- Everyday Alpha

- Posts

- The Construction Company Paving the Sun Belt Boom One Mile at a Time

The Construction Company Paving the Sun Belt Boom One Mile at a Time

While investors chase headlines, this operator is focused on asphalt, acquisition discipline, and density in America's fastest-growing states.

Sometimes the most powerful growth stories are the ones you literally drive over every day. Is this one on your portfolio GPS?

Midnight Cutoff (Sponsored)

A new research report highlights 5 stocks with the strongest potential to double in the year ahead.

Each was selected from thousands of companies and shows a rare mix of:

Strong fundamentals

Bullish technical setups

Past versions of this report delivered gains of +175%, +498%, and even +673%¹ — and the latest edition is free for a short time.

Available only until MIDNIGHT TONIGHT.

Download the free report

Never Miss a Stock Alert Again!

We now send our daily picks via text too — so you’ll get the same high-conviction ideas, even if you miss the email.

Construction Partners, Inc.

February 17 – Pre‑market

Ticker: ROAD | Sector: Engineering & Construction/Industrials | Market Cap: ~$7.57B

30‑Second Take

Infrastructure is no longer a political talking point. It is asphalt, aggregate, and crews on the ground. And that shift from promise to pavement is exactly where ROAD lives.

Construction Partners sits in the sweet spot of Sun Belt population growth and state-level transportation spending. Backlogs are healthy. State DOT budgets remain funded.

And unlike mega-national contractors chasing headline projects, this business wins steady, recurring resurfacing and highway work that compound quietly.

The market has been obsessed with AI, defense, and anything tied to rate cuts.

Meanwhile, a regional road builder with real pricing power, disciplined acquisitions, and margin expansion is trading without much noise.

Sometimes, alpha is found not where cranes are towering over city skylines, but where roads are being widened at 6 am in Alabama and Florida.

Trade Setup

Time frame: Long term

Edge type: Structural infrastructure demand with disciplined roll-up execution

This is not a one-quarter-earnings-pop trade.

It is a positioning play in a business that benefits from multiyear state transportation budgets, steady resurfacing demand, and population growth.

The edge sits in the blend. Organic project growth layered with smart bolt-on acquisitions. Margin expansion as scale improves.

And a market that still tends to lump ROAD in with cyclical construction names rather than recognizing the recurring, maintenance-heavy nature of its work.

Long-Term Edge (Sponsored)

In 1943, a teenage Warren Buffett put $114 into a special type of account called

"The 29% Account."

Today, that single, $114 investment would be worth over $15 million.

Your bank never told you about this.

