- Everyday Alpha

- Posts

- Just What the Doctor Ordered: The Biotech Stock Going Gangbusters Right Now

Just What the Doctor Ordered: The Biotech Stock Going Gangbusters Right Now

Picture this: a biotech quietly stacking a lineup of potential blockbusters while keeping revenue steady. This isn’t hype, it’s strategy in action.

Are you ready to peek behind the curtain at a stock that is already surprising the market?

Keep This Stock Ticker on Your Watchlist

They’re a private company, but Pacaso just reserved the Nasdaq ticker “$PCSO.”

No surprise the same firms that backed Uber, eBay, and Venmo already invested in Pacaso. What is unique is Pacaso is giving the same opportunity to everyday investors. And 10,000+ people have already joined them.

Created a former Zillow exec who sold his first venture for $120M, Pacaso brings co-ownership to the $1.3T vacation home industry.

They’ve generated $1B+ worth of luxury home transactions across 2,000+ owners. That’s good for more than $110M in gross profit since inception, including 41% YoY growth last year alone.

And you can join them today for just $2.90/share. But don’t wait too long. Invest in Pacaso before the opportunity ends September 18.

Paid advertisement for Pacaso’s Regulation A offering. Read the offering circular at invest.pacaso.com. Reserving a ticker symbol is not a guarantee that the company will go public. Listing on the NASDAQ is subject to approvals.

Never Miss a Stock Alert Again!

We now send our daily picks via text too — so you’ll get the same high-conviction ideas, even if you miss the email.

Incyte Corporation

September 18 – Pre‑market

Ticker: INCY | Sector: Biotechnology / Healthcare | Market Cap: ~$16.9B

30‑Second Take

A biotech delivering on its promise: This biotech isn’t just tinkering in the lab; it's lining up real blockbusters. With a stacked pipeline, rising sales, and a fresh leadership team, it's one to watch if you're looking for growth with some serious upside.

Are you wondering, ‘why now’? The answer is simple.

Incyte’s not just promising, it’s delivering. Jakafi and Opzelura are already pulling in revenue while the pipeline is stacked with autoimmune and oncology candidates that analysts are eyeing as potential blockbusters.

The stock’s up 25% this year, and a new leadership team is hitting the gas on efficiency and launches.

Wall Street’s bullish outlook? They’re talking up to 449% growth potential this year. That’s not background noise, that’s a wake-up call.

Trade Setup

Time frame: Position trade (multi-quarter hold)

Edge type: Pipeline-driven growth breakout

Watch List (Sponsored)

The difference between “nice returns” and life-changing gains often comes down to timing—and information.

Our latest research has identified 5 stocks positioned for massive growth.

These companies combine strong fundamentals with technical setups that suggest the potential for explosive upside.

Past editions of this same report have included stocks that went on to gain +175%, +498%, even +673%.

While the past can’t predict the future, the track record speaks volumes.

For a limited time, you can download the full 5 Stocks Set to Double report—absolutely free.

[Get your free copy before midnight tonight]

Smart investors know: when the window is short, action beats hesitation.

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Poll: If your 401(k) was a video game, what difficulty level are you on? |

