- Everyday Alpha

- Posts

- The Retail Rocket Turning Heads Ahead of Holiday Shopping Season

The Retail Rocket Turning Heads Ahead of Holiday Shopping Season

This retail powerhouse has turned in a very impressive performance in the last six months, but its brightest days could well be ahead as the all-important festive season beckons.

Precision Picks Inside (Sponsored)

Markets don’t wait.

The biggest moves often start quietly — and only those who act early benefit.

That’s why we’ve just released a brand-new FREE report: 7 Best Stocks for the Next 30 Days.

These aren’t random picks.

Less than 5% of all companies met the strict criteria to make this list.

Each stock was carefully screened for earnings strength, momentum, and catalysts that could spark fast gains.

[Download your free copy now] and see the 7 stocks set to lead.

Never Miss a Stock Alert Again!

We now send our daily picks via text too — so you’ll get the same high-conviction ideas, even if you miss the email.

Five Below, Inc.

October 21 – Pre‑market

Ticker: FIVE | Sector: Specialty Retail/Consumer Cyclical | Market Cap: ~$8.5B

30‑Second Take

If you’ve been watching retail lately, Five Below isn’t just finding its groove again, it’s been sprinting.

The stock’s up more than 128% in six months, fuelled by stronger traffic, cleaner inventories, and a growing chorus of analysts betting on a blockbuster holiday season.

What’s driving it? Smart merchandising, steady cost control, and a bold expansion plan that’s paying off.

While some retailers are still trimming sails, Five Below is full speed ahead, so this is a moment to take notice.

Trade Setup

Timeframe: Short to medium term

Edge Type: Momentum trade with technical rebound edge

FIVE is riding a wave of positivity and the holiday shopping tailwinds are ahead. If you were to invest now, you could ride this high towards the next resistance zone before year-end.

Last Chance (Sponsored)

The market’s been good — but “good” isn’t enough if you want to build real wealth.

A team of veteran analysts has just released a brand-new report: “5 Stocks Set to Double.”

After screening thousands of companies, only five passed their strict criteria for potential +100% or more gains in the year ahead.

While past results don’t guarantee future gains, previous reports using this same strategy have uncovered stocks that delivered +175%, +498%, even +673%.

This opportunity won’t stay open for long — access ends at midnight tonight.

Get your free copy of “5 Stocks Set to Double” before it’s gone.

Start the next year positioned for serious upside.

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Poll: When do you actually read financial news? |

