- Everyday Alpha

- Posts

- More Than Just Hair and Hormones: The Telehealth Stock with Triple-Digit Growth

More Than Just Hair and Hormones: The Telehealth Stock with Triple-Digit Growth

Hello and welcome to Everyday Alpha, the daily newsletter showcasing a different stock opportunity every day the market is open. We give you laser-focused content to save you time and energy so you can make educated investment decisions quickly.

Never Miss a Stock Alert Again!

We now send our daily picks via text too — so you’ll get the same high-conviction ideas, even if you miss the email.

Him & Hers Health, Inc

July 25 – Pre‑market

Ticker: HIMS | Sector: Household & Personal Products | Market Cap: ~ $12.98B

30‑Second Take

Why now? A strong momentum stock with an accelerated growth plan being executed at pace, HIMS has risen by 139.95% this year.

This extraordinary uplift comes on the back of a steady 75% annual growth rate achieved over the last three-year period.

That said, a recent pullback has seen prices fall below the 52-week high, providing a window of opportunity for entry at a more attractive price point.

2025 Hotlist (Sponsored)

With 2025 entering its final stretch, the smart money is rotating fast — and you need to know where it’s going.

This free guide breaks down 7 stocks primed to perform now through the end of the year.

What’s inside:

✅ Fast-growing sectors entering breakout phases

✅ Simplified research for smarter decisions

✅ Picks backed by real market trends — not guesses

Don’t let Q3 and Q4 pass you by while others grab the gains.

Trade Setup

Time frame: Swing to medium-term

Edge type: Momentum breakout

Snapshot Table

Metric | Value | Current Stance |

|---|---|---|

Price | $57.30 | Average |

52‑week range | $13.47 - $72.98 | Above average |

Short interest | 35.39% | Above average |

Next catalyst | Q2 earnings, due August 4, 2025 |

Chart

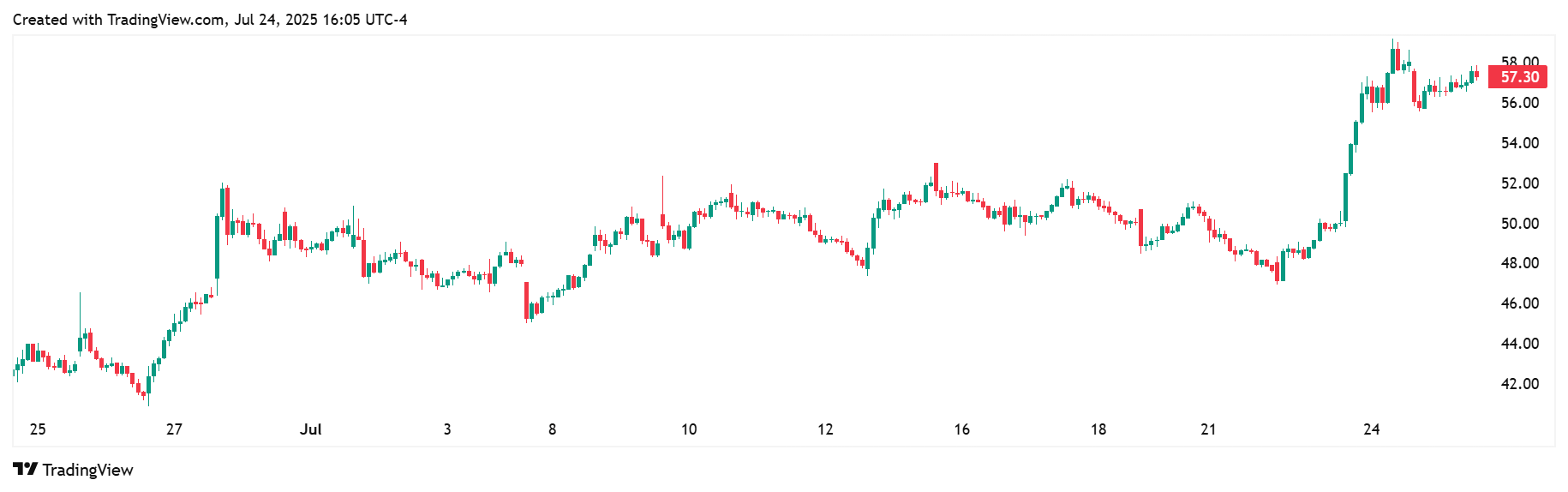

1-Month Synopsis: Price action over the last month has been compelling to watch. HIMS stock started the period very much on the back foot.

The stock lost around 35% of its value on June 23rd, with a sharp loss seeing prices plunge from $64 to $41.98.

