- Everyday Alpha

- Posts

- It’s Game On Again For This Entertainment Stock

It’s Game On Again For This Entertainment Stock

Once written off as unplayable, this digital entertainment powerhouse is quietly levelling up. Execution is cleaner, confidence is creeping back, and the market hasn’t hit refresh yet.

Investors bailed on this entertainment giant after the last boss fight went badly. Now the controls feel tighter, the strategy clearer, and the panic is largely gone.

The question isn’t whether this pick is exciting. It’s whether you’re ready to re-enter before the crowd does.

Get Content Workflows Right - Best Practices from Media Execs

The explosion of visual content is almost unbelievable, and creative, marketing, and ad teams are struggling to keep up.

The question is: How can you find, use, and monetize your content to the fullest?

Find out on January 14th as industry pioneers from Forrester Research and media executives reveal how the industry can better manage and monetize their content in the era of AI.

Save your spot to learn:

What is reshaping content operations

Where current systems fall short

How leading orgs are using multimodal AI to extend their platforms

What deeper image and video understanding unlocks

Get your content right in 2026 with actionable insights from the researchers and practitioners on the cutting edge of content operations.

Join VP Principal Analyst Phyllis Davidson (Forrester Research) and media innovation leader Oke Okaro (ex-Reuters, Disney, ESPN) for a spirited discussion moderated by Coactive’s GM of Media and Entertainment, Kevin Hill.

Never Miss a Stock Alert Again!

We now send our daily picks via text too — so you’ll get the same high-conviction ideas, even if you miss the email.

Sea Limited

December 31 – Pre‑market

Ticker: SE | Sector: Internet retail / Consumer cyclical | Market Cap: ~$76.0B

30‑Second Take

Sea Limited is in that uncomfortable but often rewarding phase where the business is healing faster than the stock.

Shares are still down 17.84% over the past six months, reflecting lingering skepticism rather than deteriorating fundamentals.

Under the surface, paying users are up 21.9%, engagement is rebuilding, and earnings expectations continue to firm.

This is no longer a turnaround story driven by cost cuts. It’s an execution story, unfolding while sentiment remains fragile.

If you’re the kind of investor who’s happy to embrace volatility, that disconnect between improving fundamentals and a bruised share price is exactly what makes this a compelling opportunity.

Trade Setup

Time frame: Medium term

Edge type: Fundamental recovery with sentiment lag

This is a medium-term setup built around the idea that the market is still pricing SE as a fragile recovery, while the underlying business is behaving more like a stabilized growth platform.

Volatility will remain part of the journey, but as execution continues and confidence rebuilds, that sentiment gap has room to close.

Rapid Wealth Creation (Sponsored)

A dramatic transformation in the financial system is creating unprecedented wealth—but most Americans aren’t ready.

Traditional investing strategies may leave you behind.

Analysts who predicted past market crashes say a unique opportunity is forming right now.

One-person companies and innovative approaches are generating massive gains faster than ever before.

