- Everyday Alpha

- Posts

- Strength in the Waiting Room: Why Patience Could Pay Off Here

Strength in the Waiting Room: Why Patience Could Pay Off Here

Not every great trade starts with fireworks. Just the opposite, in fact. Some begin with a pause, a dip, and a chance to buy a solid business while the crowd looks elsewhere.

That’s precisely what you have on offer with today’s pick.

Get In Early (Sponsored)

Markets are moving fast—and some investors are positioning for what could be the next big run.

A team of analysts has zeroed in on 5 companies with strong fundamentals and promising upside potential.

Their new report breaks down each opportunity in detail, and it’s free for a limited time.

These insights have historically uncovered major winners before the crowd catches on.

But this window closes at midnight tonight.

[Claim your free report now.]

*Results may not represent all stock picks and may reflect partially closed positions. Investing involves risk, and past performance does not guarantee future results. This is not financial advice.

Never Miss a Stock Alert Again!

We now send our daily picks via text too — so you’ll get the same high-conviction ideas, even if you miss the email.

Doximity, Inc.

November 04 – Pre‑market

Ticker: DOCS | Sector: Health Information Services/Healthcare | Market Cap: ~$12.4B

30‑Second Take

If you’ve been feeling like the market’s forgotten about steady, profitable growth stories in favour of flashier AI hype, Doximity might be your quiet reminder that boring can still be brilliant.

This is the LinkedIn-meets-Slack for doctors.

It’s a platform that quietly connects over 80% of U.S. physicians, pulls in serious free cash flow, and just posted double-digit revenue growth again.

The stock’s been knocked back after cautious guidance, but that’s where opportunity hides.

If you’ve ever learned from buying too late, this might be your chance to lean in while everyone else is looking the other way.

Trade Setup

Timeframe: Swing to long-term hold

Edge Type: Contrarian growth play

DOCS has slipped into the bargain zone after a guidance-driven selloff, but the fundamentals remain intact.

With strong free cash flow, sticky adoption among U.S. doctors, and a chart that’s starting to stabilise, this setup suits investors who like catching quality names on the rebound, not for a quick flip but for a steady climb as sentiment recovers.

It’s Happening. (Sponsored)

When 27 of crypto’s sharpest minds unite, it’s not by chance — it’s by urgency.

They’re calling this moment a once-in-a-decade setup that could reshape the entire market.

From early blockchain pioneers to top traders, they’re revealing where opportunity could strike next.

The last time this group came together, it signalled a massive shift.

Now, they’re opening the doors to a limited audience — and spots are already filling fast.

[Claim Your Free Access Now]

© 2025 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States

The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies.

Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

Trivia: Which coin was nicknamed a “two-bit piece”? |

Snapshot Table

Metric | Value | Current Stance |

|---|---|---|

Price | $66.94 | Below average |

52‑week range | $41.34 - $85.21 | Below average |

Short interest | 3.45% | Average |

Next catalyst | Q2 FY2026 earnings, tomorrow |

Chart

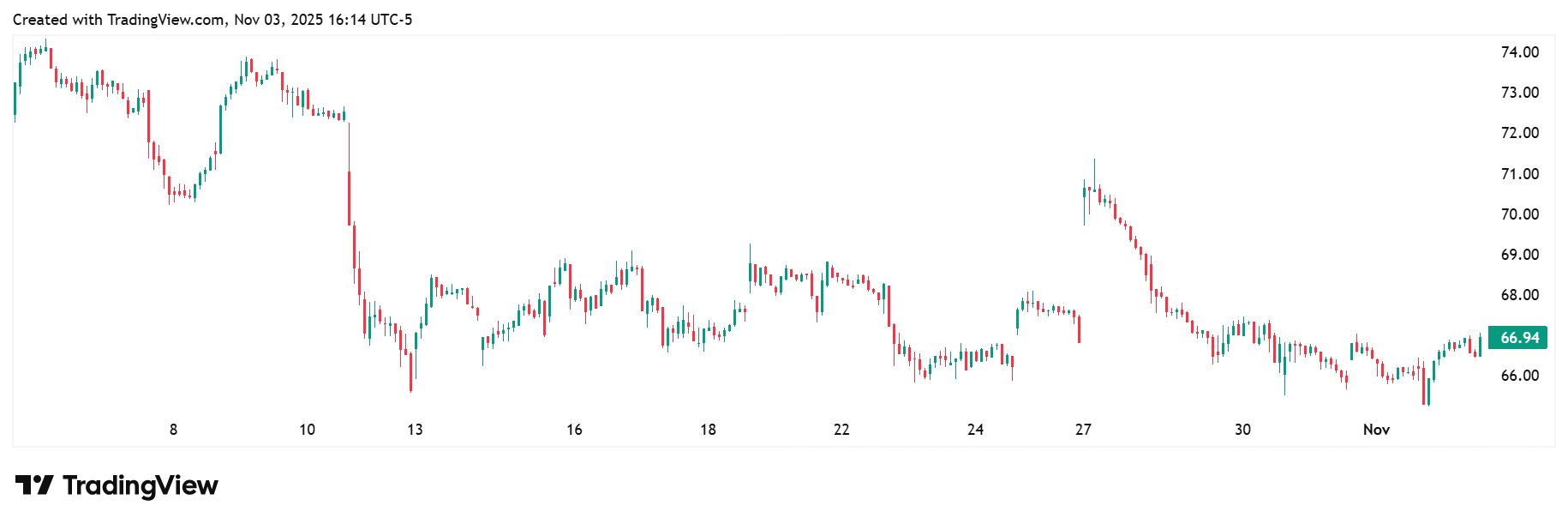

1-month trading summary: Doximity’s share price has slipped 9.77% over the last four weeks. The month opened near $73.00 before sellers took charge early, driving the stock down toward mid-$65 levels, where it found some stability.

Since then, DOCS has hovered in a tight range, suggesting short-term traders are waiting on new catalysts.

It's been a quietly consolidating month, not the kind of action that grabs headlines, but often the type that sets up the next move.

With earnings due tomorrow (November 5), things could be about to heat up.

Bull Case

A digital hub for doctors: If you like businesses that quietly win while everyone else chases the next shiny thing, Doximity is worth your time.

Think of it as the digital hub doctors actually use, not some startup trying to get noticed. More than 80% of U.S. physicians are already plugged in, which gives DOCS a network effect that’s incredibly hard to duplicate.

Revenue and cash flow are both climbing, the balance sheet is clean, and the model keeps proving itself quarter after quarter. It’s the kind of stock that rewards patience.

You won’t get a thrill ride, but you should expect a steady compounding story. It’s one for those who enjoy sipping their coffee while the rest of the market chases noise.

Pressing fast forward on the next growth phase: There’s more brewing under the surface than the recent dip suggests.

Doximity’s next phase of growth is being fuelled by deeper integration inside hospital systems and an expanding suite of workflow tools that save doctors time and keep them loyal.

The company is also leaning into AI features to make clinical communication smarter and faster, which could lift engagement and open new revenue streams.

On top of that, ad spending from healthcare brands is picking up again, feeding one of DOCS’s most profitable segments.

With cash piling up and management hinting at new product rollouts, the next few quarters could quietly remind the market why this platform is still the default digital home for America’s doctors.

Current price targets: The low price target sits at $55.00, while the high is up at $82.00.

The tailwinds are gearing up for a new phase of momentum: After a sharp pullback through October, DOCS is showing early signs of stabilizing around the $65 support zone, an area that has held multiple times this year.

Volume has started to thin out on down days, a subtle hint that sellers are tiring.

The RSI has moved back into neutral territory, too, giving the stock room to breathe if momentum returns.

Bear Case

A reliable stock that could still test your nerve: The key risk here is that Doximity’s smooth run could hit a few bumps if hospitals and healthcare advertisers start pulling back on spending.

Management already spooked the market once with cautious guidance, and another soft outlook could test your patience.

There's also the question of how far Doximity can stretch its doctor network before engagement starts to cool off.

This isn't a broken story, but it could drift sideways if growth takes a breather. In other words, it's a reminder that even the calmest, most reliable stocks can test your nerves now and then.

Could a rival crack the code faster? Doximity may be the go-to digital network for doctors, but it’s not without company in the healthcare tech space.

LinkedIn has been quietly strengthening its healthcare presence, while telehealth specialists like Teladoc and Amwell continue to chase parts of the same professional market.

Upstarts such as OpenEvidence are also fighting for attention with AI-driven clinical tools, sparking both competition and lawsuits.

The moat here is real, but it isn’t impenetrable. If a rival cracks the code for AI-assisted workflows faster, Doximity could find itself playing catch-up rather than setting the pace.

Understanding the macro headwinds: Healthcare spending is steady, but not immune to budget tightening as hospitals juggle costs and delayed payments.

At the same time, investor appetite for digital health names has cooled since the post-pandemic boom, meaning even solid results can struggle to move the needle until sentiment across the sector warms back up.

A calm playing field that could get crowded, fast: After the guidance-driven selloff, many short-term traders have already moved on, leaving a calmer field for long-term buyers.

That said, the stock’s loyal institutional base means rallies can stall if big holders decide to trim positions rather than add, keeping upside momentum in check until new interest steps in.

Quick Checklist

✅ Thesis still valid after today’s close

✅ Volume confirms move above key levels

✅ Catalyst date double-checked (November 03, 2025)

Deep‑Dive Links

That’s all for today’s Everyday Alpha. We’ll have a new pick for you every morning before the market opens, so stay tuned!

Best Regards,

—Noah Zelvis

Everyday Alpha