- Everyday Alpha

- Posts

- The Battery Builder The Market Can’t Sit Still On

The Battery Builder The Market Can’t Sit Still On

Meet the grid-scale energy player caught between booming demand and investor nerves. Wild price swings and improving fundamentals make this a volatility-driven setup worth watching.

This is not a calm stock, and that’s the appeal. As the energy transition collides with earnings reality, this name keeps snapping between fear and optimism, creating sharp moves for investors who can handle the noise.

Get The Report (Sponsored)

A new research report highlights 5 stocks with the strongest potential to double in the year ahead.

Each was selected from thousands of companies and shows a rare mix of:

Strong fundamentals

Bullish technical setups

Past versions of this report delivered gains of +175%, +498%, and even +673%¹ — and the latest edition is free for a short time.

Available only until MIDNIGHT TONIGHT.

Download the free report

Never Miss a Stock Alert Again!

We now send our daily picks via text too — so you’ll get the same high-conviction ideas, even if you miss the email.

Fluence Energy Inc.

February 11 – Pre‑market

Ticker: FLNC | Sector: Utilities – Renewable / Utilities | Market Cap: ~$3.73B

30‑Second Take

Fluence Energy finds itself right in the middle of two things markets struggle to price cleanly: grid-scale energy storage and lumpy, project-driven growth.

The stock whips around because expectations are reset constantly.

Underneath the noise, the business keeps piling on backlog, growing earnings faster than most of its peers, and steadily tightening its cash burn. Yet the valuation screams uncertainty, not conviction.

When a structurally important company trades like the market still hasn't made up its mind, volatility creates opportunity for investors willing to stomach the swings.

If you want calm and predictable, this isn’t it. If you want motion, optionality, and a chance to catch a rerating as sentiment catches up with fundamentals, this one belongs on the radar.

Trade Setup

Time frame: Short term

Edge type: Volatility-driven sentiment swings

This stock doesn’t drift, it lunges. FLNC moves in fast, emotional bursts as expectations reset again and again. Backlog momentum and improving earnings give traders something real to lean on, while the valuation reflects confusion more than conviction.

The edge here is catching those sharp sentiment reversals when fear or excitement overshoots reality, not sitting around waiting for a perfectly priced long-term story.

Act Now (Sponsored)

For decades, one type of investment was reserved for the ultra-wealthy.

Then Trump signed Executive Order 14330 - and opened it to everyone.

Now you can get into this boom for less than $20.

