- Everyday Alpha

- Posts

- This Dollar Store Cleanup Has Turned Into a Comeback

This Dollar Store Cleanup Has Turned Into a Comeback

Some retailers limp out of a rough year, others quietly rebuild and surprise the market.

This one is emerging from its messy chapter with a tighter strategy, improving trends, and a chart that's finally waking up.

Market Secret (Sponsored)

He warned of past crashes before they hit.

Now, his powerful #1 trading indicator just flashed again.

This 30-year-old signal has quietly guided traders to some of the most profitable opportunities in recent memory — and it’s triggering right now.

It doesn’t require charts, math, or guesswork.

Just one glance, and you’ll see when to buy… and when to wait.

He’s revealing it today, along with a free guide that explains exactly how it works.

Don’t wait until this move is already halfway over — see the signal while it’s still fresh.

[Get the free indicator now]

Never Miss a Stock Alert Again!

We now send our daily picks via text too — so you’ll get the same high-conviction ideas, even if you miss the email.

Dollar Tree, Inc.

November 27 – Pre‑market

Ticker: DLTR | Sector: Discount Stores/Consumer Defensive | Market Cap: ~$22.9B

30‑Second Take

Dollar Tree is stepping into 2025 with something it hasn’t had in a while: a cleaner slate.

Last year’s headaches, including elevated shrinkage, pricing transitions, and the big store optimization plan, are mainly in the rearview mirror now.

What the market is finally waking up to is the after story: a leaner footprint, clearer pricing architecture, and a business that has already absorbed most of the tough medicine.

With Family Dollar off the books and management refocusing the brand, DLTR is quietly shifting from "trouble patch" to "turnaround tailwind."

As value shoppers tighten their belts heading into the holiday stretch, this name suddenly looks far more interesting than its recent narrative suggests.

Trade Setup

Timeframe: Short to Medium Term

Edge Type: Turnaround Meets Value Momentum

With defensive retail back in favor and value-driven foot traffic rising into year-end, this setup leans into a quiet but compelling shift: a turnaround story that’s just beginning to show up on the charts.

Big Gains (Sponsored)

Every market cycle produces a select group of companies that drastically outperform the rest.

The latest screening has pinpointed the 5 Stocks Set to Double, each showing rare traits linked to early stage momentum.

These names carry the same type of indicators that have historically appeared ahead of strong rallies.

Earlier reports featured stocks that delivered +175%, +498%, and +673%.

Get the Free 5 Stocks Set to Double Report.

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Poll: Cash or card for everyday purchases? |

Snapshot Table

Metric | Value | Current Stance |

|---|---|---|

Price | $109.76 | Average |

52‑week range | $ 61.80 - $118.06 | Average |

Short interest | 9.69% | Above average |

Next catalyst | Holiday traffic trends |

Chart

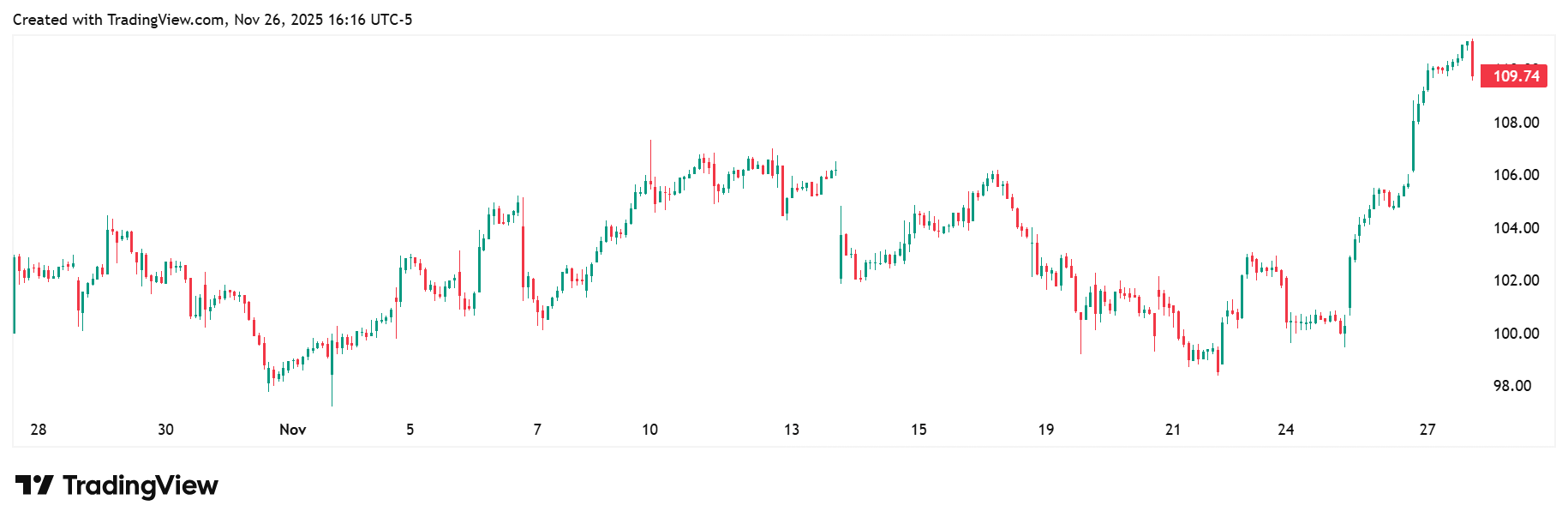

1-month trading summary: Dollar Tree has put together an impressive rebound, climbing just over 11% over the past month and reclaiming the psychologically important $110.00 level.