Snapshot Table

Metric | Value | Current Stance |

|---|---|---|

Price | $156.22 | Above average |

52‑week range | $52.38 - $157.54 | Above average |

Short interest | 5.81% | Above average |

Next catalyst | Expansion into Pacific Northwest in November |

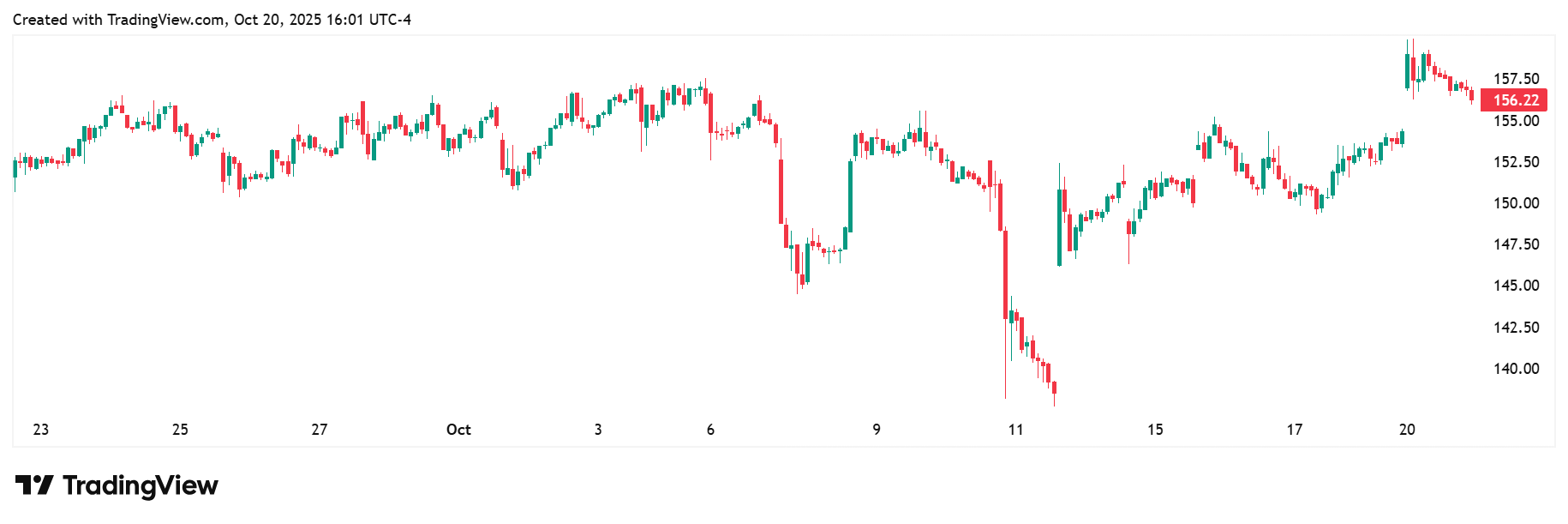

Chart

1-month trading summary: It’s been a calm, controlled month for Five Below, with shares inching up 3.81% and holding steady near the 52-week high.

A slow and steady step up has characterized the month, with a lack of dramatic moves meaning there’s been no volatility to speak of.

What we have seen is firm support around the $150 mark, suggesting confidence rather than hype.

This one feels less like you’re chasing momentum and more like you’ve landed on a stock quietly setting up for its next leg higher.

Bull Case

A low-cost treasure-hunt model to keep shoppers shopping: Here’s the thing about Five Below. As a discount retailer, it thrives when higher end rivals are reporting sluggish sales figures and tightening their belts.

With inflation still shaping how people spend, shoppers are trading down but still want small treats, and that’s exactly where Five Below shines.

Its treasure-hunt model and ultra-low price points keep traffic flowing, even when cash is tight and consumers are exasperated with persistent high prices.

Management has been smart about scale: expanding stores, upgrading merchandising, and leaning into seasonal categories just as we head into the all-important holiday stretch.

Add in improving same-store sales trends and operational discipline, and you’ve got a retailer that’s not just surviving the squeeze, it’s quietly setting up to outperform.

Gearing up for a profitable holiday season: The next few months could bring several sparks for Five Below.

First up, the holiday shopping season (historically one of FIVE’s key revenue drivers) is expected to show strong demand for low-cost gifting and décor, right in Five Below’s wheelhouse.

Just before that, it will open eight new stores across Oregon and Washington, marking its first ever expansion into the Pacific Northwest.

Next, the company’s Q3 earnings report, due in early December, could confirm whether improving foot traffic is translating to stronger margins.

Investors will also be watching new store openings under the “Five Beyond” format, which tests higher-ticket items and could boost average transaction values.

Finally, any upbeat commentary on 2026 expansion plans or digital initiatives could be the nudge that pushes the stock higher into year-end.

Price targets: There’s a high target of $190.00 and a low of $90.00.

Technical signals indicate bullish momentum: Five Below is trading above its 50-, 100-and 200-day moving averages, signalling steady bullish momentum.

The RSI sits in the high-60s, so there’s healthy strength without tipping into overbought territory.

Bear Case

Keeping a close eye on budgets: The main risk for Five Below is that its budget-conscious customer base could retreat if inflation sticks around longer than expected and household spending slows into winter.

Even a small dip in discretionary spending can hit traffic hard at the value end of retail. Add in higher freight and labour costs that could pinch margins, and the setup becomes fragile.

If holiday sales underwhelm or management trims guidance, the rebound story would be impossible to maintain.

The discount and value retailer battle: Five Below goes toe-to-toe with a wide range of discount and value retailers (think Dollar Tree, Dollar General, and TJX Companies).

While those peers cater to similar budget-conscious shoppers, Five Below targets a younger demographic with trend-driven products, giving it a niche edge.

That said, competitors like Dollar Tree and TJX have deeper scale and stronger international presence, meaning Five Below must keep innovating and expanding to hold its ground – not easy when the majority of products are priced between $1-$5.

Walking a tightrope, on a budget: Retail’s still walking a tightrope. Consumers are feeling a bit of relief from inflation granted, but they’re not exactly throwing money around right now.

The broader discretionary sector’s been choppy, with mixed signals from recent retail sales data and uneven foot traffic across categories.

Add in higher wage and shipping costs nibbling at margins, and it’s clear this isn’t an easy sector to navigate.

For Five Below, the trick will be keeping that “fun on a budget” magic alive even as shoppers get a little more selective with every dollar they spend.

Chasing momentum: FIVE’s recent strong performance and positive momentum is one thing, but it comes with a ‘too many cooks in the kitchen’ risk too.

If too many short-term players pile in expecting a holiday pop, solid results could trigger profit-taking instead of a breakout.

Quick Checklist

✅ Thesis still valid after today’s close

✅ Volume confirms move above key levels

✅ Catalyst date double-checked (October 20, 2025)

Deep‑Dive Links

That’s all for today’s Everyday Alpha. We’ll have a new pick for you every morning before the market opens, so stay tuned!

Best Regards,

—Noah Zelvis

Everyday Alpha