- Everyday Alpha

- Posts

- The Luxury Reseller That’s High Risk, Improving Fast, and Priced for Doubt

The Luxury Reseller That’s High Risk, Improving Fast, and Priced for Doubt

This beaten-down consumer name is quietly rebuilding credibility. Execution is improving, sentiment is shifting, and the upside could be asymmetric for investors willing to embrace volatility.

This is not a safe stock, and it isn’t pretending to be. But when a high-risk business starts doing the right things, the market can change its mind faster than most expect. Does this one suit your portfolio?

New Playbook (Sponsored)

A dramatic transformation in the financial system is creating unprecedented wealth—but most Americans aren’t ready.

Traditional investing strategies may leave you behind.

Analysts who predicted past market crashes say a unique opportunity is forming right now.

One-person companies and innovative approaches are generating massive gains faster than ever before.

Access the Free Briefing

Never Miss a Stock Alert Again!

We now send our daily picks via text too — so you’ll get the same high-conviction ideas, even if you miss the email.

The RealReal, Inc.

January 02 – Pre‑market

Ticker: REAL | Sector: Luxury Goods / Consumer Cyclical | Market Cap: ~$1.8B

30‑Second Take

The RealReal has spent years being written off as a broken growth story. Cash burn, margin pressure, and constant resets crushed investor confidence.

That skepticism is still baked into the stock today, which is exactly why the opportunity exists.

What’s changed is operational discipline. The business is showing clearer progress on margins, cost control, and unit economics, while demand for authenticated luxury resale remains structurally intact.

This is no longer a “grow at any cost” story. It’s a credibility rebuild story.

What we’re looking at here is a speculative turnaround with momentum potential. High risk, yes. But when sentiment flips on names like this, it rarely does so quietly.

Trade Setup

Time frame: Medium term

Edge type: Speculative turnaround with sentiment momentum

This is a medium-term opportunity because the upside depends on a sequence of proof points rather than a single catalyst.

If execution stays on track, the market can continue to reprice the business higher as confidence rebuilds.

That said, this is not a long-term sleep-at-night compounder, nor is it a short-term day trade.

The sweet spot is staying positioned while the story improves, then reassessing once expectations begin to look stretched.

Early Signals (Sponsored)

A dramatic transformation in the financial system is creating unprecedented wealth—but most Americans aren’t ready.

Traditional investing strategies may leave you behind.

Analysts who predicted past market crashes say a unique opportunity is forming right now.

One-person companies and innovative approaches are generating massive gains faster than ever before.

Access the Free Briefing

Trivia: What happens legally to unclaimed property after a set time? |

Snapshot Table

Metric | Value | Current Stance |

|---|---|---|

Price | $15.78 | Below average |

52‑week range | $4.61 - $16.41 | Below average |

Short interest | 26.92% | Above average |

Next catalyst | Q4 earnings |

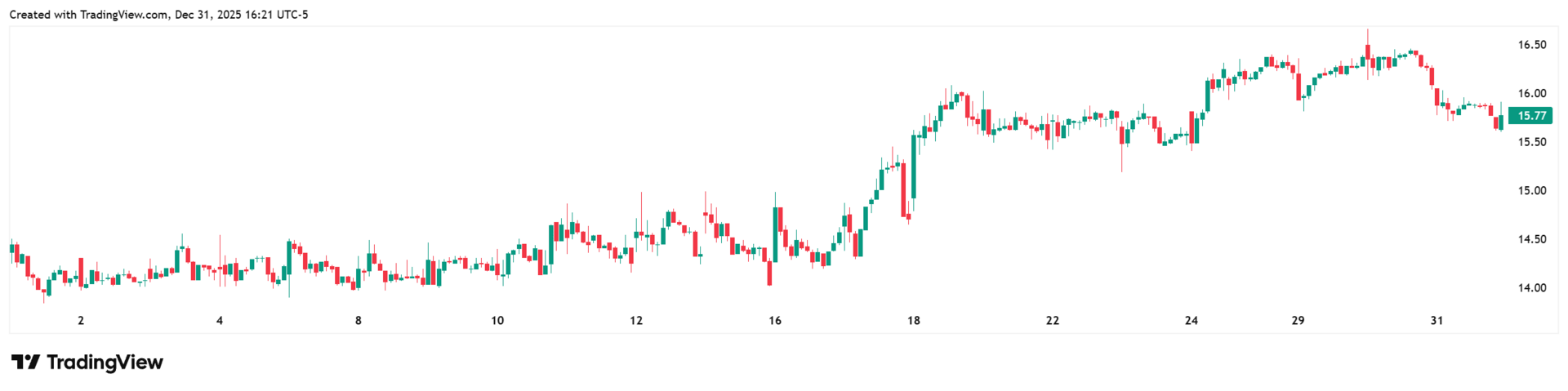

Chart

1-month trading summary: REAL has had a strong, confidence-building month by anyone’s standards.

