- Everyday Alpha

- Posts

- Laying The Foundations Before Wall Street Moves In

Laying The Foundations Before Wall Street Moves In

This is not a finished story; it’s a construction site.

Loud, messy, and full of potential. If you’re willing to back ambition before the income statement catches up, this could be where the groundwork for something much bigger gets laid.

Market Risks Ahead (Sponsored)

Political transitions historically increase uncertainty—and this cycle is no exception.

Tariff expansion is reviving crash-risk conversations across Wall Street.

Asset protection strategies are gaining attention as volatility accelerates.

Ignoring structural risk has consequences during regime shifts.

Awareness precedes action.

No guarantees are implied.

This content is not a recommendation to buy or sell.

Download the FREE Presidential Transition Guide now.

Never Miss a Stock Alert Again!

We now send our daily picks via text too — so you’ll get the same high-conviction ideas, even if you miss the email.

QXO, Inc.

January 06 – Pre‑market

Ticker: QXO | Sector: Industrial Distribution/Industrials | Market Cap: ~$15.71B

30‑Second Take

QXO, Inc. isn’t a story about what is today; it's a story about what's being built in plain sight for tomorrow.

The company is in the early innings of a roll-up strategy aimed at a massive, fragmented building products and distribution market.

The timing matters. The stock is trading more on imagination than income right now.

Still, that imagination is anchored to a very real endgame: scale, consolidation, and operating leverage in an industry that desperately lacks both.

In short, this is a “get positioned before the pieces click into place” setup. The numbers will come later. The optionality is already here.

Trade Setup

Time frame: Medium to long term

Edge type: Early-stage narrative build

This is not a precision entry chasing clean comps or tidy margins. It’s a positioning trade in a company that’s still assembling the machine.

Expect volatility. Expect gaps in headlines. That’s the price of admission. The payoff is exposure to a roll-up thesis while it’s still being debated, not celebrated.

Act Now (Sponsored)

Liquidity is rising, institutions are investing, and regulations are becoming friendlier.

The foundation is set for what could be a major market move.

Investors who act now may benefit most.

A 250-page digital system reveals how to grow crypto wealth safely, without risky speculation or constant stress.

Download now and claim $788 in bonuses—including the #1 crypto pick this cycle.

Access the Crypto Guide

Trivia: What triggers a credit score drop most quickly? |

Numbers at a Glance

Metric | Value | Current Stance |

|---|---|---|

Price | $23.30 | Below average |

52‑week range | $11.85 - $24.69 | Below average |

Short interest | 20.38% | Above average |

Next catalyst | Next acquisition announcement |

Chart

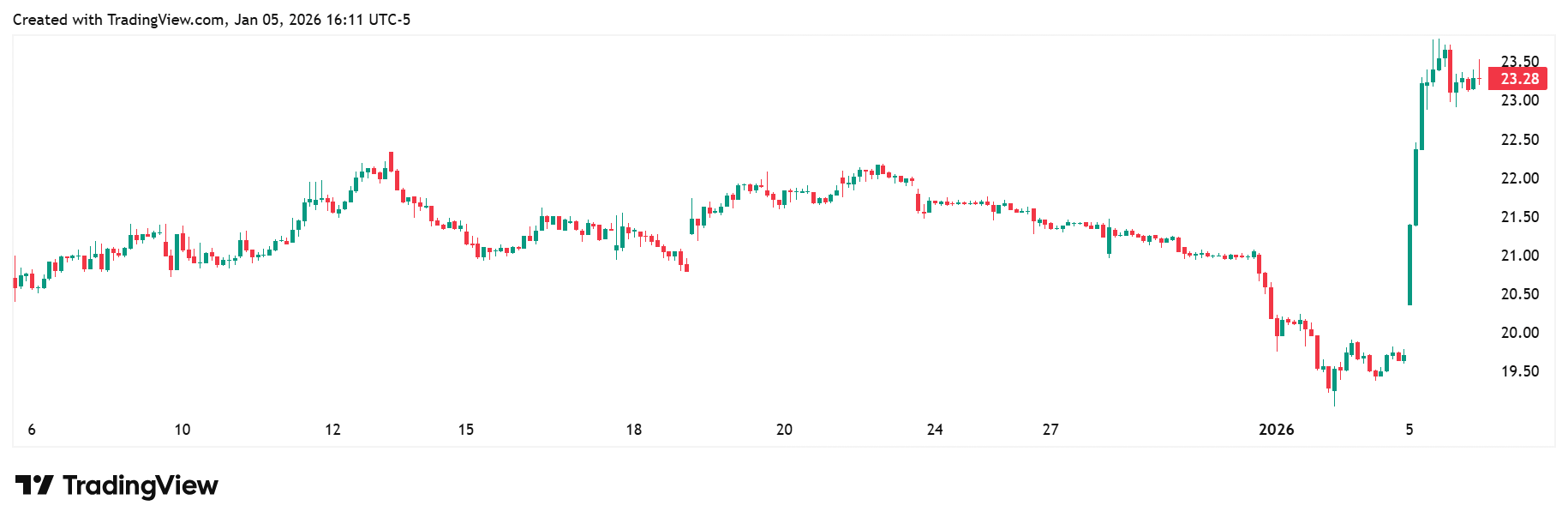

1-month trading summary: QXO hasn’t drifted higher. It’s announced itself.

