- Everyday Alpha

- Posts

- From Remittance to Revolution: The Underrated Fintech Stock Transforming A $700B Industry

From Remittance to Revolution: The Underrated Fintech Stock Transforming A $700B Industry

Hello and welcome to Everyday Alpha, the daily newsletter showcasing a different stock opportunity every day the market is open. We give you laser-focused content to save you time and energy so you can make educated investment decisions quickly.

Never Miss a Stock Alert Again!

We now send our daily picks via text too — so you’ll get the same high-conviction ideas, even if you miss the email.

Remitly Global, Inc

July 23 – Pre‑market

Ticker: RELY | Sector: Software – Infrastructure / Technology | Market Cap: ~ $73.48B

30‑Second Take

Why now? Analyst price targets indicate an upside north of 70% for this digital payment stock.

In Q1, the company, which counts Amazon founder Jeff Bezos as an early investor, confidently beat earnings expectations with a 34.4% year-on-year revenue increase.

Despite the strong performance, stock prices are down 24.01% year-to-date.

This decline has been fueled by speculation that stablecoins could replace wire transfers, while rumors also persist that taxes may be levied on remittance payments.

In our opinion, those fears are smoke and mirrors – according to figures from The World Bank, remittances to low- to middle-income countries, such as India, Mexico, and the Philippines, increased by 5.8% in 2024.

Digital currencies are unlikely to be a mainstream alternative for traditional remittances in those markets for years to come due to infrastructure and conversion challenges.

A review of the company fundamentals makes it clear that Remitly is a disruptor that individual senders and business users trust.

It’s growing fast, has a strong value proposition, and is already outperforming more established rivals in a thriving market.

Send volumes are up, revenue is up, user numbers are up, and its geographical footprint spans than 170 countries.

If you’re a high-risk, high-reward investor, this decline is a compelling opportunity to add a high-potential growth stock to your portfolio.

Sector Incentive Stocks (Sponsored)

The second quarter has brought a wave of volatility, but also rare opportunity.

A just-released investor guide reveals seven stocks positioned to lead, based on deep research and market momentum.

These companies have one thing in common: big upside with limited crowd exposure.

From energy to biotech, this report uncovers where the smart money is flowing.

Claim the full list now before institutional buyers drive up prices.

[Get Your Free Guide Now]

Trade Setup

Time frame: Swing to medium-term

Edge type: Momentum breakout

Snapshot Table

Metric | Value | Current Stance |

|---|---|---|

Price | $17.24 | Average |

52‑week range | $12.43 - $27.32 | Average |

Short interest | 8.54% | Above average |

Next catalyst | Q2 earnings, due August 6, 2025 |

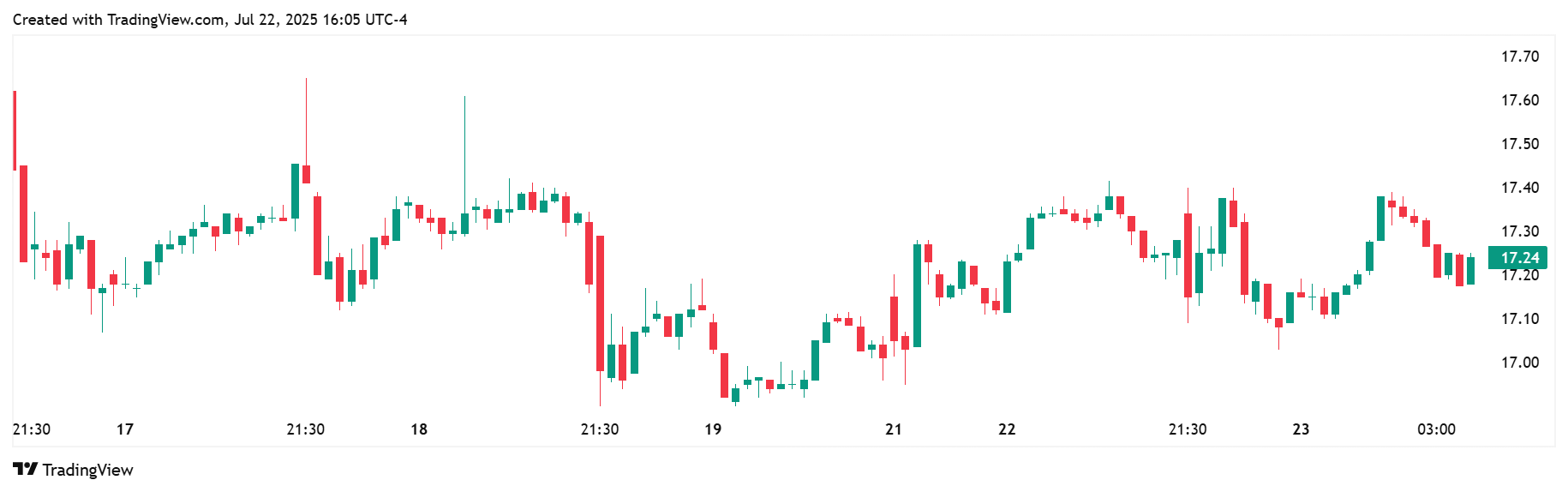

Chart

5-Day Synopsis: The last five trading sessions have been mainly uneventful with no major policy changes to disrupt the status quo.

