- Everyday Alpha

- Posts

- Stacking the Deck for a Breakout

Stacking the Deck for a Breakout

Hello and welcome to Everyday Alpha, the daily newsletter showcasing a different stock opportunity every day the market is open. We give you laser-focused content to save you time and energy so you can make educated investment decisions quickly.

If you’re not looking for more emails from us, just click here to unsubscribe!

Gambling.com Group Ltd. (GAMB)

May 13, 2025 – Pre-market

Ticker: GAMB | Sector: Consumer Cyclical – Gambling | Market Cap: ~$550M

30‑Second Take

Why now? Gambling.com Group is gaining momentum ahead of its Q1 2025 earnings report, scheduled for May 15. The company has shown consistent growth in revenue and profitability, and recent institutional investments suggest confidence in its future performance.

Time frame: Swing to medium-term position

Edge type: Momentum breakout with earnings-driven catalyst

Trade Setup

Entry Zone: $14.00–$14.50

Trigger: Close above $14.50 on above-average volume

Target Range: $16.50–$18.00 over 2–3 months

Stop-Loss: Close below $13.00

Reward/Risk Ratio: Approximately 2.5:1

This setup is tailored for swing-to-medium-term traders aiming to capitalize on Gambling.com Group's recent positive momentum. The stock has been steadily climbing, and a decisive close above $14.50, especially on increased volume, could signal the start of a new upward trend.

Fundamentally, the company is expected to report Q1 2025 earnings of $0.25 per share on revenue of $40.07 million. Recent institutional investments, including Driehaus Capital Management LLC purchasing over 500,000 shares, indicate strong investor confidence.

Snapshot Table

Metric | Value | Vs. Peers |

|---|---|---|

Price | $13.67 | Mid-range |

52‑week range | $10.50 – $16.75 | Mid-range |

Short interest | ~6.39% float | Above average |

Next catalyst | Q1 earnings – May 15, 2025 | Potential upside |

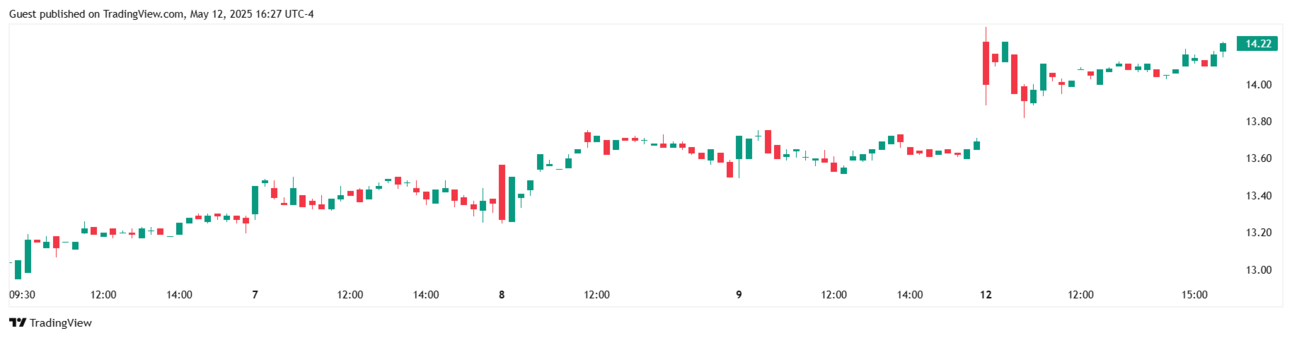

Chart

5-Day Synopsis:

Over the past week, Gambling.com Group (GAMB) stock has exhibited a steady upward trend. Starting from approximately $13.17 on May 2, 2025, the stock has consistently closed higher each day, reaching $13.67 by May 9. This progression indicates strong investor confidence and suggests potential for further growth.

Technical indicators support this positive outlook. The stock has reclaimed its 50-day moving average, and the Relative Strength Index (RSI) is approaching 60, signaling bullish momentum. Volume has been increasing modestly, indicating growing investor interest. If GAMB breaks above the $14.50 resistance level with conviction, it could pave the way toward the $16.50–$18.00 target range over the next 2–3 months.

Bull Case

Core thesis: Gambling.com Group specializes in digital marketing services for the global online gambling industry. As the sector continues to grow, the company's niche focus positions it to benefit from increased demand.

Catalysts: The company's Q1 2025 earnings report, scheduled for May 15, could further boost investor sentiment if positive trends continue. Recent institutional investments suggest confidence in the company's growth prospects.

Valuation upside: Analysts have set a consensus price target of $17.67, reflecting a potential upside of approximately 29% from the current price.

Technical tailwind: The stock is approaching its 52-week high, and a breakout above this level could attract momentum traders. Technical indicators support a bullish outlook in the near term.

Bear Case

Key risk: The company's reliance on the online gambling sector makes it vulnerable to regulatory changes and shifts in consumer behavior, which could impact demand for its services.

Macro/sector headwind: Economic downturns or increased competition in the online gambling industry could pressure margins and affect revenue growth.

Competitive threat: Larger digital marketing firms with broader service offerings and more extensive client networks could pose competitive challenges, potentially impacting market share.

Crowded-trade concern: With a short interest of approximately 6.39% of the float, the stock may be susceptible to volatility if short sellers increase pressure or if investor sentiment shifts.

Quick Checklist

✅ Thesis still valid after today’s close

✅ Volume confirms move above key levels

✅ Catalyst date double-checked (Q1 earnings – May 15, 2025)

✅ Portfolio correlation OK (low overlap with tech/energy sectors)

Deep‑Dive Links

Best Regards,

—Noah Zelvis

Everyday Alpha

Legal Stuff: Stocks featured in this newsletter are for entertainment purposes only. You should not base any investment decisions on information contained in my newsletter. Stocks featured in this newsletter may be owned by owners/operators of this website, which could impact our ability to remain unbiased. Please consult a financial advisor before making any trading decisions. I may earn a small commission from links placed inside these emails.