- Everyday Alpha

- Posts

- Gold Momentum Powers Breakout as Safe-Haven Demand Surges

Gold Momentum Powers Breakout as Safe-Haven Demand Surges

Hello and welcome to Everyday Alpha, the daily newsletter showcasing a different stock opportunity every day the market is open. We give you laser-focused content to save you time and energy so you can make educated investment decisions quickly.

Never Miss a Stock Alert Again!

We now send our daily picks via text too — so you’ll get the same high-conviction ideas, even if you miss the email.

Newmont Corporation

July 28 – Pre‑market

Ticker: NEM | Sector: Gold / Basic Materials | Market Cap: ~ $72.6B

30‑Second Take

Why now? With a 75.28% gain in the year to date, it would be hard not to take a closer look at Newmont.

With gold prices reaching an all-time high of $3,500.05/oz in April, the gold miner has been one of the first companies in line to benefit.

In its second-quarter results, reported just a few days ago on July 24, it reported a record quarterly free cash flow of $1.7 billion and topped expectations in nearly every part of its balance sheet.

Earnings per share clocked in at $1.85 for example, compared with 73 cents for the same period last year. Revenue growth, meanwhile, came in at 20.8% year-over-year.

2025 Hotlist (Sponsored)

With 2025 entering its final stretch, the smart money is rotating fast — and you need to know where it’s going.

This free guide breaks down 7 stocks primed to perform now through the end of the year.

What’s inside:

✅ Fast-growing sectors entering breakout phases

✅ Simplified research for smarter decisions

✅ Picks backed by real market trends — not guesses

Don’t let Q3 and Q4 pass you by while others grab the gains.

Trade Setup

Time frame: Swing to medium-term

Edge type: Momentum breakout

Snapshot Table

Metric | Value | Current Stance |

|---|---|---|

Price | $65.75 | Below average |

52‑week range | $36.86 - $66.57 | Below average |

Short interest | 1.84% | Average |

Next catalyst | Q3 results, expected October 22 |

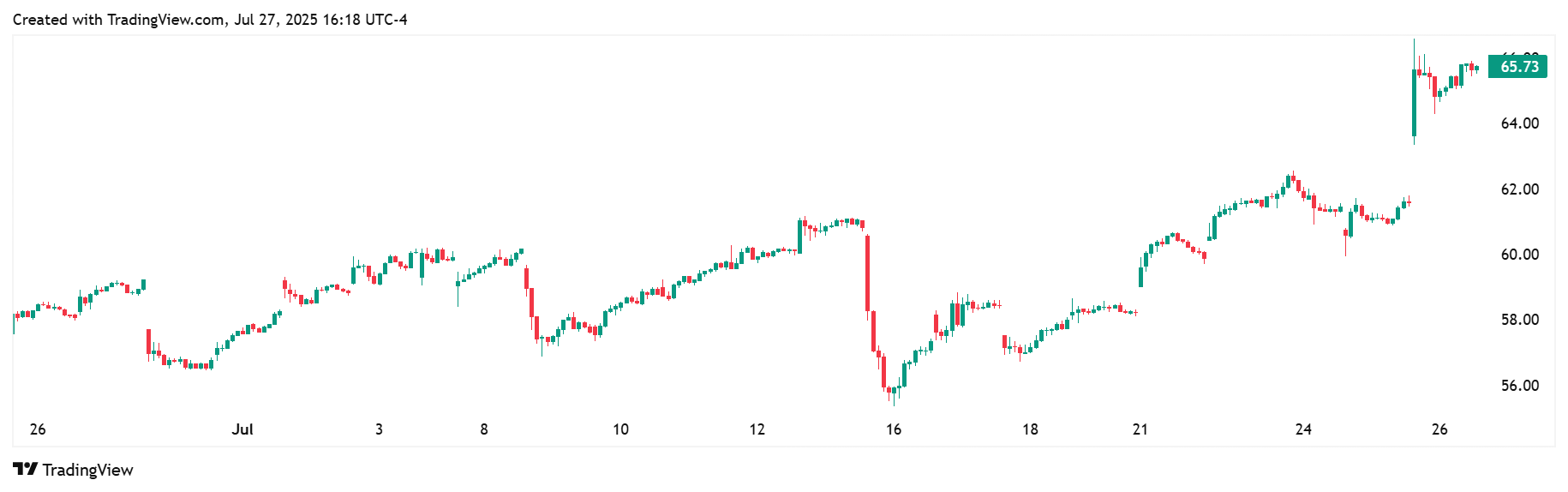

Chart

1-Month Synopsis: NEM stock has traded positively over the last month, with a 12.66% gain. Volatility has been low, and progress has been robust, with prices trading at the top end of the 52-week range.

This upward momentum was fuelled by robust Q2 2025 earnings and a sharp rise in gold prices, which averaged $3,320/oz during the quarter.

