- Everyday Alpha

- Posts

- This Beauty Means Business: The Consumer Staple That’s Still Stealing the Spotlight

This Beauty Means Business: The Consumer Staple That’s Still Stealing the Spotlight

In a sector known for safe and steady, one beauty brand is rewriting the rules. It’s turning social buzz into serious earnings power, proving that even staples can sparkle under pressure.

Are you ready for your close-up on this stock?

Explosive Picks Now (Sponsored)

The market won’t wait—and neither should you.

Our research team identified 5 rare stocks positioned for explosive upside.

What’s inside this report?

Bulletproof fundamentals

Momentum building now

A clear roadmap of why they made the cut

These reports have a history of spotting triple-digit gainers.

Access is free until midnight.

[Click now to download instantly]

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Never Miss a Stock Alert Again!

We now send our daily picks via text too — so you’ll get the same high-conviction ideas, even if you miss the email.

e.l.f. Beauty, Inc.

October 14 – Pre‑market

Ticker: ELF | Sector: Household & Personal Products / Consumer Defensive | Market Cap: ~10B

30‑Second Take

If you’re behind on your celebrity gossip, let us catch you up.

ELF is the beauty brand that purchased Hailey Bieber’s cult skincare line, Rhode, earlier this summer in a $1 billion deal that spawned almost as many headlines.

Why is that relevant?

It matters because it’s helped e.l.f. Beauty maneuvers into pole position as the rock star and disruptor of the consumer staples world — blending recession-proof demand with influencer-fueled growth.

While most staples are treading water, ELF has gone from strength to strength, powered by smart brand acquisitions (like Rhode) and a cult-like Gen Z following enamored with its revolutionary cosmetics products.

Tariffs might squeeze margins in the short term, but the company’s track record of turning social buzz into real revenue makes this a rare defensive-meets-growth play.

In short, ELF isn’t just selling lipstick; it's selling momentum.

Trade Setup

Timeframe: Swing to tactical

Edge Type: Momentum + catalyst

ELF is trading just below its recent highs, with momentum building on the back of substantial brand expansion and its Rhode acquisition buzz.

The setup favors you if you’re the kind of investor looking for a near-term push as sentiment rotates back toward high-growth consumer names.

It’s not a buy-and-forget stock — this is a play on execution, hype, and a steady uptrend that still has room to run before resistance kicks in, so don’t take your eye off the ball.

AI Divide Deepens (Sponsored)

The U.S.–China trade battle isn’t just about tariffs.

It’s reshaping the future of AI.

Export restrictions on advanced AI chips are forcing the industry to pivot.

And while one group of companies takes the hit, another group is stepping into the spotlight.

Our analysts just uncovered 9 AI-focused stocks ready to benefit from this seismic shift.

Strong growth, U.S. operations, and ready-to-scale infrastructure give them a unique edge.

[Claim your free copy of “Top 9 AI Stocks for This Month” here.]

