- Everyday Alpha

- Posts

- The Defense Supplier Moving From Damage Control To Demand Alignment

The Defense Supplier Moving From Damage Control To Demand Alignment

A messy past still hangs over this defense electronics name, but demand is rotating straight into its core franchises. The gap between perception and reality is where the opportunity sits.

The defense cycle is no longer about scale alone. It is about speed, processing power, and systems that work under pressure.

This name is emerging from a reset just as that shift accelerates. Are you locked in?

Early Picks (Sponsored)

From thousands of stocks, only five stood out as having the best chance to gain +100% or more in the months ahead.

A newly released 5 Stocks Set to Double special report reveals all five tickers — free for a limited time.

While future results can’t be guaranteed, previous editions of this report delivered gains of +175%, +498%, and even +673%¹.

The newest picks could follow a similar path.

This free opportunity expires at MIDNIGHT TONIGHT.

Get the free report here

Never Miss a Stock Alert Again!

We now send our daily picks via text too — so you’ll get the same high-conviction ideas, even if you miss the email.

Mercury Systems, Inc.

February 05 – Pre‑market

Ticker: MRCY | Sector: Aerospace & Defense / Industrials | Market Cap: ~$4.75B

30‑Second Take

Mercury Systems is emerging from a painful reset at the exact moment the defense cycle is turning in its favor. Pentagon priorities are shifting away from big, slow platforms and toward mission-critical electronics that actually decide outcomes, and that is Mercury's core competency.

The business is leaner, execution is cleaner, and defense urgency is rising fast. The stock is still pricing in yesterday’s mistakes while tomorrow’s demand is accelerating.

Trade Setup

Time frame: Medium term

Edge type: Fundamental recovery with cycle alignment

Next Wave (Sponsored)

$1,000 in just seven stocks in 2004 could have turned into a million-dollar portfolio today…

Back then… one financial expert begged people to look at Nvidia -- when it was trading at just $1.10!

Now… he’s urging you to look at a new group of seven stocks…

Check this Out (The NEXT Magnificent Seven)

Poll: If you could own ONE historical artifact, which from this list would you choose? |

Snapshot Table

Metric | Value | Current Stance |

|---|---|---|

Price | $79.08 | Below average |

52‑week range | $39.89 - $103.84 | Below average |

Short interest | 8.64% | Above average |

Next catalyst | Program execution updates |

Chart

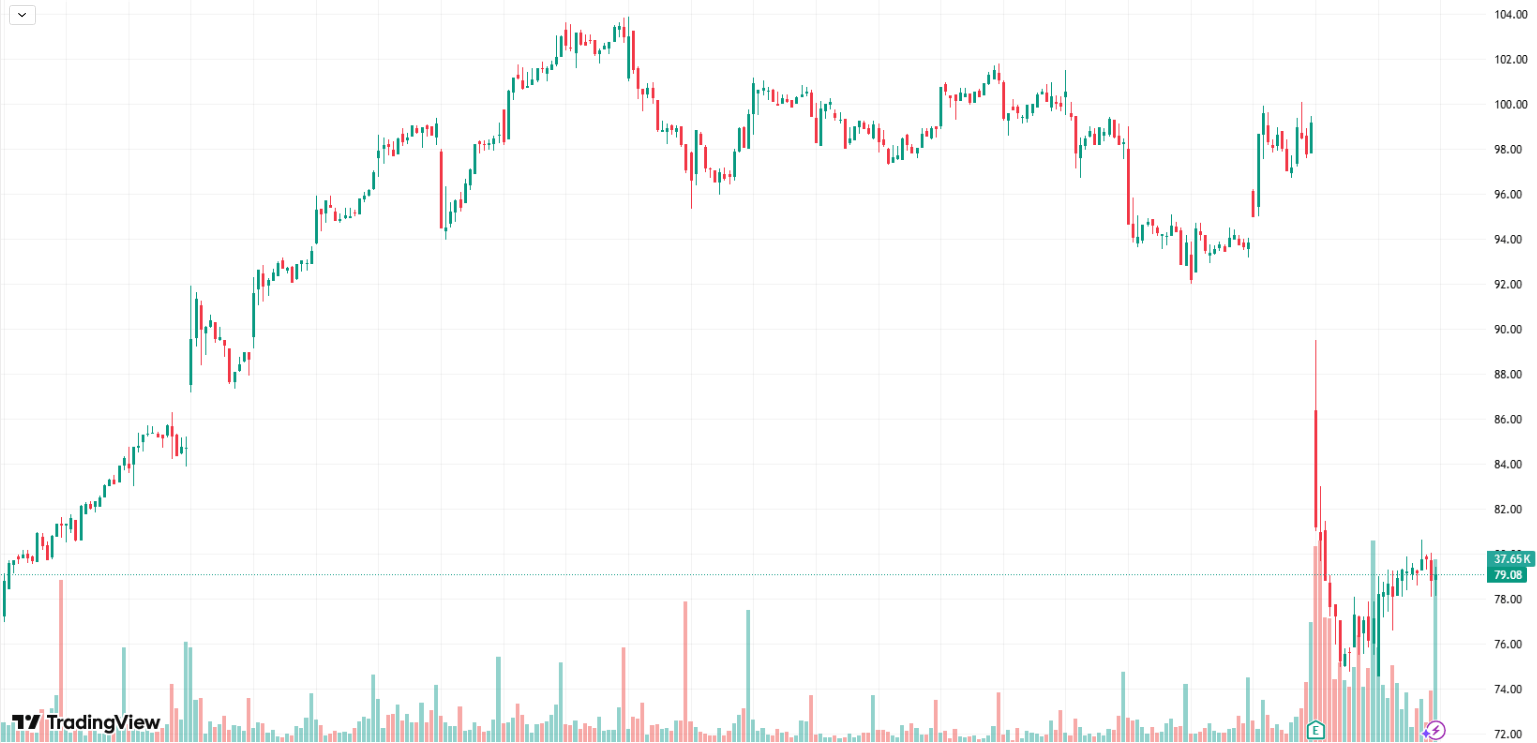

1-month trading summary: Mercury Systems is down roughly 3 percent over the past month, but the path matters more than the headline number.