Access the Free Briefing

Poll: How do you actually check your bank balance? |

Snapshot Table

Metric | Value | Current Stance |

|---|---|---|

Price | $128.32 | Below average |

52‑week range | $99.50 - $199.30 | Average |

Short interest | 2.52% | Average |

Next catalyst | Subscription updates |

Chart

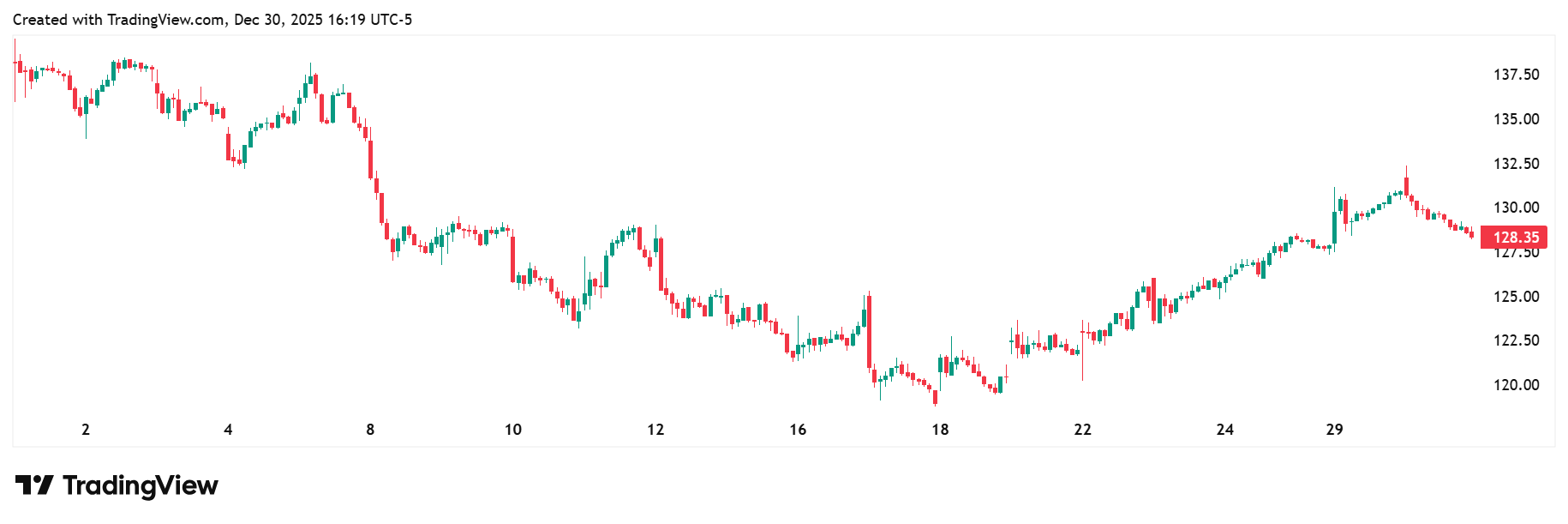

1-month trading summary: Sea Limited has quietly tightened up over the past month.

After an early pullback that shook out weak hands, the stock found its footing and worked steadily higher, finishing the period near $131.

The shape matters here. This wasn’t a straight-line rally fueled by hype, but a grind higher with higher lows, suggesting sellers are losing control.

Volume stayed orderly, volatility cooled, and momentum rebuilt without overheating.

For a stock still wearing plenty of skepticism, that kind of price action hints at accumulation rather than exhaustion.

Bull Case

Executing on ecommerce and entertainment: Sea runs one of Southeast Asia’s most powerful consumer internet ecosystems, spanning ecommerce, digital entertainment, and financial services.

When it works, it throws off enormous operating leverage. When it doesn’t, the market punishes it hard.

The bull case today is about control returning to the cockpit. Management is no longer chasing growth at any cost.

Capital allocation is tighter, focus is sharper, and the company is playing to its strengths rather than trying to win every battle at once.

That shift matters. It turns Sea from a fragile momentum trade into a business that can compound if things go right, not perfectly.

Turning the tide: SE isn’t a stock that needs a miracle to fulfil its potential. It just needs a few things to keep going right at the same time.

Continued profitability improvement is the big one.

Each quarter that can demonstrate operational discipline is sticking rather than slipping chips into the old narrative. Stabilization in e-commerce performance is another.

Any sign that digital entertainment is once again a dependable cash generator would change how this story is framed.

None of these is a flashy catalyst on its own. Together, they're the kind that quietly force the market to pay attention.

A huge expectation gap: Analysts are very mixed on SE's potential, with an almost $100 divide between price targets.

On the pessimistic end, the lowest price target is $138.00. At the other end of the scale, the highest price target is a lofty $226.00.

Catching a wave and riding the tailwind: Sea Limited has stopped behaving like a stock that wants to hurt you.

The wild swings are calming down, higher lows are starting to stack up, and dips are being bought rather than dumped.

That's a subtle but meaningful shift. It suggests that panic sellers are mostly gone and that more patient money is stepping in.

The chart is saying the worst may be behind us, and for a name like this, that change in tone can matter more than any single indicator.

Bear Case

Risk is still clouding the forecast: SE has minimal margin for error. This is a stock that the market has fallen out of love with before, and it won't hesitate to do so again.

If execution slips, costs creep back, or growth wobbles, patience could evaporate quickly. Valuation also leaves the door open to disappointment.

You're paying up for a recovery that isn't yet entirely proven. This is not a set-and-forget name. It demands attention, discipline, and a tolerance for volatility. If you want certainty, this isn't it.

A crowded and unforgiving arena: Sea operates in markets where the competition never sleeps. In e-commerce, regional heavyweights like Alibaba Group and Lazada are relentless on price, logistics, and marketing.

In gaming, user attention is fickle and hit-driven, with global publishers constantly fighting for the same eyeballs and wallets.

Financial services bring their own challenges, from nimble fintech startups to deep-pocketed incumbents.

Sea can absolutely win, but it rarely gets to do so easily, and any slip is quickly exploited.

The backdrop isn’t doing this stock any favours: SE lives at the intersection of growth, consumer spending, and risk appetite, and none of those are in a hurry right now.

Capital is more selective, investors are less forgiving, and markets are demanding proof rather than promises.

In Southeast Asia, consumer behaviour is still uneven, with spending choices becoming more practical and less aspirational.

That makes it harder for high-growth platforms to reaccelerate cleanly.

Even if Sea executes well, the environment may mean progress feels slower than investors would like, so expect your patience to be tested.

Not as lonely as it looks: Sea Limited sits in an awkward middle ground. It's no longer a consensus growth darling, but it's not an ignored small-cap either.

Plenty of investors are circling the same idea: a cleaned-up balance sheet, better discipline, and a second act for growth.

That means the trade can get crowded quickly if sentiment turns, and just as quickly unwind if confidence wobbles. The opportunity is real, but it's not secret. Timing and conviction matter more than cleverness here.

Quick Checklist

✅ Thesis still valid after today’s close

✅ Volume confirms move above key levels

✅ Catalyst date double-checked (December 31, 2025)

Deep‑Dive Links

That’s all for today’s Everyday Alpha. We’ll have a new pick for you every morning before the market opens, so stay tuned!

Best Regards,

—Noah Zelvis

Everyday Alpha