- Everyday Alpha

- Posts

- Price Pullback Makes This 159% AI-Powered Loan Platform A Top Pick

Price Pullback Makes This 159% AI-Powered Loan Platform A Top Pick

AI technology is transforming consumer finance, unlocking new markets and driving revenue like never before for this innovative consumer finance platform.

Dive in to explore why this could be your next big investment opportunity.

Never Miss a Stock Alert Again!

We now send our daily picks via text too — so you’ll get the same high-conviction ideas, even if you miss the email.

Upstart Holdings, Inc

August 12 – Pre‑market

Ticker: UPST | Sector: Credit Services / Financial Services | Market Cap: ~ $6.6B

30‑Second Take

Why now? After recent market pullbacks due to profit taking, UPST is trading at an attractive valuation well below its growth potential.

The firm's Q2 earnings confirmed the platform has returned to growth, with the number of loans originated up 159% year-over-year.

This 23.9% Conversion Rate is up from 15.2% in Q2 2024. Total originations exceeded $2.8 billion, up 154% YoY.

As consumer finance continues shifting toward digital solutions, Upstart is perfectly positioned to capture significant market share and drive strong revenue growth.

For investors seeking an under-the-radar alpha stock for less than $75, Upstart offers a compelling opportunity to outperform the broader market with its innovative approach and scalable business model.

Learn from this investor’s $100m mistake

In 2010, a Grammy-winning artist passed on investing $200K in an emerging real estate disruptor. That stake could be worth $100+ million today.

One year later, another real estate disruptor, Zillow, went public. This time, everyday investors had regrets, missing pre-IPO gains.

Now, a new real estate innovator, Pacaso – founded by a former Zillow exec – is disrupting a $1.3T market. And unlike the others, you can invest in Pacaso as a private company.

Pacaso’s co-ownership model has generated $1B+ in luxury home sales and service fees, earned $110M+ in gross profits to date, and received backing from the same VCs behind Uber, Venmo, and eBay. They even reserved the Nasdaq ticker PCSO.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Trade Setup

Time frame: Swing to medium-term

Edge type: Momentum breakout

Snapshot Table

Metric | Value | Current Stance |

|---|---|---|

Price | $63.46 | Above average |

52‑week range | $31.40 - $96.43 | Above average |

Short interest | 19.34% | Average |

Next catalyst | Q3 earnings |

Chart

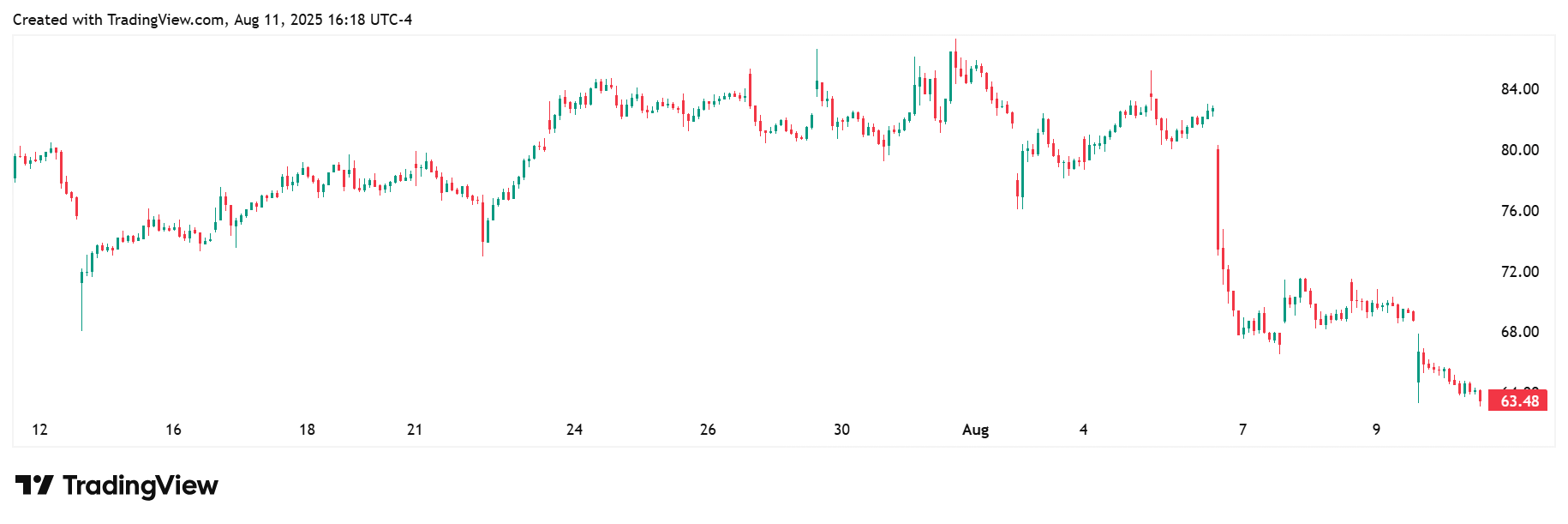

1-Month Synopsis: The last month has seen UPST endure a period of heightened volatility. The stock initially rose to a high of $84.69 thanks to optimism around AI-driven lending growth and favorable analyst commentary.

