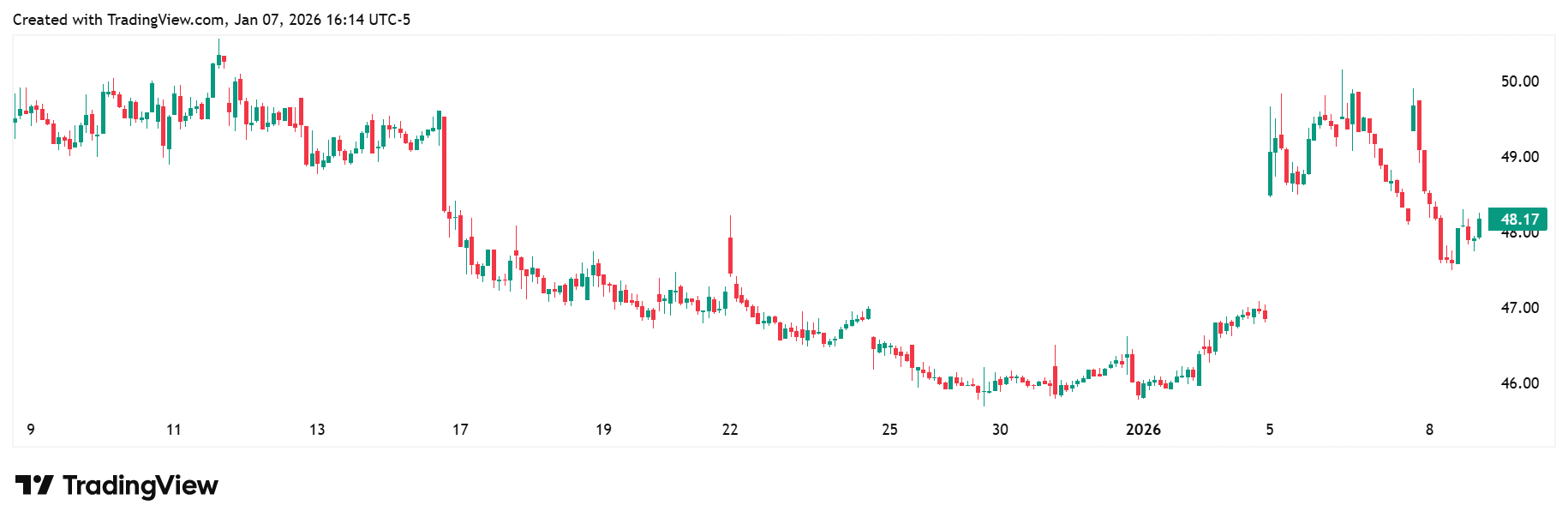

1-month trading summary: Over the past month, DINO has looked messy on the surface, but constructive underneath.

The stock slid through much of the month, drifting from the high-$40s toward the mid-$40s as energy sentiment cooled and traders lost patience.

That move shook out weak hands and reset expectations. Then, right on cue, energy woke up.

DINO snapped higher into early January, reclaiming ground quickly and reminding the market it still moves with force when the sector catches a bid.

The key takeaway isn’t the dip. It’s the response. Buyers showed up fast, volume picked up, and the stock pushed back toward recent highs instead of rolling over again.

Bull Case

Turning oil into cash, not headlines: At its core, HF Sinclair is a downstream energy business. It buys crude oil, refines it into products people use, like gasoline, diesel, and jet fuel, and sells them into the market.

No exploration risk. No drilling budgets blowing out. Just turning raw inputs into finished fuels and getting paid for the spread.

When oil prices firm and demand stays healthy, refiners don’t need perfection to win.

They benefit from wider crack spreads and better margins, which flow straight into cash generation.

HF Sinclair has proven it knows how to use that cash, returning capital to shareholders while keeping the balance sheet in good shape.

Chasing the spark: The first and most obvious catalyst is staring us in the face. Energy stocks have snapped higher this week, and if oil prices stay firm, refiners like HF Sinclair tend to feel it quickly.

Improving crack spreads translate into earnings power almost in real time, which the market is quick to price in once momentum takes hold.

The second catalyst is capital returns.

DINO has a track record of using strong cash flow for buybacks and dividends, and any signal that excess cash is building again tends to pull in income-focused and value-oriented buyers.

Price targets: There is little consensus amongst analysts, with the lowest at $53.00 and the highest notably higher at $70.00.

Technical tailwinds: Technicals are finally doing HF Sinclair a favor instead of tripping it up. After spending weeks sliding and testing investors’ patience, DINO hit a point where sellers ran out of energy.

Then the sector lit up, and this stock didn't hesitate. It popped, it held, and it stopped behaving like a name everyone wanted to avoid.

Bear Case

When energy pulls the rug: The biggest risk with HF Sinclair Corporation is unforgiving and straightforward. Energy giveth, and energy taketh away.

Refiners live and die by margins, and those can compress fast if oil prices roll over, demand softens, or the market suddenly decides it's done with energy again.

When crack spreads tighten, earnings momentum fades quickly, and sentiment can flip just as fast as it improved.

There's also a timing risk. Energy stocks love to sprint and then catch their breath.

If this recent rally proves to be another short-lived pop rather than a sustained move, HF Sinclair could slip back into chop mode, frustrating anyone who chased the bounce.

This isn’t a broken business risk. It’s a cycle risk. When energy falls out of favor, even well-run refiners get marked down without much mercy.

That’s the price of admission for this trade, and it’s why discipline on entry and position size matters.

Plenty of sharks in the tank: HF Sinclair doesn’t operate in a cozy corner of the market. It’s swimming alongside some serious heavyweights, and competition is always lurking.

Large refiners with deeper scale and broader geographic reach can put pressure on margins when capacity ramps up or demand cools.

In good times, everyone makes money. In tougher stretches, the biggest players tend to squeeze harder, and smaller refiners can feel it first.

The cycle always has the last word: Energy doesn't move in a straight line, and that's the most significant macro headwind facing HF Sinclair.

A slowdown in economic activity can hit fuel demand faster than most investors expect.

Fewer miles driven, softer freight volumes, and cautious consumers all feed straight into weaker refining margins.

Add in the ever-present risk of crude price volatility, and the backdrop can turn from friendly to hostile quickly.

There's also the sentiment swing to contend with. Energy is a sector the market loves passionately and abandons just as fast. One week, it's the only thing working.

The next capital rotates elsewhere and leaves energy names treading water.

Everyone back on the same side: After months in the wilderness, money has rushed back into energy this week, and refiners like HF Sinclair are back on traders’ radar.

That can be powerful in the early stages, but it also creates a familiar problem. When positioning fills up fast, any wobble in oil prices can trigger equally speedy exits.

Quick Checklist

✅ Thesis still valid after today’s close

✅ Volume confirms move above key levels

✅ Catalyst date double-checked (January 07, 2026)

Deep‑Dive Links

That’s all for today’s Everyday Alpha. We’ll have a new pick for you every morning before the market opens, so stay tuned!

Best Regards,

—Noah Zelvis

Everyday Alpha