Snapshot Table

Metric | Value | Current Stance |

|---|---|---|

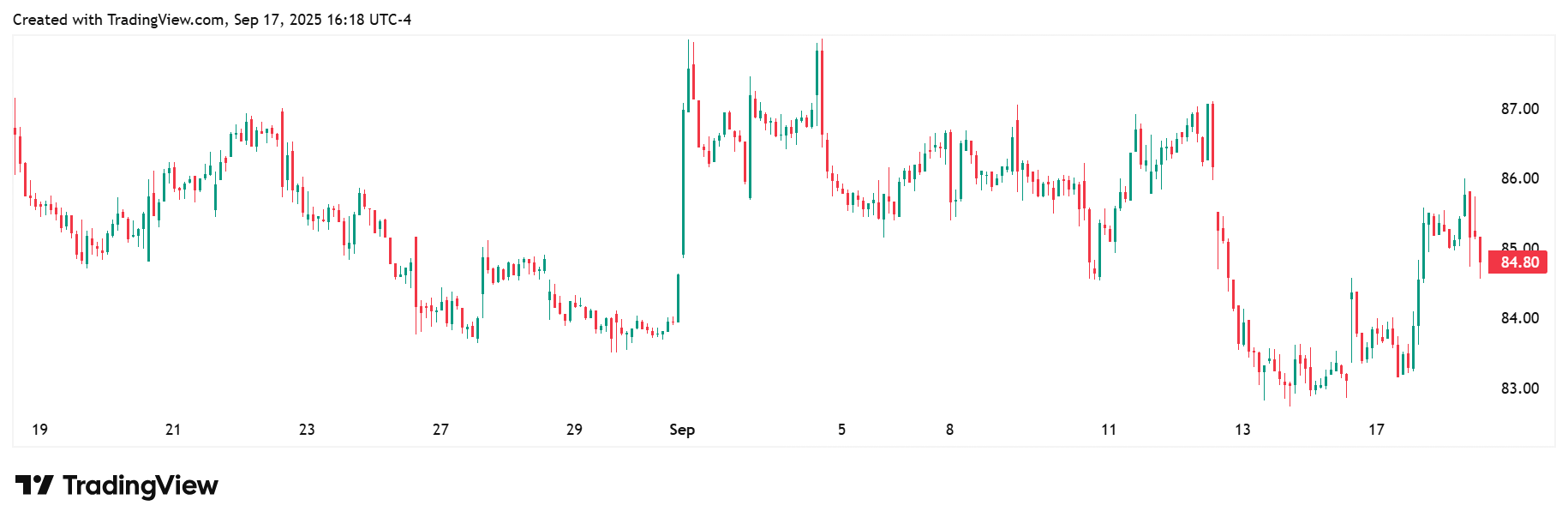

Price | $84.80 | Average |

52‑week range | $53.56 - $87.99 | Average |

Short interest | 3.89% | Average |

Next catalyst | Q3 earnings, expected October 28, 2025 |

Chart

1-Month Synopsis: Incyte has been riding a steady uptrend, with shares pushing toward the top of their 52-week range, although prices are down slightly (-1.89%) for the month.

Momentum’s been fueled by optimism around its leadership shake-up and strong trial results feeding into its pipeline story.

Investors aren’t just speculating here; they’re leaning in, with volume confirming conviction.

Bull Case

Building for the future: Incyte offers something rare in biotech: dependable revenue today and genuine moonshot potential tomorrow.

Jakafi anchors the business with blood disorder treatments, while Opzelura is gaining traction in eczema.

On top of that, the pipeline is thick with oncology and immunology candidates that could shift the growth curve entirely.

New leadership, a growing product pipeline, and a renewed focus on cost management: The next 12 months could be pivotal for INCY, with multiple catalysts poised to shape its growth trajectory.

Major product launches, such as the FDA-approved Niktimvo for chronic graft-versus-host disease (cGVHD), continue to diversify the INCY portfolio and create new revenue streams.

The company has also received favorable critical trial readouts in the areas of oncology and immunology, further developing its product portfolio.

Positive Phase 3 results for Monjuvi in first-line diffuse large B-cell lymphoma and Zynyz in first-line squamous cell anal carcinoma could translate into significant value inflection points as each product inches closer to FDA approval.

The new leadership team is adding energy, discipline, and a sharper focus on cost management.

In short, exactly what you want when scaling. Coupled with disciplined cost management and an emphasis on late-stage pipeline advancement, Incyte is positioned for sustained expansion.

Valuation upside: Analyst price targets span an extensive range, from a low of $60.00 to a high of $110.00.

Watch out for the golden cross: The stock flashed a golden cross this month with the 50-day moving average pushing above the 200-day. This is a bullish signal that lines up with the fundamental story. Shares are in an uptrend without looking frothy.

Bear Case

More product diversity, please: Here’s the catch: Jakafi accounts for most of Incyte’s revenue, which makes the company vulnerable to patent cliffs and rivals like AbbVie’s Rinvoq or Pfizer’s Xeljanz.

The pipeline is promising, but trial risk is always lurking.

One dud can sap momentum. Add in $16B+ of market cap that still leans heavily on a single drug, and concentration risk is real.

Risk aversion could be a headwind: The broader biotech backdrop isn’t exactly smooth sailing. Higher rates mean investors are choosier with risk, and chatter about drug pricing reform could weigh on the sector.

Inflation also pushes up the cost of capital, making it tougher to fund R&D. For Incyte, this means it has to manage resources tightly while pushing late-stage candidates forward.

New entrants, new ideas: Incyte’s main competitive threat comes from emerging JAK inhibitors and immuno-oncology therapies, such as AbbVie’s Rinvoq and Pfizer’s Xeljanz, which could erode Jakafi's market share.

New entrants with broader efficacy, lower side effects, or more aggressive pricing may undercut Incyte's revenue and pressure its pipeline to deliver results more quickly.

The sentiment flip: Heavy institutional ownership brings its own set of risks. If trial results disappoint or guidance slips, the exits could get crowded fast. In biotech, when sentiment flips, it doesn't trickle out — it rushes.

Quick Checklist

✅ Thesis still valid after today’s close

✅ Volume confirms move above key levels

✅ Catalyst date double-checked (September 17, 2025)

Deep‑Dive Links

That’s all for today’s Everyday Alpha. We’ll have a new pick for you every morning before the market opens, so stay tuned!

Best Regards,

—Noah Zelvis

Everyday Alpha