A sharp reversal triggered by the company’s Q2 earnings on August 5th saw prices tumble to $66.50, with further losses in the following days.

Despite the sell-off, trading volumes remained elevated throughout the period, reflecting sustained speculative interest, particularly from leveraged ETF activity, even as sentiment became more cautious.

Bull Case

Core thesis: Upstart Holdings is revolutionizing the lending industry with its cutting-edge AI technology, making loan approvals faster, safer, and more accurate than traditional credit scoring methods.

Unlike legacy credit models, Upstart’s AI-driven platform evaluates a broader range of data points, enabling more accurate risk assessments and expanding credit access to underserved consumers.

This technological edge not only reduces default rates but also enhances lenders’ profitability, making Upstart’s solution highly attractive in a large, fragmented $1.5 trillion consumer loan market.

As more banks and financial institutions adopt AI-driven lending, Upstart’s scalable platform is poised for exponential growth, supported by recurring revenue streams and expanding partnerships.

Despite short-term volatility, the company’s strong unit economics, innovative product pipeline, and growing market share position it to deliver sustainable alpha, outperforming traditional financial stocks and the broader S&P 500 over the coming years.

Catalysts: UPST stock is up 7.87% on the year but has also beaten analyst expectations for the last three quarters.

It demonstrated a strong Q2 performance with revenues of $257 million, an improvement of 102% YoY.

Revenue from fees was $241 million, up 84% YoY, with a full-year outlook calling for total revenue of approximately $1.055 billion.

The company also reached GAAP profitability a quarter sooner than expected. Upstart’s investment in AI is one of its key growth drivers.

The accuracy of this technology is significant in the current macroeconomic backdrop, where the level of consumer demand for credit is at odds with the more conservative approach to lending that many traditional banks and credit providers have adopted post-pandemic.

This disconnect means platforms like Upstart are in high demand with an increasing number of would-be borrowers searching for alternatives to their usual banks.

According to data from the Federal Reserve, total consumer credit grew $7.37 billion in June 2025, which was higher than expected.

Significantly, credit card and auto loans are expected to increase further in the coming months – both areas where Upstart offers a fast, seamless, digital solution, which could be much more attractive to borrowers than the usually long-winded process of gaining approval from a traditional lender.

Valuation upside: The highest analyst target for this stock is $108.00, with a low of $20.00. The average price target is $66.20.

Technical tailwind: The technical MACD indicator, along with the 10, 20, 30, and 50-day moving averages, is flashing buy signals, which is notable with the stock trading at a bargain right now.

Steep losses after its stellar Q2 results suggest a strong performance was already priced in. The short-term profit taking creates a clear window of opportunity for high-risk, high-reward buyers.

Momentum Starts Now (Sponsored)

Most investors are focused on the noise—volatile headlines, policy shifts, and global uncertainty.

But often, the biggest gains happen where no one is looking.

Our free, in-depth report reveals 7 under-the-radar stocks that have the potential to outperform as the market adjusts.

These companies operate in booming sectors and have the resilience to turn challenges into catalysts.

You’ll learn:

• Which industries could lead the next market upswing

• How to identify stocks with breakout potential before the crowd

• Why timing now could be your greatest advantage

Markets reward the prepared—don’t wait until the opportunity is gone.

Bear Case

Key risk: As with any loan provider, defaults are a primary concern.

An increase in credit defaults or tighter funding conditions could force the company to hold more loans on its balance sheet, straining liquidity, increasing exposure to credit losses, and undermining investor confidence in its AI-driven lending model.

Given Upstart has been in recovery mode for more than a year, any sharp shift in these metrics could unwind the progress it has already made to return to growth over the last 12 months.

Macro/sector headwinds: Interest rates, inflation, and geopolitics could all put the brakes on growth, but the most significant headwind is compliance and regulation.

That's because AI powers much of Upstart’s platform (and its explosive growth this year) – but it’s still a grey area for regulators who have already expressed concerns about potential bias and transparency.

Competitive threat: While UPST has leveraged AI to power its growth, it doesn't have a monopoly on this technology.

Traditional banks and other platforms are also adopting AI-supported decision-making. In the case of banks in particular, their much larger client base and bigger budgets could pose a threat.

Crowded-trade concern: Heavy positioning by momentum-driven funds and retail traders magnifies gains and losses beyond what the fundamentals may suggest.

UPST has already experienced this in 2021 and could see a similar sharp loss if sentiment shifts once again, whether due to a miss on the next earnings report or, as was the case previously, due to interest rate changes.

Quick Checklist

✅ Thesis still valid after today’s close

✅ Volume confirms move above key levels

✅ Catalyst date double-checked (August 11, 2025)

Deep‑Dive Links

That’s all for today’s Everyday Alpha. We’ll have a new pick for you every morning before the market opens, so stay tuned!

Best Regards,

—Noah Zelvis

Everyday Alpha