See what changed

Poll: Which industry relies most on confusing pricing on purpose? |

Snapshot Table

Metric | Value | Current Stance |

|---|---|---|

Price | $18.99 | Below average |

52‑week range | $3.46 - $33.51 | Below average |

Short interest | 11.99% | Above average |

Next catalyst | Backlog update |

Chart

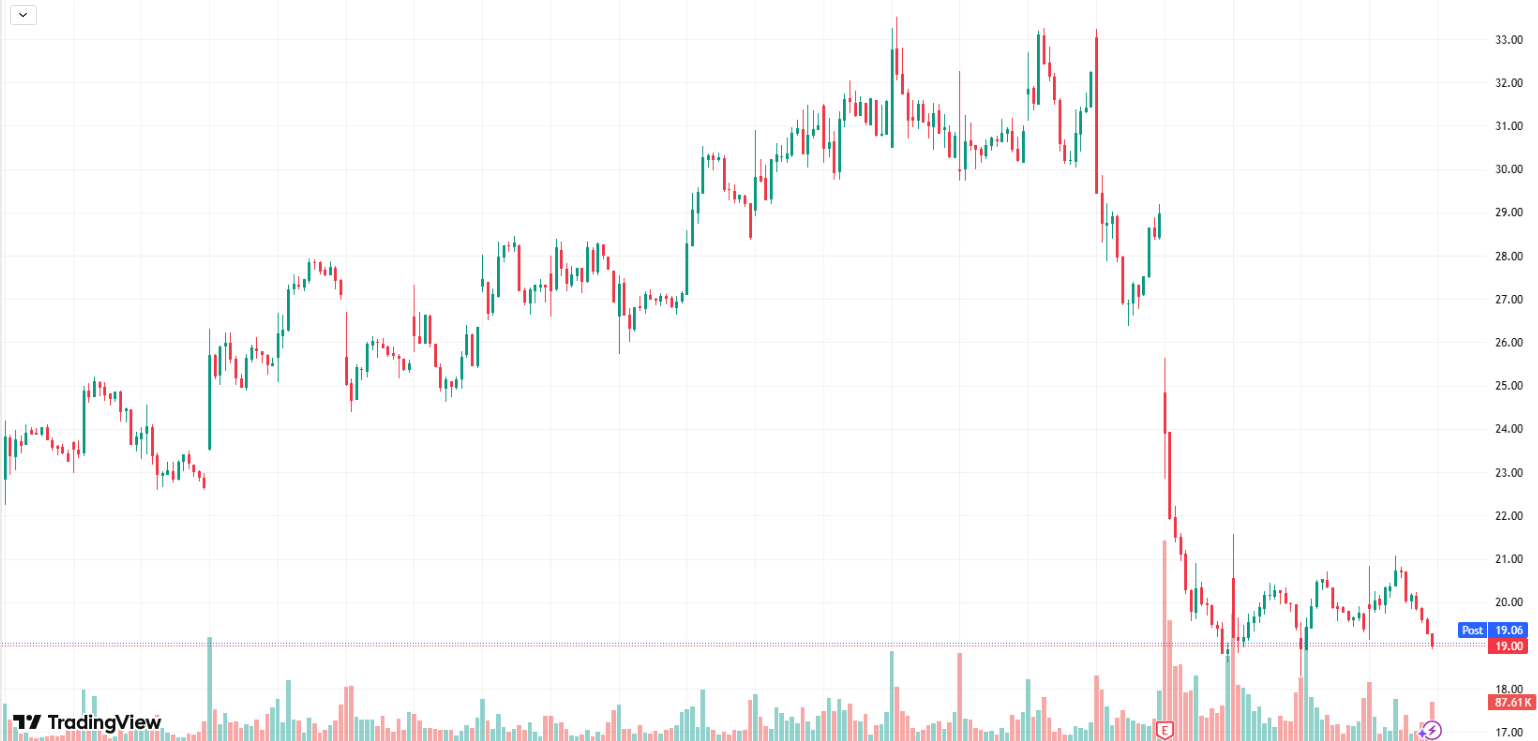

1-month trading summary: Trading action over the last month has been anything but polite. FLNC ripped higher into late January, rolled over hard after earnings, then snapped back quickly as buyers stepped in around the low $19.00s.

That sharp drop-and-reclaim tells you everything you need to know. This is a high-beta name where sentiment flips fast, volume spikes on emotion, and rebounds can be just as aggressive as the sell-offs.

Right now, price action suggests the market is still arguing with itself, which is exactly the kind of environment short-term volatility trades thrive in.

Bull Case

Volatility with a pulse: This stock gives traders whiplash because the story refuses to sit still.

Fluence builds grid-scale battery systems that catch excess renewable power when it floods the grid and release it when demand spikes, basically acting as the shock absorber for a modern energy system that was never designed for this much wind and solar.

The market treats that mission like a mood swing. Backlog keeps piling up, earnings growth keeps beating peers, and cash burn is quietly improving, yet the stock still trades on nerves rather than on narrative.

In the short term, that's gold. Every panic sell feels overdone, every bounce feels violent, and each reminder that the business is executing can trigger a fast repricing. This isn't a clean trend; it's a fight between fear and fundamentals, and volatility is where the upside hides.

Searching for the next jolt: For a stock like FLNC, catalysts don't arrive quietly; they hit the tape and move the price fast. Any update that reinforces backlog momentum, project wins, or execution progress can flip sentiment in a hurry, especially after recent volatility reset expectations.

Short term, this name is wired to react to earnings follow-through, guidance clarity, and contract announcements tied to grid-scale storage demand.

With the stock still trading emotionally, even modestly good news can feel bigger than it should, and that’s exactly what volatility traders want to see.

Price targets: The volatility of this stock has analysts in flux as well. That's reflected in the disparity in price targets, with the low sitting at just $9.00 and the high set at $32.00.

When the floor stops falling out: After the post-earnings shakeout, Fluence Energy found buyers quickly and reclaimed key near-term levels, a sign the sell-off ran out of energy faster than expected.

That kind of snapback is typical in high-beta names when weak hands are flushed and stronger conviction steps in.

Volume expanded on the move off the lows, momentum indicators have started to turn, and price is no longer free-falling.

It doesn’t need to be perfect. It just needs to stay constructive long enough for sentiment to swing again.

Bear Case

Volatility cuts both ways: The same chaos that creates upside can just as easily work against you.

FLNC recently reminded the market of its stock's sensitivity to disappointment, with an EPS miss triggering a sharp sell-off. When expectations are high, even a small stumble can feel big.

Execution hiccups, project timing issues, or another quarter that leaves earnings clarity fuzzy could quickly reignite downside pressure.

With the stock still priced for progress, there's limited patience for short-term missteps. Confidence is fragile, and once it cracks, the selling can get aggressive fast.

A crowded, unforgiving arena: Fluence Energy isn't operating in a quiet corner of the market. Grid-scale energy storage is drawing serious capital, and competition is intense.

Large industrial players like Tesla, Inc., and LG Energy Solution bring scale, balance sheets, and pricing power that can squeeze margins when projects get competitive.

At the same time, specialists such as Wärtsilä and Powin are aggressive in execution and willing to fight for a share.

In a space where contracts are lumpy and pricing matters, losing just a handful of large deals can move the needle fast, and the market won't ignore it.

When the backdrop turns hostile: Grid-scale storage is a structural growth story, but the path isn’t smooth. FLNC operates in a sector exposed to interest rates, project financing conditions, and utility spending cycles.

When capital is tight, or rates stay higher for longer, large storage projects can be delayed, downsized, or pushed down the priority list.

Layer in policy uncertainty, shifting subsidy frameworks, and supply chain sensitivity around battery inputs, and momentum can slow quickly.

In a market that’s already jumpy, macro hesitation doesn’t need to be dramatic to matter. Even a mild cooling in project activity can amplify volatility and pressure sentiment in the short term.

When everyone rushes the same exit, Fluence Energy attracts momentum traders who love fast-moving energy transition names, which cuts both ways.

When sentiment flips, positioning unwinds quickly, turning normal pullbacks into sudden air pockets.

Quick Checklist

✅ Thesis still valid after today’s close

✅ Volume confirms move above key levels

✅ Catalyst date double-checked (February 10, 2026)

Deep‑Dive Links

That’s all for today’s Everyday Alpha. We’ll have a new pick for you every morning before the market opens, so stay tuned!

Best Regards,

—Noah Zelvis

Everyday Alpha