- Everyday Alpha

- Posts

- The Builder Behind the Boom: This Electronic Expert Is a Steady Hand in a Noisy Market

The Builder Behind the Boom: This Electronic Expert Is a Steady Hand in a Noisy Market

Some companies don't chase the spotlight; they build it.

This steady operator is proving that reliable execution and smart reinvention can still beat the noise in today's restless market. Read on to get the full scoop and what it can mean for your portfolio.

Read Now (Sponsored)

Your portfolio might be doing well—but some investors are targeting even bigger wins ahead.

Analysts have uncovered 5 high-upside opportunities with massive growth potential over the next year.

Each one features rock-solid fundamentals and strong momentum indicators that could drive powerful gains.

This special report is 100% free to access—but only until midnight tonight.

[Get your free copy now.]

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Never Miss a Stock Alert Again!

We now send our daily picks via text too — so you’ll get the same high-conviction ideas, even if you miss the email.

Flex, Ltd.

November 05 – Pre‑market

Ticker: FLEX | Sector: Electronic Components / Technology | Market Cap: ~$23.2B

30‑Second Take

If you’ve ever admired the companies quietly keeping the world running, Flex deserves a seat at your table.

This isn’t a flashy tech play. It’s a global design and manufacturing powerhouse that’s been steadily transforming itself into a high-margin solutions partner.

After another strong earnings beat and raised guidance, the market’s finally catching on, but it isn't fully awake yet.

If you’re an investor who loves the thrill of getting in before the headlines do, Flex feels like that reliable workhorse you want in your portfolio when everyone else is chasing noise.

Trade Setup

Timeframe: Swing to long-term hold

Edge Type: Strategic industrial pivot play

FLEX is in a transition phase, moving from traditional manufacturing services to higher-margin, value-added supply-chain solutions.

As this transformation takes place, you've got a chance to get in while the stock is still relatively overlooked.

See Why. (Sponsored)

The signals are flashing again.

Twenty-seven crypto legends — from early builders to top traders — say a massive breakout could be near.

They’ve stayed quiet for years… until now. What they’re seeing has the potential to reshape the entire market.

Access to this closed-door event is free but limited. Once spots are gone, they’re gone for good

[Reserve Your Free Spot Now]

© 2025 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States

The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies.

Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

Poll: You’re given $1,000 to invest in a company’s stock—no research. What’s your gut move? |