The stock pushed toward the top of its recent range before a sharp late-month selloff quickly reset sentiment.

That flush was met with stabilization and early signs of dip-buying rather than continued panic.

This kind of fast repricing fits a stock still rebuilding credibility. Volatility remains part of the setup, but price action suggests sellers are becoming more tactical rather than structural.

For a medium-term recovery trade, this looks more like a reset than a breakdown.

Bull Case

Defense spending shift meets a reset cost base: This is a high-risk, high-reward recovery story, but the odds are improving as defense demand rotates directly into Mercury's sweet spot.

Mercury Systems sits at the center of a major shift in modern warfare, where mission-critical electronics are no longer supporting infrastructure but are now supporting the mission itself.

Secure processing, sensors, avionics, and embedded systems increasingly determine speed, survivability, and battlefield advantage.

What changes the story now is focus. After a difficult stretch, Mercury has simplified its portfolio, tightened execution, and rebuilt the business around programs it can deliver reliably.

That matters in defense, where consistency wins contracts and credibility compounds. With the cost base reset, incremental revenue carries meaningful operating leverage as programs ramp.

The market is still anchored to past missteps rather than future demand. If Mercury executes at a merely solid level, not heroic, earnings power can look very different from what the stock price implies today.

The bull case is about recognizing a defense recovery early, before confidence returns and valuation catches up.

Execution speaks volumes: Mercury does not need blockbuster contract wins; it needs clean quarters that prove the reset is working. As defense programs move from delay to delivery, even modest execution wins can shift investor perception fast.

The second catalyst is a mix. Spending is flowing toward secure processing, sensors, and embedded systems that sit deep inside modern defense platforms. That is Mercury's core revenue base, not an adjacency.

As these programs ramp, margin leverage shows up sooner than the market expects.

Finally, earnings matter more than headlines here. This stock moves when results reduce doubt, not when press releases add noise. One solid report can do more than a dozen announcements.

Analyst expectations: There’s a lot of ground to cover between analyst price targets. The lowest target sits at just $55.00, well below current price levels. The high price target is a much more ambitious $120.00.

A reset that improves the risk-reward ratio: After the late-month selloff, MRCY has reset positioning without breaking its broader recovery structure.

The sharp drop flushed weak hands quickly, volume cooled as price stabilized, and support held, a combination that often marks forced selling rather than a change in long-term conviction.

For a medium-term recovery trade, this kind of fast reset followed by base-building is where risk-reward quietly improves ahead of the next fundamental catalyst.

Bear Case

Credibility is still on trial: Defense demand is not in question. Execution is, and Mercury has no margin left for doubt.

Any stumble in delivery, margin progression, or program timing reopens old wounds fast. Investors have been burned here before, and patience is limited. If execution wobbles, the stock does not drift lower; it snaps lower.

This setup works only if the reset holds. If management fails to turn improving demand into clean, repeatable results, the recovery narrative collapses, and the valuation discount stops being an opportunity and starts being a warning.

Swimming with bigger, better-funded sharks: Mercury competes in a crowded field that includes deep-pocketed primes and highly disciplined specialists like RTX, Northrop Grumman, and focused electronics players such as Teledyne Technologies.

The advantage for those peers is obvious: scale, balance sheet strength, and long-standing Pentagon relationships. The advantage for Mercury is focus. It lives deeper within platforms, closer to the electronics that actually process data, guide systems, and enable real-time decisions.

The risk is that larger players can bundle, underprice, or outwait smaller competitors when programs get tight.

The upside is that Mercury wins when customers care more about performance and security than vendor size. This is not a winner-takes-all space, but it is unforgiving if execution slips.

A strong cycle does not guarantee clean execution: The defense backdrop is supportive, but it is not frictionless. Budget growth is increasingly targeted rather than broad, raising the bar for program performance and delivery timelines.

For Mercury Systems, that means less tolerance for delays, rework, or cost creep, even in a healthy spending environment.

Supply chain normalization has helped, but long lead times and component complexity still create execution risk in high-spec electronics.

At the same time, customers are pushing harder on pricing and milestones as procurement discipline tightens.

Recovery optimism is growing louder: The risk is that Mercury’s turnaround could become consensus before the results fully merit it.

If too much optimism is priced in before clean execution, the stock becomes vulnerable to sharp pullbacks on even minor disappointments.

Quick Checklist

✅ Thesis still valid after today’s close

✅ Volume confirms move above key levels

✅ Catalyst date double-checked (February 05, 2026)

Deep‑Dive Links

That’s all for today’s Everyday Alpha. We’ll have a new pick for you every morning before the market opens, so stay tuned!

Best Regards,

—Noah Zelvis

Everyday Alpha