- Everyday Alpha

- Posts

- Gold’s Glow-Up: A Miner Riding the Momentum

Gold’s Glow-Up: A Miner Riding the Momentum

Gold's back in fashion, and this miner is leaning into the moment with absolute conviction.

With momentum building across both the commodity and the company, this could be one of the more compelling setups in the sector.

The Future of Shopping? AI + Actual Humans.

AI has changed how consumers shop by speeding up research. But one thing hasn’t changed: shoppers still trust people more than AI.

Levanta’s new Affiliate 3.0 Consumer Report reveals a major shift in how shoppers blend AI tools with human influence. Consumers use AI to explore options, but when it comes time to buy, they still turn to creators, communities, and real experiences to validate their decisions.

The data shows:

Only 10% of shoppers buy through AI-recommended links

87% discover products through creators, blogs, or communities they trust

Human sources like reviews and creators rank higher in trust than AI recommendations

The most effective brands are combining AI discovery with authentic human influence to drive measurable conversions.

Affiliate marketing isn’t being replaced by AI, it’s being amplified by it.

Never Miss a Stock Alert Again!

We now send our daily picks via text too — so you’ll get the same high-conviction ideas, even if you miss the email.

Kinross Gold Corporation

December 04 – Pre‑market

Ticker: KGC | Sector: Gold/Basic Materials | Market Cap: ~$33.4B

30‑Second Take

Gold has quietly crept back onto investors’ radars as rates soften, recession murmurs linger, and geopolitical jitters keep safe haven demand alive.

Kinross sits in that sweet spot where solid production, stable costs, and improving free cash flow can translate into meaningful upside if gold continues its grind higher.

After a strong year-to-date performance, the stock still feels reasonably valued relative to peers, making this a timely moment to take another look.

Trade Setup

Timeframe: Swing to medium-term accumulation

Edge type: Riding momentum in a strengthening commodity cycle

Kinross is shaping up as a classic momentum-plus-macro setup. The stock has already put in a strong run, but the trend remains constructive, and there's still room if gold keeps firming.

If you’re of a longer-term mindset (never a bad thing with precious metals), this could be your opportunity to build a position in a well-run miner that’s benefiting directly from rising bullion prices.

Huge Upside (Sponsored)

Every market cycle produces a select group of companies that drastically outperform the rest.

The latest screening has pinpointed the 5 Stocks Set to Double, each showing rare traits linked to early stage momentum.

These names carry the same type of indicators that have historically appeared ahead of strong rallies.

Earlier reports featured stocks that delivered +175%, +498%, and +673%.

Get the Free 5 Stocks Set to Double Report.

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Poll: How often do you think about retirement? |

Snapshot Table

Metric | Value | Current Stance |

|---|---|---|

Price | $27.13 | Below average |

52‑week range | $8.99 - $28.81 | Below average |

Short interest | 2.06% | Average |

Next catalyst | Q4 production update |

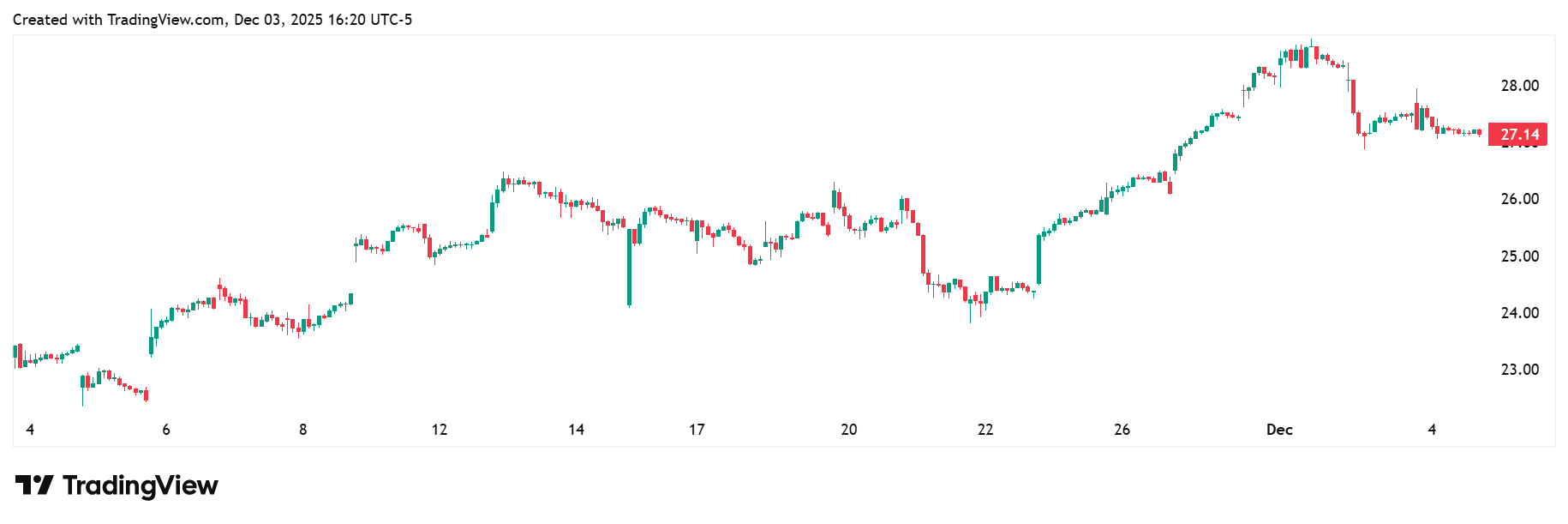

Chart

1-month trading summary: Kinross has delivered a punchy 17.58% rally over the past month, a move that’s been anything but quiet.