The stock spent early November drifting in the mid-90s to low-100s, but momentum flipped sharply in the final stretch as buyers stepped back in.

Higher lows, improving sentiment, and a decisive surge into the month-end tell a simple story.

This chart is no longer stuck in retail limbo; it's starting to behave like a turnaround that's gaining believers.

Bull Case

From Cleanup Mode to Comeback Mode: Dollar Tree is finally acting like a retailer that’s done apologizing for the past and ready to get on with the next chapter.

Management has already taken out the trash in the form of underperforming stores, and with Family Dollar off the books, DLTR suddenly looks like a far more focused operator.

This is the cleaner, tighter, more disciplined version you’ve likely been waiting for if your portfolio has a discount-store-size gap.

Let’s not forget, the value shopper is also having a moment right now.

With consumers feeling squeezed and the holiday season kicking into gear, Dollar Tree sits right where traffic naturally wants to go with low prices, predictable finds, and a simpler store model that’s easier on margins.

Add in stabilizing shrink, more rational pricing, and a leadership team that’s finally steering with both hands on the wheel, and the setup starts to look compelling.

Pushing the cart further down the aisle: Dollar Tree has a handful of near-term drivers that could keep the momentum rolling.

First, the big-store optimization hangover is fading, and the market loves a retailer that’s finally right-sized. As those closures begin to lap, comps should look cleaner, and sentiment should follow.

Holiday traffic is also swinging in DLTR’s favor.

Value shopping is back in fashion, and if management can squeeze a little extra margin from stabilizing shrink and clearer pricing tiers, the next couple of quarters could surprise on the upside.

Third, with Family Dollar out of the picture, investors can focus on the healthier core business instead of the ongoing soap opera that weighed on the multiple.

A range of price targets: There's a gulf in analysts' expectations, with the more pessimistic setting a low price target of $70.00, while the high is $135.00.

The technical tailwinds are gathering pace: The chart is definitely warming up. DLTR has climbed 11% over the past month, and the shift to steadily higher lows suggests buyers are showing up with more conviction.

Volume has improved on up days, and the price action around 109.00 looks like accumulation rather than hesitation.

In short, this technical setup supports the broader turnaround: early strength, guarded optimism, and the sense that this chart is finally waking up and gathering energy from its morning cup of coffee.

Bear Case

The gremlin still hiding in the aisles: The most significant risk for Dollar Tree is that the turnaround takes longer than investors have patience for.

Store closures, pricing resets, and the Family Dollar exit clean up the long-term story, but they don't magically fix foot traffic or margin pressure overnight.

If consumers pull back harder than expected, or if value shopping spreads across more competitors, DLTR could find itself doing all the right things… just not fast enough to impress the market.

Who’s crowding the bargain aisle? Dollar Tree doesn’t get to stroll through the value retail world unchallenged.

Dollar General is still its closest rival, and while DG has its own operational bruises, it’s been working hard to steady the ship, meaning DLTR doesn’t automatically get the “better operator” crown every quarter.

Investors compare these two the way shoppers compare bargain bins: whoever looks tidier tends to win.

Then there’s Walmart, the quiet giant that keeps nibbling at the lower-price segment with ruthless efficiency.

When Walmart decides to sharpen prices, it can make even the toughest dollar stores feel the squeeze.

And Target, while less of a direct threat on pure pricing, continues to up its value game with curated essentials that lure away more casual DLTR shoppers.

Macro mood swings: Even with a tighter business and cleaner story, Dollar Tree isn’t immune to the mood swings of the value consumer.

If inflation stays sticky in the wrong places (groceries, fuel, household essentials), shoppers might visit dollar stores more often, but they also tend to spend less per trip.

High traffic with low baskets is the retail equivalent of a treadmill: lots of movement, not much progress.

On top of that, the broader retail environment is still battling uneven consumer confidence.

Households are feeling stretched, and while that usually helps value chains, it can also cap discretionary sales, such as impulse buys and seasonal items that boost Dollar Tree's margins.

Crowding for the exit: Value retail has become a popular defensive hideout again, and if too many investors crowd into the same "turnaround + discount shopper" trade, DLTR could struggle to stand out.

If sentiment shifts or another retailer becomes the new favourite, the exit could feel narrow.

Quick Checklist

✅ Thesis still valid after today’s close

✅ Volume confirms move above key levels

✅ Catalyst date double-checked (November 27, 2025)

Deep‑Dive Links

That’s all for today’s Everyday Alpha. We’ll have a new pick for you every morning before the market opens, so stay tuned!

Best Regards,

—Noah Zelvis

Everyday Alpha