The catalyst for this volatility?

Global healthcare company Novo Nordisk publicly ended its one-month partnership with Him & Hers Health after an investigation uncovered evidence of "deceptive promotion and selling of illegitimate, knockoff versions of Wegovy® that put patient safety at risk."

This case cast a shadow over stock prices well into July, with prices establishing short-term support in the ~$47–$50 range. In more recent sessions, there are signs that a recovery is underway.

Confidence started to creep back in mid-July, with prices benefiting from an uptick in the broader telehealth segment and positive momentum from growth plans.

These factors pushed HIMS to $58 by July 23, an approximate ~38% rebound from its early June low.

Bull Case

Core thesis: Hims & Hers Health Inc. (HIMS) is a direct-to-consumer digital health platform redefining access to affordable, stigma-free care across key therapeutic categories, including sexual health, mental health, dermatology, weight loss, and primary care.

Its vertically integrated model, combining telehealth consultations, personalized treatment plans, and in-house pharmacy fulfilment, delivers convenience, privacy, and strong unit economics.

With a rapidly growing subscriber base and expanding average revenue per user, HIMS is scaling a high-margin, recurring-revenue model.

The company’s data-driven approach and category innovation, such as GLP-1 offerings and at-home testing, position it as a disruptive force in the $4+ trillion U.S. healthcare market.

As traditional systems lag in affordability and accessibility, HIMS offers a compelling long-term growth story at the intersection of healthcare, technology, and consumer experience.

Catalysts: Expansion is a key driver of the 154.81% growth HIMS stock has achieved in the last 12 months.

The company forecasts that sales will increase by a factor of x4 and reach $6.5 billion by 2030. To achieve that aim, it is pursuing an active growth trajectory.

In its Q1 earnings report, HIMS appeared to be making good progress towards that goal with a 38% YoY increase in subscribers and a 53% YoY uplift in monthly online revenue per average subscriber.

Recent announcements have confirmed that Hims & Hers will acquire ZAVA, accelerating its growth in Germany, France, Ireland, and the UK.

Plans are also underway to expand to Canada in 2026.

Valuation upside: Current analyst price targets run from a low of $28.00 to a high of $85.00. The average price target is $49.19.

Technical tailwind: The subscription-based healthcare provider is trading comfortably above the 50-day and 200-day moving averages, with high volumes indicating renewed investor interest following June's reputational challenges.

Market Play (Sponsored)

The escalating U.S.-China trade tensions are reshaping the AI landscape.

Companies like Nvidia are facing significant revenue hits with the U.S. imposing new export restrictions on advanced AI chips to China.

This shift opens doors for U.S.-based AI companies poised to fill the gap. I’ve identified 9 under-the-radar AI stocks with:

Deep AI integration across their core operations

Strong U.S. manufacturing capabilities

Infrastructure ready to capitalize on policy shifts

Access our FREE report, "Top 9 AI Stocks for This Month" to discover these opportunities before the broader market catches on.

Bear Case

Key risk: Operating in healthcare and telemedicine exposes HIMS to evolving regulatory scrutiny, reputational damage, and class action lawsuits when it fails to meet required standards. As a DTC healthcare brand, consumer trust is critical.

Missteps in patient safety, privacy breaches, or bad publicity could severely damage reputation and retention.

This is something the stock has already experienced firsthand with the fallout from Novo Nordisk.

Reputation aside, the main risk is that HIMS relies heavily on subscription-based revenue.

If customers don’t find long-term value or results (e.g., for ED, hair loss, mental health), churn could spike, damaging revenue growth and profitability.

Macro/sector headwinds: Hims & Hers is sensitive to macroeconomic shifts. As a discretionary purchase for some users, subscriptions to wellness/health products may decline in a recessionary environment or periods of inflation.

Competitive threat: The DTC telehealth space is crowded with players such as Ro, Thirty Madison, Amazon Clinic, and traditional providers expanding their online presence.

Larger players may offer lower prices, better logistics, or broader services, challenging HIMS' growth trajectory.

Crowded-trade concern: The enormous growth trajectory that HIMS has established over the last 12 months or so means it likely has a large pool of momentum investors on board.

The crowded long position means that any change in sentiment could result in a mass selloff, with prices dropping below what company fundamentals would justify.

Quick Checklist

✅ Thesis still valid after today’s close

✅ Volume confirms move above key levels

✅ Catalyst date double-checked (July 24, 2025)

Deep‑Dive Links

That’s all for today’s Everyday Alpha. We’ll have a new pick for you every morning before the market opens, so stay tuned!

Best Regards,

—Noah Zelvis

Everyday Alpha