Click Here to See How It Works

Trivia: What year did Amazon go public (IPO)? |

Snapshot Table

Metric | Value | Current Stance |

|---|---|---|

Price | $133.93 | Below average |

52‑week range | $64.79 - $141.90 | Below average |

Short interest | 6.58% | Average |

Next catalyst | Acquisition announcement |

Chart

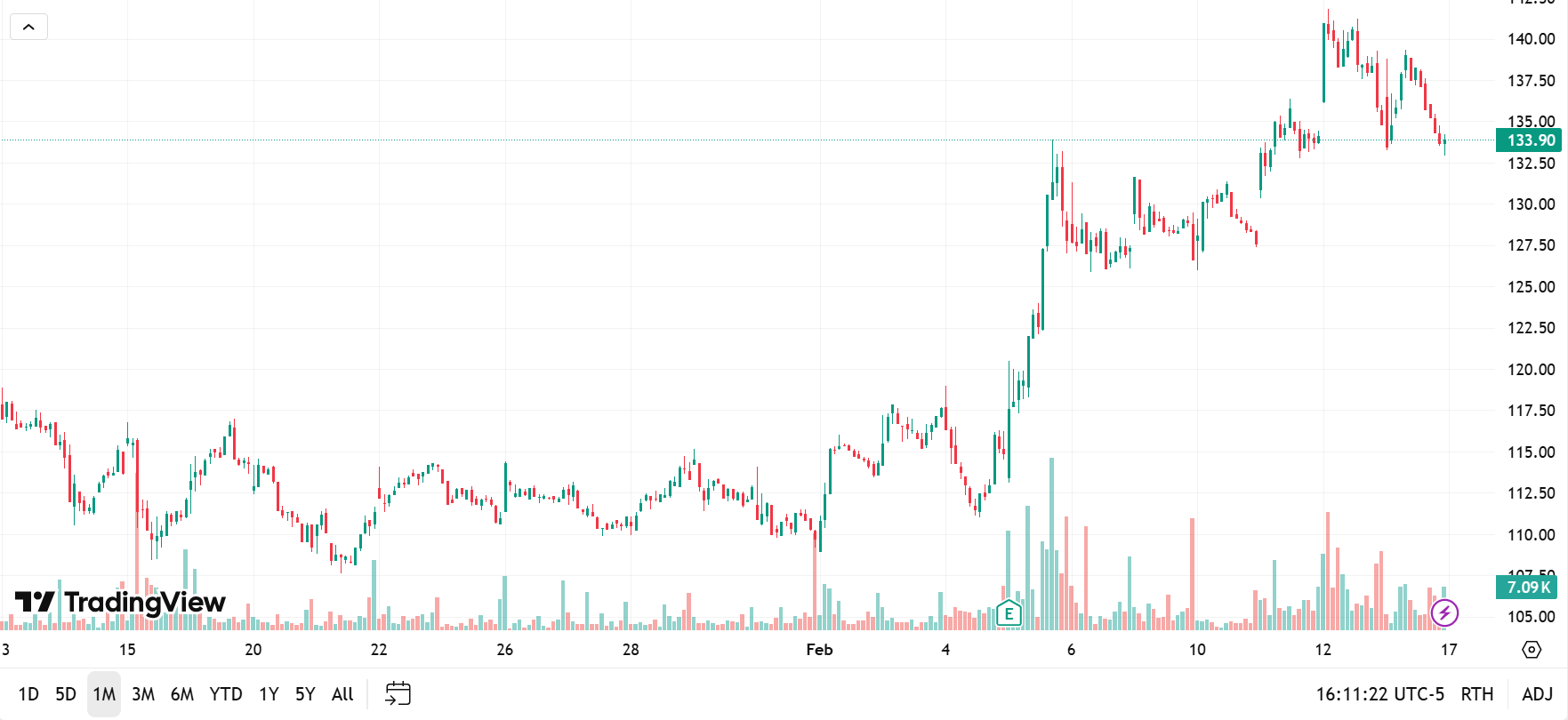

1-month trading summary: ROAD has climbed roughly 16% over the past month, but it’s not the elevation that impresses. What really stands out is the structure of the move.

The rally was not a single spike. It was a stair step higher.

Higher lows through late January, then a sharp upside expansion in early February on heavier volume, followed by consolidation near the highs.

That tells you this is not just short covering. It looks like accumulation.

Price is now just below its recent peak and not far from the upper end of the 52-week range at $141.90.

Momentum is positive but not stretched to the point of exhaustion. If buyers defend this zone on pullbacks, the path toward a retest of highs stays firmly intact.

Bull Case

The asphalt compounder hiding in plain sight: ROAD is not chasing headline megaprojects. It is paving, resurfacing, and maintaining the highways that people drive every single day.

That matters because maintenance work is not optional. Roads crack. Traffic grows. States keep spending.

Its footprint across high-growth Sun Belt markets gives it a structural tailwind. More people and more freight mean more wear and tear.

ROAD sits right in that stream with local scale and long-standing DOT relationships.

Layer in a disciplined roll-up strategy and expanding asphalt capacity, and you have a business quietly building density and margin leverage.

If backlog holds and execution stays tight, this starts to look less like a small contractor and more like a compounding regional infrastructure platform.

Crews on the ground, numbers on the board: The most immediate catalyst here is pure execution.

Continued backlog growth and another clean quarter of margin expansion reinforce the idea that this is a compounding operator, not a one-cycle trade.

Acquisition cadence is another lever. A smart bolt-on in an adjacent Sun Belt market can instantly add plants, crews, and pricing power. The market tends to reward visible scale.

And do not underestimate the visibility of state-level funding.

As multiyear transportation budgets translate into awarded projects, each contract win is a reminder that ROAD is plugged directly into recurring infrastructure spend, not waiting on Washington headlines to move.

What Wall Street sees: Analyst price targets range from $115.00 on the low end to $150.00 on the high.

Momentum with room to run: The recent breakout toward the top of the 52-week range has been supported by higher lows and expanding volume, a constructive technical setup.

If price holds above the $130.00 zone, momentum traders may lean in for a push toward fresh highs.

Bear Case

When paving slows: Execution is a double-edged sword. While it’s a catalyst, execution at scale is also the most notable challenge.

As ROAD grows through acquisitions, integration missteps or margin slippage could quickly dent the compounding story.

There is also sensitivity to input costs.

Asphalt and aggregates are not immune to price swings, and if cost inflation outpaces pricing power, margins can compress faster than the market expects.

Add in any slowdown in state-level project awards, and the steady narrative starts to wobble.

Battling for every mile of pavement: ROAD shares the road with national heavyweights like Vulcan Materials Company, Martin Marietta Materials, and Granite Construction, all of whom bring scale, balance sheet strength, and deep supplier relationships.

If they decide to defend or expand their share in ROAD's core Sun Belt markets, pricing pressure could creep in.

Against giants with national scale and vertical integration, even a strong regional operator can feel margin heat.

Funding friction and input volatility: ROAD’s demand may be durable, but it is still tied to state transportation budgets.

If tax receipts soften or political priorities shift at the state level, project timing can slide. Delays in bid awards or funding approvals would directly impact backlog conversion.

There is also exposure to bitumen and fuel costs. While ROAD has pricing power, sudden spikes in oil-linked inputs can create short-term margin pressure before contracts reset.

In a business built on tight execution and steady expansion, even small cost shocks can ripple through earnings.

Infrastructure momentum crowd: If infrastructure spending remains a favored theme, ROAD could get pulled into a broader trade where capital floods the space regardless of valuation.

When that happens, expectations rise quickly, and even solid quarters can disappoint if the bar has been set too high.

Quick Checklist

✅ Thesis still valid after today’s close

✅ Volume confirms move above key levels

✅ Catalyst date double-checked (February 16, 2026)

Deep‑Dive Links

That’s all for today’s Everyday Alpha. We’ll have a new pick for you every morning before the market opens, so stay tuned!

Best Regards,

—Noah Zelvis

Everyday Alpha