- Everyday Alpha

- Posts

- The Biotech Toll Booth Quietly Printing Royalties

The Biotech Toll Booth Quietly Printing Royalties

Some biotech stocks live and die by a single data readout. This one doesn’t. It gets paid when its partners succeed, and right now those wins are stacking up.

Rare Momentum (Sponsored)

Every market cycle produces a select group of companies that drastically outperform the rest.

The latest screening has pinpointed the 5 Stocks Set to Double, each showing rare traits linked to early stage momentum.

These names carry the same type of indicators that have historically appeared ahead of strong rallies.

Earlier reports featured stocks that delivered +175%, +498%, and +673%.

Get the Free 5 Stocks Set to Double Report.

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Never Miss a Stock Alert Again!

We now send our daily picks via text too — so you’ll get the same high-conviction ideas, even if you miss the email.

Halozyme Therapeutics, Inc.

December 30 – Pre‑market

Ticker: HALO | Sector: Biotechnology/Healthcare | Market Cap: ~$8.1B

30‑Second Take

This is a classic “the hits keep coming” setup.

Halozyme just picked up US FDA approval for RYBREVANT FASPRO, an ENHANZE-enabled therapy targeting advanced EGFR-mutated non-small cell lung cancer, extending its platform deeper into oncology where pricing power and durability matter most.

At the same time, a German court issued a preliminary injunction protecting Halozyme’s ENHANZE patents against a rival product, reinforcing the moat around its royalty engine.

This one-two punch matters. It shows Halozyme can both expand ENHANZE into new high-value indications and actively defend the royalty stream that underpins its cash flow.

The business is de-risking in real time, and the market is still catching up to how valuable that combination really is.

Trade Setup

Time frame: 6–12 months

Edge type: Platform re-rating with royalty compounding

This is a patience-rewarding setup rather than a quick biotech pop.

You’re buying into a proven platform that keeps stacking approved products, expanding royalties, and reducing downside risk.

As Halozyme continues to look less like a speculative biotech and more like a durable growth business, the market’s willingness to pay up for that consistency is the real edge.

Market Risk (Sponsored)

Political transitions historically increase uncertainty—and this cycle is no exception.

Tariff expansion is reviving crash-risk conversations across Wall Street.

Asset protection strategies are gaining attention as volatility accelerates.

Ignoring structural risk has consequences during regime shifts.

Awareness precedes action.

No guarantees are implied.

This content is not a recommendation to buy or sell.

Download the FREE Presidential Transition Guide now.

Poll: Which would you rather have? |

Numbers at a Glance

Metric | Value | Current Stance |

|---|---|---|

Price | $68.93 | Above average |

52‑week range | $47.50 - $79.50 | Above average |

Short interest | 10.95% | Below average |

Next catalyst | Partner momentum and pipeline proof |

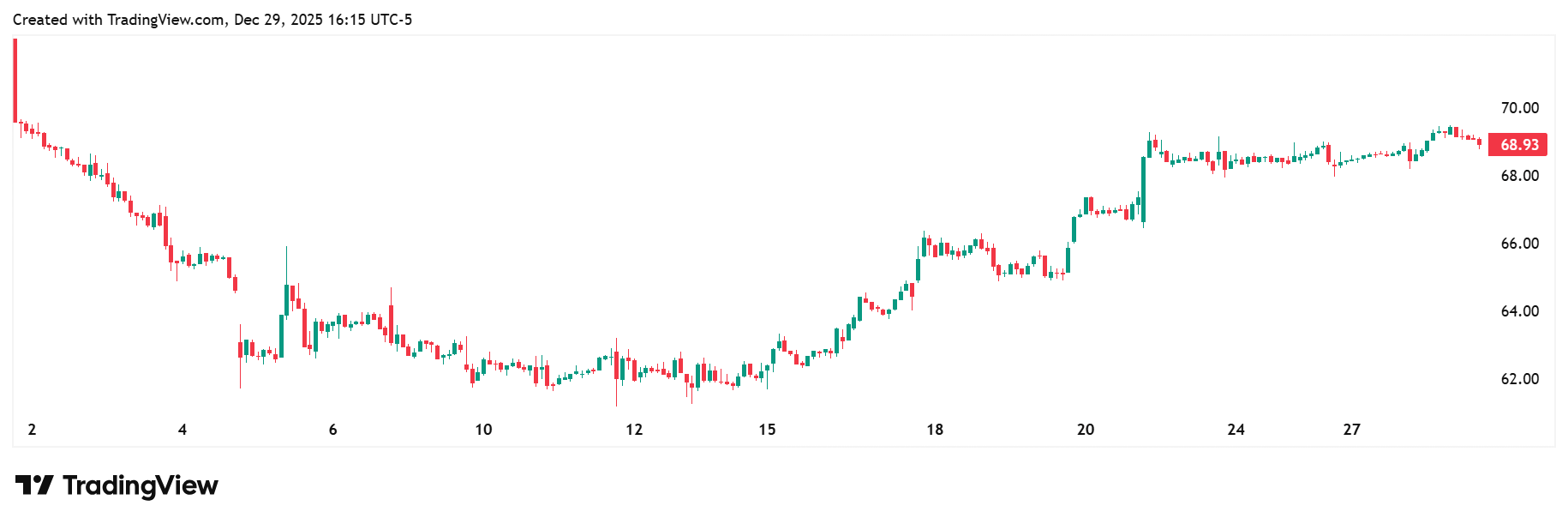

Chart

1-month trading summary: Let’s be honest. The stock is down a little over 3% on the month, so this hasn’t been a straight-line march higher.