The stock has surged with real intent, pushing toward the very top of its 52-week range before a modest pullback.

Even with that breather, it remains comfortably above previous resistance, signaling strong demand and a clear shift in sentiment.

It’s been a confident, high-energy month, with momentum firmly on the side of the bulls.

Bull Case

Shining bright against a bullish backdrop: Kinross is one of those names that finally looks to have the wind at its back.

With gold prices strong and macro nerves keeping safe haven demand alive, the company is benefiting from exactly the kind of environment it’s built for.

Production has been steady, costs have stayed under control, free cash flow has hit record levels, and the production pipeline is progressing at pace.

What makes the story more interesting is that Kinross isn’t trying to be flashy.

It’s simply executing well across its core assets, leaning on a clean balance sheet, and quietly turning rising gold prices into expanding margins.

Add in jurisdictions that investors like and a valuation that still sits below some of the more glamorous peers, and you have a miner that’s not only participating in the gold rally but arguably still has room to rerate if the metal keeps climbing.

In short, this is a well-run operator catching a very supportive macro wave. As you’re sure to know, sometimes that elusive combination is all you need.

Keeping the shine: Kinross has a few meaningful drivers lined up that could nudge its recent growth story forward to the next chapter.

The obvious catalyst is gold itself. If bullion continues to firm up on rate-cut expectations and global jitters, Kinross's margins should expand almost mechanically.

Pair that with the company's ongoing focus on operational efficiency, and you've got the potential for pleasantly surprising quarterly numbers.

There’s also the production side.

Any upbeat updates from key assets or signs of smoother throughput could reassure investors that Kinross is firmly in its groove.

And finally, with free cash flow trending higher, the market will be watching closely for hints of sweeter shareholder returns or disciplined reinvestment plans.

None of this needs to be dramatic. All we need to see here is steady, confidence-building progress that ties directly to an improving gold price backdrop.

Price targets: Analysts are split on KGC’s potential, with the low price target just $8.00. This contrasts with a high of $37.00.

This chart is behaving like a bull’s best friend: Kinross is riding a clear upward trend, with the stock holding comfortably above prior resistance and buyers showing up on every dip.

Momentum indicators are firm without looking overstretched, and the recent push toward the top of its range suggests the bulls are still in control.

Bear Case

When gold sneezes, miners catch a cold: The most significant risk here is simple: Kinross is tightly tethered to the gold price.

If bullion pulls back because the Fed delays rate cuts, the dollar strengthens, or risk appetite rushes back into equities, margins could compress just as quickly as they expanded.

Add in the usual mining wild cards like cost inflation or operational hiccups, and the story can wobble fast.

Mining in a crowded field: Kinross operates in a space filled with heavyweight rivals, and that competition shapes investor expectations.

Names like Barrick Gold, Newmont, and Agnico Eagle often steal the spotlight thanks to their scale and deeper project pipelines.

These larger players can attract capital more easily during gold rallies, sometimes leaving mid-tier operators like Kinross fighting for attention.

At the same time, strong performance from peers raises the bar.

If the industry delivers big exploration wins or cost breakthroughs and Kinross lags, the market is quick to notice.

It’s a healthy ecosystem, but one where standing out requires consistently tight execution.

The gold tide isn’t always smooth: Even with momentum behind it, Kinross isn’t immune to the broader forces that push the whole sector around.

A more stubborn inflation backdrop or a suddenly hawkish Federal Reserve could lift real yields and firm up the dollar, both of which tend to clip gold’s wings.

If that happens, the entire mining space can lose altitude in a hurry.

There’s also the global growth picture. If economies stabilize and risk appetite shifts back to equities, safe-haven demand for gold can soften faster than miners can adjust.

And while energy prices have cooled, a fresh spike in fuel or materials costs would squeeze margins across the sector.

It’s a supportive environment today, but miners always live at the mercy of macro mood swings.

Crowding around a shiny object: With gold rallying and sentiment warming fast, there's a risk that too many investors pile into miners at once.

If positioning becomes heavy, even a slight wobble in bullion or a softer-than-expected earnings print could spark a sharper pullback as fast-money traders rush for the exit.

Quick Checklist

✅ Thesis still valid after today’s close

✅ Volume confirms move above key levels

✅ Catalyst date double-checked (December 03, 2025)

Deep‑Dive Links

That’s all for today’s Everyday Alpha. We’ll have a new pick for you every morning before the market opens, so stay tuned!

Best Regards,

—Noah Zelvis

Everyday Alpha