After chopping sideways and testing patience through most of the month, the stock flipped the script with a sharp, high-energy breakout that ripped through recent resistance and reset the narrative in a single session.

The message from the tape is clear. Sellers stepped aside, momentum traders showed up, and the stock re-entered discovery mode near the top of its recent range.

Short term, expect digestion after the spike. But the character change matters. QXO is no longer trading like a forgotten shell. It’s trading like a name investors are finally watching.

Bull Case

Building the platform before the profits show up: QXO, Inc. is a bet on scale creation, not near-term polish.

The bull case rests on a simple but powerful idea: take a sprawling, inefficient building products ecosystem and start stitching it together with capital, discipline, and ambition.

This is an industry where fragmentation isn’t a feature, it’s a flaw, and QXO is positioning itself as the fix.

What makes this compelling isn’t just the roll-up angle, it’s the starting point. QXO isn’t over-levered, boxed in, or forced to chase marginal deals.

It has the balance sheet flexibility and strategic freedom to be selective, to buy assets others can’t, and to improve them through scale, purchasing power, and operational clean-up.

That’s where real value gets created, quietly for a while, then very loudly.

The upside comes from getting involved while that transformation is still being sketched, not once it’s fully drawn.

Progressive catalysts: This story doesn’t hinge on a single earnings print or a binary announcement. The catalysts here are progressive, and that’s what makes them powerful.

First, any meaningful acquisition changes the conversation, not because of the immediate numbers, but because it turns QXO from a concept into an operator.

Second, deal cadence matters. One transaction is interesting. A sequence of them signals momentum.

As the market starts seeing repeatable execution, the stock stops trading on hypotheticals and begins trading on pattern recognition.

Next, watch for infrastructure build-out. Hires, systems, integration frameworks.

These don’t make headlines, but they tell institutions the company is preparing to scale, not improvise.

A tale of two halves: There’s an interesting gulf in price targets, with the low coming in at $26.00 and the high exactly double that at $50.00.

When price action starts reflecting the story: After weeks of choppy, indecisive action, QXO has broken higher with conviction.

Momentum has shifted from defensive to offensive.

Pullbacks are getting bought faster, volatility is resolving to the upside, and price is spending more time above short-term support levels than below them.

This isn’t a straight line move, and it won’t pretend to be. But the technical setup now supports the narrative.

As long as QXO holds recent breakout levels, the path of least resistance points higher, with dips increasingly viewed as opportunities rather than warnings.

Bear Case

Execution risk shows no mercy: QXO, Inc. is asking the market to trust a vision before the spreadsheet looks pretty.

That's powerful when it works and painful when it doesn't. The biggest risk is unforgiving and straightforward: execution.

Roll-ups look elegant on paper and brutal in real life. Overpay for assets, stumble on integration, or underestimate operational complexity, and the story can unwind fast.

Scale amplifies mistakes just as efficiently as it amplifies profits. If early acquisitions fail to deliver synergies or cultural alignment, investor patience won’t be endless.

There's also a timing risk. This stock is trading on forward belief, not trailing proof.

If deal flow slows, financing tightens, or management goes quiet for too long, momentum can evaporate and the multiple with it. In a narrative-driven name, silence is rarely rewarded.

Challengers don’t get courtesy lanes: QXO, Inc. is stepping into a ring with some battle-hardened incumbents, and they won’t give up share without a fight.

Names like Builders FirstSource, GMS Inc., and privately held giants such as ABC Supply already operate at scale, with entrenched relationships, seasoned management teams, and years of integration scars that QXO has yet to earn.

A tough neighbourhood for big ambitions: QXO is building in a sector that doesn't hand out freebies.

Building products and distribution are cyclical, sentiment-driven, and heavily exposed to construction confidence.

When contractors pull back, volumes soften fast, and optimism disappears even quicker.

Higher-for-longer interest rates are another friction point. They don’t just cool end demand, they also make acquisitions harder to pencil.

Financing costs matter, valuations compress, and sellers suddenly expect yesterday’s prices in today’s market. That can slow deal flow or force tougher negotiations.

Consensus hasn’t arrived… yet: QXO is not a packed theatre. This isn’t a stock everyone already owns, loves, and defends on pullbacks.

Positioning still feels tentative, with investors circling the story rather than piling in.

Quick Checklist

✅ Thesis still valid after today’s close

✅ Volume confirms move above key levels

✅ Catalyst date double-checked (January 05, 2026)

Deep‑Dive Links

That’s all for today’s Everyday Alpha. We’ll have a new pick for you every morning before the market opens, so stay tuned!

Best Regards,

—Noah Zelvis

Everyday Alpha