An accelerated share buyback program, including a fresh $3 billion authorisation, has reinforced investor confidence.

Technically, the stock broke out from a cup-with-handle pattern earlier in July and is now trading above 10-, 20-, 30-, 50-, 100-, and 200-day moving averages.

While current levels may be extended for new buyers, institutional sentiment remains largely positive, and the outlook for Newmont remains strong if gold prices continue to hold.

Investors may watch for a pullback to moving averages for a more favourable entry point.

Bull Case

Core thesis: Newmont Corporation (NYSE: NEM) is the world's largest gold mining company, with operations spanning North and South America, Australia, and Africa.

Founded in 1921 and headquartered in Denver, Colorado, Newmont engages in the exploration, extraction, and processing of gold, as well as significant holdings in copper, silver, lead, and zinc.

The company is recognized for its disciplined capital allocation, sustainability initiatives, and consistent shareholder returns, achieved through dividend payments and share repurchases.

With a diverse portfolio of high-quality assets and a strong commitment to operational efficiency and environmental stewardship, Newmont plays a central role in the global precious metals and mining industry.

Catalysts: As a miner, NEM's performance is closely tied to the price of gold.

The precious metal’s price is significantly up year-over-year and continues to benefit from concerns about inflation, geopolitical instability, and potential rate cuts.

Each of these considerations could sustain high gold prices and positively impact NEM’s growth trajectory.

A strong operational performance, aggressive capital returns, attractive dividend yields, and strong institutional and analyst support are also buoying stock prices.

Valuation upside: Analyst price targets run from a low of $58.00 to a high of $85.00. The average price target is $68.65.

Technical tailwind: Any signs of global economic stress (e.g., recessionary fears, geopolitical flare-ups) may drive further safe haven flows into gold and gold miners like NEM.

Market Play (Sponsored)

The escalating U.S.-China trade tensions are reshaping the AI landscape.

Companies like Nvidia are facing significant revenue hits with the U.S. imposing new export restrictions on advanced AI chips to China.

This shift opens doors for U.S.-based AI companies poised to fill the gap. I’ve identified 9 under-the-radar AI stocks with:

Deep AI integration across their core operations

Strong U.S. manufacturing capabilities

Infrastructure ready to capitalize on policy shifts

Access our FREE report, "Top 9 AI Stocks for This Month" to discover these opportunities before the broader market catches on.

Bear Case

Key risk: The bear case for Newmont Corporation (NEM) centers on a few critical key risks that could pressure the stock despite its recent momentum.

Most obviously, Newmont’s earnings are highly leveraged to the gold price.

A pullback in gold due to rising real interest rates, reduced inflation fears, or U.S. dollar strength would compress margins and cash flow.

As gold falls, NEM’s valuation (which is currently supported by high bullion prices) could quickly contract.

Cost inflation (labor, fuel, energy) or underperformance at key mines could erode profitability.

Gold mining is reliant on a harmonious convergence of human, political and environmental factors.

Adverse weather, geopolitical instability, or permitting issues, especially in key regions such as Latin America or Africa, may impact production and guidance.

Macro/sector headwinds: A stronger dollar typically puts downward pressure on gold, making it more expensive for holders of other currencies.

Since Newmont reports in USD, currency shifts can impact the value of foreign operations and sales.

Inflation rates are also a factor. While they remain stubborn in the USA and across Europe, there is a danger that they could cool more rapidly than expected.

This would mean the demand for gold as an inflation hedge could weaken. Reduced inflationary pressures may then diminish gold’s appeal as a safe haven.

Competitive threat: The biggest competitive threat to Newmont Corporation (NEM) comes from Barrick Gold Corporation, its closest rival and one of the world’s largest gold producers.

Barrick competes aggressively on scale, production efficiency, and geographic diversification, with major operations in North America, Africa, and the Middle East.

Their ability to optimize costs, pursue strategic acquisitions, and maintain strong balance sheets challenges Newmont’s market share and investor appeal.

Crowded-trade concern: A confluence of bullish macro themes, including surging gold prices, inflation fears, geopolitical tensions, and expectations of Federal Reserve rate cuts, has created a (quite literal) gold rush.

This could be problematic if positioning becomes too one-sided, as any relatively minor negative trigger (e.g., stronger-than-expected job data, a Fed hawkish pivot, or a gold price dip) could prompt a sharp unwind as traders exit en masse.

Quick Checklist

✅ Thesis still valid after today’s close

✅ Volume confirms move above key levels

✅ Catalyst date double-checked (July 27, 2025)

Deep‑Dive Links

That’s all for today’s Everyday Alpha. We’ll have a new pick for you every morning before the market opens, so stay tuned!

Best Regards,

—Noah Zelvis

Everyday Alpha