With Q2 earnings due in just under two weeks, this period of calm is no real surprise.

Digging deeper into each day, we can see that RELY showed initial stability and a mild upside at the onset of the five sessions before succumbing to modest selling pressure and losing almost 2% from its mid-week peak.

If you're watching for a rebound, two key areas to keep an eye out for are a break back above the mid-week range (~$17.45–$17.50) or a consolidation at current levels with supportive volume.

Bull Case

Core thesis: A mission-driven fintech, Remitly is on course to transform the global remittance industry by providing fast, affordable, and reliable money transfers for immigrants and their families.

This may be an unfamiliar name, but don’t be fooled. This is no young upstart. The company was founded in 2011 by CEO Matt Oppenheimer.

With first-hand experience of sending money across borders after living in India for a period, he launched Remitly.

Unlike traditional providers burdened by high fees and legacy infrastructure, Remitly delivers a digital-first, mobile-centric experience that meets the needs of underserved populations in emerging markets.

With a presence in over 170 countries, the company is capitalising on rising global migration, smartphone adoption, and demand for financial inclusion.

Its asset-light model and focus on customer trust have led to consistent revenue growth and improving margins, with clear pathways to profitability.

As remittance volumes surpass $700 billion globally, Remitly’s scalable platform and expanding product offerings, which now include banking services for migrants and services for business customers, position it as a long-term winner in a growing market.

Catalysts: Despite recent stock losses, Remitly’s progress has been overwhelmingly positive in 2025.

Under the leadership of CEO Matt Oppenheimer, the company has successfully combined social impact with revenue growth, exceeding expectations by a comfortable margin in Q1.

A 41% increase in send volumes was accompanied by a 29% rise in active customers and a 157% improvement in adjusted EBITDA.

It has lifted its net revenue outlook for the year and continued to boost customer trust levels.

The mood is optimistic, and when you factor in recent product innovations and new service launches, further progress could be made to grow active customers, increase volumes, and drive revenue much sooner than observers may expect.

Valuation upside: Analyst price targets currently range from a low of $25.00 to a high of $32.00.

Technical tailwind: RELY is stuck in a holding pattern ahead of its upcoming Q2 earnings reveal.

The current price is below the Short MA and the Long MA, but if Q2 results build on the progress of Q1’s earnings as expected, this could quickly change.

Policy Shift (Sponsored)

While headlines focus on the same overhyped AI names, a bigger opportunity is taking shape — and it’s flying under the radar.

A new report reveals 9 AI companies with real U.S. operations, accelerating revenue, and deep AI integration. These aren’t speculative plays — they’re positioned to benefit from a massive shift in how and where AI is being built.

This free guide includes:

A chip supplier poised to fuel U.S. AI manufacturing

A cloud provider set to expand under new policy changes

A data firm with potential government contracts on deck

The early window on these opportunities may be closing — now’s the time to see what’s coming next.

Bear Case

Key risk: A significant portion of Remitly’s transactions is concentrated in a few key corridors (for example, from the U.S. to Mexico, the Philippines, and India).

If regulation or competition intensifies in those routes, transaction volume and margins could be disproportionately affected, posing a clear barrier to growth.

Macro/sector headwinds: As a cross-border money transfer service, Remitly must comply with various anti-money-laundering (AML), Know Your Customer (KYC), and data privacy laws, some of which may change rapidly across multiple jurisdictions.

Any misstep or shift in regulatory tone (especially in the U.S. or EU) could result in fines, restrictions, or reduced service flexibility.

Competitive threat: Remitly’s users are highly sensitive to even minor pricing differences.

This creates a very narrow range of movement, even as others in the space aggressively undercut on fees.

If Remitly is forced to lower fees to retain users in the face of intense price pressure from the likes of WorldRemit, PayPal and Revolut, gross margins may shrink, with customer acquisition costs remaining disproportionately high.

Crowded-trade concern: Remitly is often lumped in with "mission-driven" fintechs like SoFi, Affirm, and Block, which are popular with growth-focused retail investors.

This creates exposure to sentiment swings as we are seeing right now, where perception outweighs pure fundamentals.

Quick Checklist

✅ Thesis still valid after today’s close

✅ Volume confirms move above key levels

✅ Catalyst date double-checked (July 22, 2025)

Deep‑Dive Links

That’s all for today’s Everyday Alpha. We’ll have a new pick for you every morning before the market opens, so stay tuned!

Best Regards,

—Noah Zelvis

Everyday Alpha