It’s up just over 12% and is pushing toward the top end of its recent range, flirting with fresh highs.

Price action has been constructive and stair-stepped, with higher lows and follow-through after pullbacks. That’s what healthy accumulation looks like.

Volatility is still part of the package, but trading activity is telling a clear story: buyers are stepping in earlier, and dips are getting bought rather than faded. For a high-risk name like this, that shift in behavior matters.

Bull Case

From broken growth story to disciplined operator: The RealReal is finally acting like a company that wants to make money, not just headlines.

The bull case is simple: the messy, cash-burning version of this business is being replaced by a tighter, more disciplined operator.

Growth no longer has to do all the heavy lifting. As volumes hold steady, the cost structure starts to behave, and incremental revenue drops more meaningfully to the bottom line.

That operating leverage was always supposed to be here. Now it’s starting to show up.

Just as significantly, the demand story hasn't cracked. Luxury resale is still growing, shoppers are still trading down without trading off, and The RealReal remains one of the few scaled platforms people trust with high-value items. This isn't a fad, and it isn't going away.

If management keeps executing, the market doesn’t need to fall in love with the story. It only needs to stop assuming it’s broken. And when that mindset shifts, stocks like this don’t grind higher. They re-rate fast.

Proof beats promises: REAL doesn't need a splashy announcement to move higher. The real catalyst here is steady execution showing up in the numbers.

Each quarter that margins improve, costs stay under control, and cash burn narrows, it chips away at the bear case and forces the market to take the story more seriously.

This is a stock where confidence rebuilds incrementally, but the price reacts disproportionately when it does.

A couple of solid earnings updates, credible commentary around profitability, or even modest upside to expectations could be enough to shift sentiment meaningfully.

Analyst expectations: Price targets sit within a narrow band, with the current low at $14.00 and the high at $20.00.

The chart is finally playing ball: REAL is no longer fighting its own chart. Recent pullbacks are getting bought, momentum has improved, and prices are holding above key levels.

For a stock this volatile, that shift matters. As long as the projection stays constructive, the technicals are a tailwind, not a headwind.

Bear Case

Execution still has to be earned: The RealReal doesn’t get the benefit of the doubt yet, and that’s the risk.

That’s because this turnaround is still fragile. If margins stall, costs creep back in, or demand softens, the market will be quick to punish the stock.

Investors have seen this story reset before, and patience is thin. Add in a choppy consumer backdrop and the reality that this business still isn’t consistently profitable, and you have very little room for error.

In short, the bull case only works if management keeps delivering. This is a stock that rewards progress but has no mercy on disappointment.

Not the only game in town: The RealReal may be a leader in authenticated luxury resale, but it’s operating in a crowded and increasingly competitive arena.

Platforms like ThredUp, Vestiaire Collective, and even broader resale players such as Poshmark all compete for the same value-conscious consumer.

Some are leaner, some are growing faster, and others don’t carry the same cost-heavy authentication and logistics burden.

That pressure matters. It limits pricing power and keeps execution front and center. The RealReal doesn’t just have to improve. It has to improve faster and more visibly than its peers.

The consumer is still fragile: Like its peers in the luxury goods space, REAL is not immune to the macro backdrop, even with resale tailwinds.

Discretionary spending remains uneven, especially at the higher end, and luxury demand can soften quickly if confidence wobbles.

Inflation fatigue, interest rates, and a cautious consumer all create an environment where purchases are delayed rather than rushed. Resale helps, but it doesn’t fully insulate the business.

The sector also carries sentiment risk. When investors rotate out of consumer or growth names, stocks like this tend to get hit first and ask questions later.

Macro doesn’t break the story, but it raises the bar for execution, which matters for a high-risk name like this.

A crowded trade risk, but not yet: REAL is attracting more attention, but this is not a packed room.

Positioning is improving, momentum traders are circling, and sentiment has clearly lifted from the lows. That said, long-only conviction remains cautious, and many investors are still watching from the sidelines.

The risk is further down the line. If the stock keeps running and the turnaround narrative becomes consensus, upside compresses quickly.

Quick Checklist

✅ Thesis still valid after today’s close

✅ Volume confirms move above key levels

✅ Catalyst date double-checked (January 01, 2026)

Deep‑Dive Links

That’s all for today’s Everyday Alpha. We’ll have a new pick for you every morning before the market opens, so stay tuned!

Best Regards,

—Noah Zelvis

Everyday Alpha