But the pullback matters less than how it’s happened.

Selling pressure showed up early, cooled off quickly, and then gave way to a steadier grind as the stock found support in the low-to-mid $60s.

Since then, price action has looked more like a pause than a panic.

Volumes have stayed muted, downside follow-through has been limited, and buyers have quietly stepped back in as the story improved.

This is what digestion looks like after a prior run, not a stock falling apart.

Bull Case

A toll booth, not a gamble: Halozyme isn’t betting the company on a single binary drug readout. That’s the key distinction.

Instead, it owns a toll-booth business model through its ENHANZE platform, collecting high-margin royalties from a growing roster of partnered drugs that are already approved, already selling, and still scaling.

This shifts Halozyme out of the “hope and hype” biotech bucket and into something far more durable.

Partners fund development, commercialization, and sales while Halozyme captures recurring economics with limited incremental cost.

As more ENHANZE-enabled therapies move into oncology and other high-value indications, operating leverage quietly compounds.

It’s a business built to grow without swinging for the fences.

Royalties, range, and reinforced moats: HALO’s toll-booth model is firing on multiple cylinders right now.

The recent FDA approval of an ENHANZE-enabled oncology therapy extends the platform into another large, durable cancer indication, reinforcing Halozyme’s relevance in areas where treatment adoption tends to stick.

At the same time, the court ruling protecting ENHANZE patents sends a clear signal to would-be competitors: this royalty stream is defended.

Each new approval adds incremental revenue, and each legal win strengthens pricing power and longevity.

The result is a compounding catalyst stack rather than a single headline moment, precisely what you want to see as a long-term growth investor.

Price targets: Price targets span from $56.00 to a high of $92.00.

Support, structure, and patience: From a technical standpoint, this chart is doing more right than wrong.

After the early-month dip, the stock carved out a clear base in the low-to-mid $60s and has since worked its way back toward the top of the recent range.

That ability to stabilise, rather than cascade lower, is a quiet but essential tell.

If the broader action cooperates, the technical setup supports a move higher without needing anything dramatic to go right.

Bear Case

Could the royalty engine stumble? The most significant risk here isn't a failed trial or a surprise FDA rejection. It's something quieter. Halozyme's strength is also its vulnerability.

The business depends on partners continuing to grow sales of ENHANZE-enabled drugs.

If adoption slows, pricing comes under pressure, or partners shift focus to alternative delivery technologies, royalty growth could disappoint even if nothing "goes wrong" operationally.

There's also a concentration risk to respect. A handful of major products drive a meaningful share of revenue, so any stumble by a key partner can ripple through results.

This isn't a reason to avoid the stock, but it is a reminder that this is still a platform story, not a guaranteed annuity.

Good science, shakier economics: Halozyme doesn’t compete in the usual biotech knife fight. Its real competition comes from alternative drug-delivery technologies and internal solutions developed by big pharma.

Names like Amgen, Pfizer, and Roche all have the resources to build or buy their own delivery platforms if they choose.

The difference is economic discipline.

Most competitors are still spending heavily to prove their tech works or justify internal investment, while Halozyme is already cash-flowing from approved products.

That gives it a timing advantage.

Still, if a cheaper or more flexible delivery solution gains traction, some partners could eventually look elsewhere.

This isn't an immediate threat, but it's the competitive pressure that sits quietly in the background, keeping this from becoming a permanent monopoly.

Biotech still needs to behave: Even high-quality biotech doesn't trade in a vacuum. If risk appetite fades, rates rise, or the market swings back into a risk-off mood, Halozyme can get dragged lower with the group, regardless of fundamentals.

Platform stories tend to hold up better than binary names, but they're not immune to sector-wide multiple compression.

There’s also the reality that healthcare policy noise never really goes away.

Pricing pressure, regulatory scrutiny, and shifting reimbursement dynamics can spook investors fast, even when the underlying business is executing.

Consensus creeping in: As Halozyme continues to execute and the royalty story becomes easier to understand, more generalist investors are starting to show up.

That’s good for validation, but it can cap upside in the short term if expectations run ahead of results. Not a red flag, just something to keep an eye on.

Quick Checklist

✅ Thesis still valid after today’s close

✅ Volume confirms move above key levels

✅ Catalyst date double-checked (December 29, 2025)

Deep‑Dive Links

That’s all for today’s Everyday Alpha. We’ll have a new pick for you every morning before the market opens, so stay tuned!

Best Regards,

—Noah Zelvis

Everyday Alpha