Poll: If you could own just one U.S. stock forever, which type wins? |

Numbers At A Glance

Metric | Value | Current Stance |

|---|---|---|

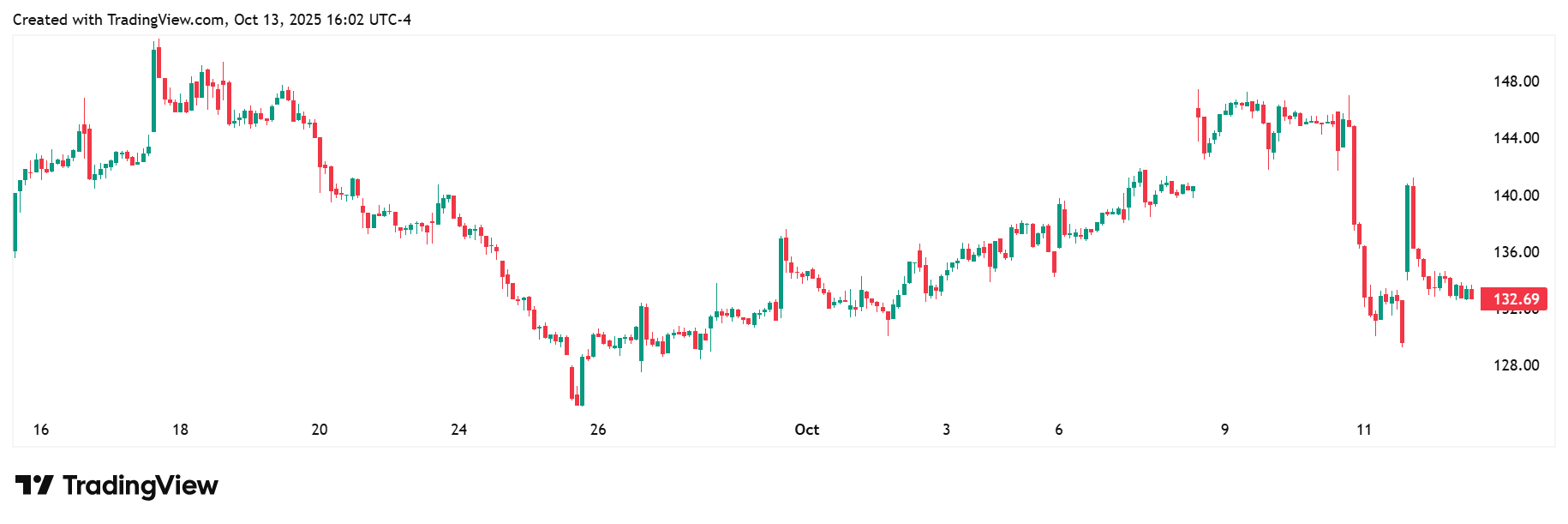

Price | $132.69 | Above average |

52‑week range | $49.40 - $150.99 | Average |

Short interest | 9.93% | Above average |

Next catalyst | Q2 FY2026 earnings, October 30 |

Chart

1-month trading summary: e.l.f. Beauty’s stock has slipped 0.59% over the past month in a mild pullback after an extended rally earlier in the year (ELF is up over 150% for the last six months).

The dip reflects some profit-taking and tariff-related jitters rather than a breakdown in fundamentals.

Trading action has been choppy but contained, with buyers stepping in near the 50-day moving average to defend support.

Despite the pause, ELF continues to exhibit strong growth signals, with analysts from JP Morgan and Goldman Sachs raising their ratings in the last couple of weeks.

Bull Case

Nimble and social media savvy looks good on ELF: Founded in 2004 and headquartered in Oakland, California, e.l.f. Beauty has built an empire on affordable, cruelty-free cosmetics that punch above their price point.

The bull case hinges on its ability to bridge the gap between mass and prestige beauty — capturing younger consumers who want trend-driven products without the luxury markup.

With a savvy marketing engine rooted in social media virality and influencer partnerships, ELF has consistently outgrown legacy rivals by staying nimble and data-driven.

The recent Rhode acquisition adds fresh star power and potential for brand synergies that could expand its reach across both retail and digital channels.

Investors bullish on ELF see it not just as a cosmetics brand, but as a scalable beauty platform with a long runway for growth and pricing power that’s rare in the staples sector.

The Rhode factor: ELF’s near-term catalyst is the integration and rollout of Rhode, Hailey Bieber’s viral skincare brand, which could significantly expand its presence in the premium segment and attract a wider Gen Z audience.

The company’s continued international expansion — particularly in Europe and Asia — is another growth lever, supported by rising demand for affordable luxury beauty.

On the financial side, upcoming quarterly results will offer a litmus test for how well ELF is navigating tariff headwinds and cost pressures.

Any margin resilience or revenue surprise could ignite fresh momentum.

Price Targets: Analysts see enormous upside potential for ELF. The current low is $128.00 with a high price target of $170.00. The average is $150.79.

Technical tailwinds: ELF is flashing strong buy signals. It is trading above its key moving averages, and the RSI is hovering near 55, signalling steady momentum and strong dip-buying support.

Bear Case

Key risk: Here’s the thing; even great brands can hit a wall. For ELF, that wall could be margin pressure.

Tariffs and rising production costs are already nibbling at profits, and with much of its manufacturing tied to China, there’s only so much wiggle room.

Add in a consumer base that’s starting to tighten its purse strings, and suddenly even beauty staples can feel a bit… well, discretionary.

Swimming with sharks: ELF might be winning the social media game, but it’s swimming with sharks.

Heavyweights like L’Oréal and Estée Lauder have global scale, supply chain muscle, and the marketing budgets to crush smaller rivals if they decide to chase the same demographic.

Meanwhile, indie names like Rare Beauty and Glossier are also eating into ELF’s market share with trendy branding and direct celebrity pull.

In a beauty market where loyalty can shift with the next viral post, even a slight stumble in innovation or pricing could quickly lead to ELF being outshone.

Effortless glam or uphill struggle? Let’s be real. Even lipstick stocks can lose their shine when the economy tightens up.

Inflation’s still eating into wallets, and consumers are getting pickier about what’s a “need” versus a “nice-to-have.”

Tariffs and freight costs aren’t doing ELF any favours either, squeezing margins just as shoppers start hunting for cheaper dupes.

Add a strong dollar into the mix, and global expansion suddenly feels more uphill than glam.

The beauty business might look glossy on the surface, but right now, it’s taking some heavy macro touch-ups to stay picture-perfect.

Respect the risk: If earnings disappoint or management tones down guidance, the sell-off could be quick and unforgiving. In short: love the brand, respect the risk.

Quick Checklist

✅ Thesis still valid after today’s close

✅ Volume confirms move above key levels

✅ Catalyst date double-checked (October 13, 2025)

Deep‑Dive Links

That’s all for today’s Everyday Alpha. We’ll have a new pick for you every morning before the market opens, so stay tuned!

Best Regards,

—Noah Zelvis

Everyday Alpha