Snapshot Table

Metric | Value | Current Stance |

|---|---|---|

Price | $61.81 | Below average |

52‑week range | $25.11 - $67.00 | Below average |

Short interest | 1.47% | Below average |

Next catalyst | New contract wins |

Chart

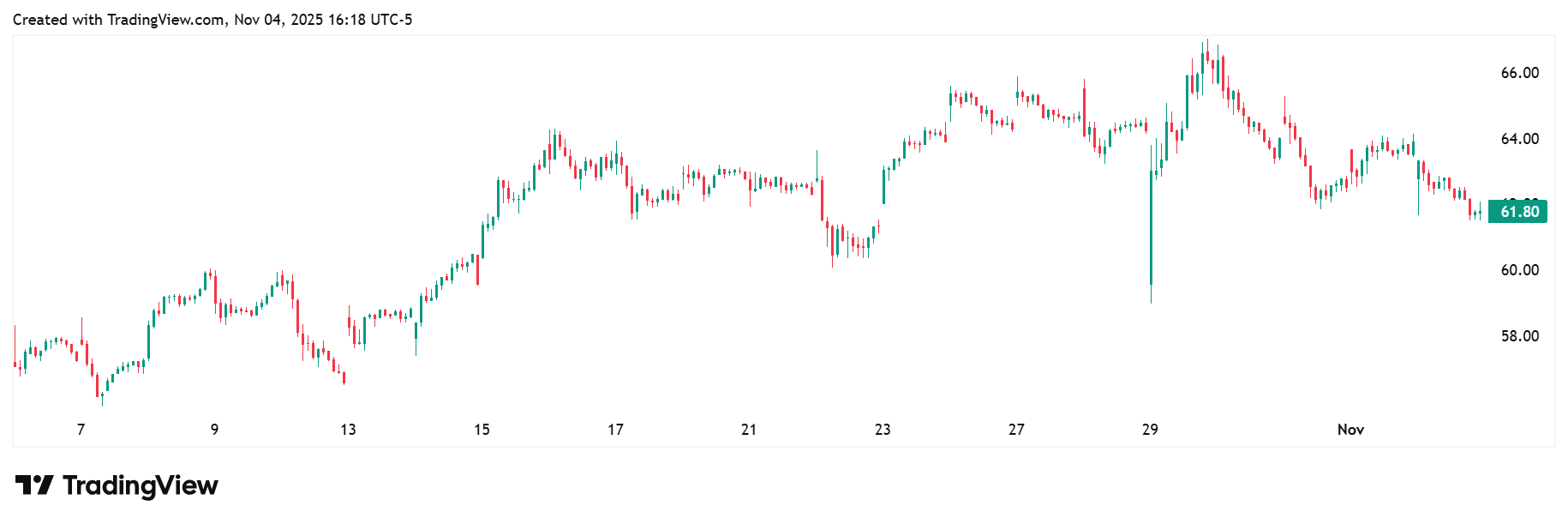

1-month trading summary: Flex has gained 7.85% in what has been a month of slow and steady progress.

The stock climbed through mid-October before hitting resistance just above $65, where profit-taking set in after it reported a record quarter for Q2 FY2026.

Despite that pullback, the uptrend remains intact, supported by solid post-earnings sentiment and healthy trading volume.

In a month where many industrial names treaded water, Flex quietly pushed higher, a sign that buyers are still showing up on the dips.

Bull Case

Getting things done behind the scenes: If you like companies that quietly get things done while others make noise, Flex is your kind of story.

This is the behind-the-scenes builder of the modern world, from data centers to electric vehicles to next-generation electronics.

What's changed is how Flex now earns its money. It's moving up the value chain, focusing less on low-margin assembly work and more on design, engineering, and end-to-end solutions that customers actually rely on.

Margins are improving, cash flow is strong, and management is guiding higher with confidence.

If you’re the kind of investor who likes substance over flash, Flex is a steady operator turning consistency into compounding growth.

Another record quarter of growth in the books: There’s real momentum building beneath the surface here.

Flex just delivered another earnings beat and raised its full-year guidance, a clear sign that the pivot to higher-margin work is paying off.

Demand from automotive, data center, and industrial customers is strong, giving the company a healthy mix of growth drivers.

Management is also doubling down on automation and AI-powered manufacturing, which could further lift productivity and margins.

Add in the possibility of new long-term contracts with big-name clients, and you've got a setup where steady execution could turn into steady upside.

Current price targets: $69.58 to $78.00. The average is $74.37.

Pushing for the next leg higher: Flex is showing the kind of chart you want to see after a strong earnings run.

The stock is holding above $62 support, a level buyers have defended several times, and volume picked up on green days through October.

Momentum is healthy without being overheated, with the RSI sitting comfortably in neutral territory.

A clean push above $65 could open the door to new highs, but even a little sideways movement here would count as healthy consolidation before the next leg higher.

Bear Case

Transformation is rarely straightforward: The key risk here is that Flex’s transformation takes longer to deliver the payoff everyone’s expecting.

Moving from traditional contract manufacturing to high-margin design and engineering work isn't an overnight job, and any slowdown in demand from big tech or auto clients could throw off the rhythm.

Rising labour and material costs are another watch point, especially if pricing power slips.

This isn't a broken story, but it needs consistent execution, and one soft quarter could be enough to make the market hit pause on optimism.

Playing in a tough neighborhood: Flex operates in a tough neighborhood. It's up against giants like Jabil and Foxconn, both of which have deep client lists and massive scale.

These players can undercut on price or muscle in on new contracts, especially in electronics and automotive manufacturing.

Then there are rising regional competitors in Asia, hungry for market share as they move up the value chain.

Flex's edge lies in its global reach and shift toward higher-margin solutions, but maintaining that edge will require constant innovation and tight execution to stay ahead of very capable rivals.

Sector headwinds could cause turbulence: Global manufacturing is still feeling the ripple effects of shifting supply chains, uneven demand, and higher borrowing costs.

Slower growth in consumer electronics or autos could easily squeeze new orders, while a strong dollar can dent overseas margins.

Add the ever-present risk of geopolitical tensions or trade disruptions, and Flex's globally spread operations could face more turbulence than the steady chart suggests.

Crowded Trade: Flex isn’t overcrowded right now, which works in your favor.

Most traders are still chasing hotter tech names, leaving this one quietly compounding in the background.

The flip side is that it doesn’t have the buzz that sparks fast momentum, so rallies may take time to build.

You can use this moment of calm to your advantage, as it offers a chance to accumulate before the crowd rediscovers the story.

Quick Checklist

✅ Thesis still valid after today’s close

✅ Volume confirms move above key levels

✅ Catalyst date double-checked (November 04, 2025)

Deep‑Dive Links

That’s all for today’s Everyday Alpha. We’ll have a new pick for you every morning before the market opens, so stay tuned!

Best Regards,

—Noah Zelvis

Everyday Alpha