- Everyday Alpha

- Posts

- From Rehab to Returns: The Hidden Healthcare Stock Powering a $60B Industry Surge

From Rehab to Returns: The Hidden Healthcare Stock Powering a $60B Industry Surge

Hello and welcome to Everyday Alpha, the daily newsletter showcasing a different stock opportunity every day the market is open. We give you laser-focused content to save you time and energy so you can make educated investment decisions quickly.

Never Miss a Stock Alert Again!

We now send our daily picks via text too — so you’ll get the same high-conviction ideas, even if you miss the email.

Encompass Health Corporation

July 24 – Pre‑market

Ticker: EHC | Sector: Medical Care Facilities | Market Cap: ~ $10.9B

30‑Second Take

Why now? EHC is emerging as a compelling long-term growth stock with 22% upside potential, making its recent bounce all the more irresistible to bargain hunters.

The company has strong fundamentals, with an impressive 34.8% growth in diluted EPS in Q1.

Since releasing its Q1 earnings, Encompass Health has confirmed plans to expand its footprint with additional facilities and bed space, further cementing its scope for delivering specialized post-acute healthcare services in the USA.

Quite Strength (Sponsored)

As we dive into 2025, the stock market is buzzing with opportunities, and I’ve got the insider scoop just for you.

I’ve handpicked the Top Seven Stocks for this quarter, offering you a clear roadmap for growth as the year progresses.

Here’s what makes this guide indispensable:

High-Growth Sectors: Key industries poised to boom this summer.

In-Depth Analysis: Simplified insights to make wise investment decisions.

Expert Picks: Data-driven, not just guesses, for reliable potential.

Profit-Boosting Opportunities: Position your portfolio for a strong finish in 2025.

This isn’t merely a list; it’s your chance to seize the market’s hottest opportunities before they pass you by.

Trade Setup

Time frame: Swing to medium-term

Edge type: Momentum breakout

Snapshot Table

Metric | Value | Current Stance |

|---|---|---|

Price | $108.77 | Below average |

52‑week range | $82.74 - $123.13 | Average |

Short interest | 1.19% | Below average |

Next catalyst | Q2 earnings, due August 4, 2025 |

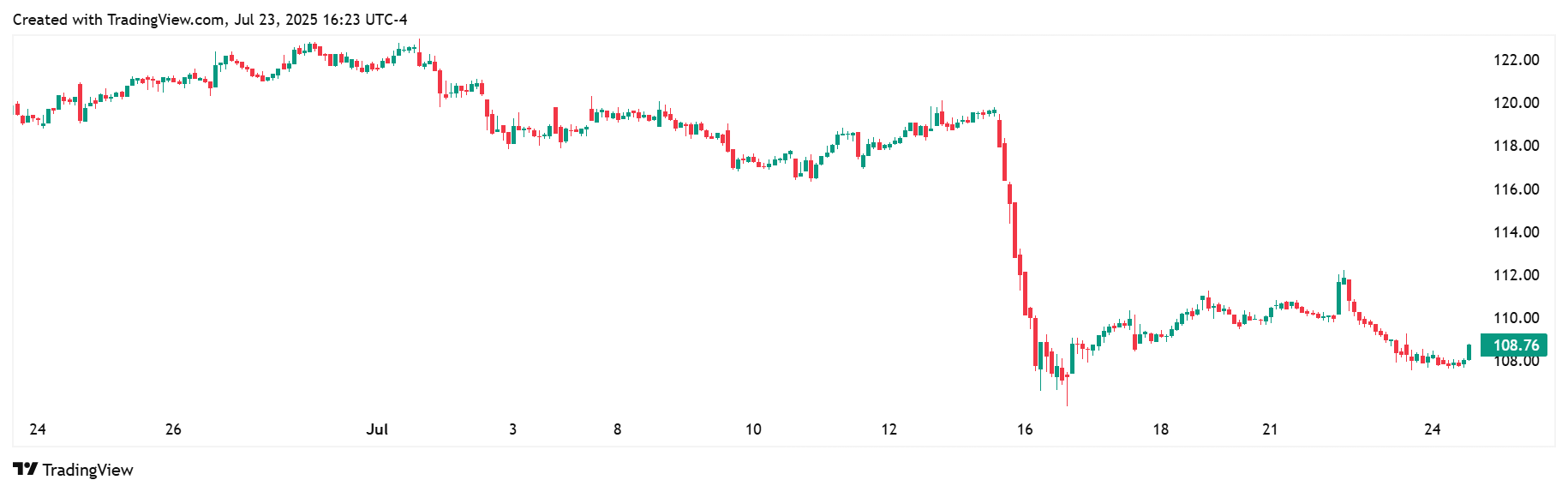

Chart

1-Month Synopsis: EHC stock has dipped by ~10.83% over the last month.

Its highest close in those trading sessions came at $123.00, recorded on July 1, with a low of $105.70 on July 16, retracing earlier mid-June to early-July gains.

Before this retracement, EHC stock had performed strongly, with an early June rally of ~13%. Some of the recent volatility can therefore be attributed to profit-taking.

Looking at the broader sector, healthcare stocks have struggled during this period and are trading at three-year lows.

This overall sector drop has its roots in uncertainty over U.S. drug pricing policy, changes to favored nation rules, and the potential impact of trade tariffs.

Bull Case

Core thesis: As one of the largest operators of inpatient rehabilitation hospitals in the USA and Puerto Rico, EHC benefits from strong referral networks, favourable Medicare reimbursement dynamics, and growing demand for specialised rehabilitative services.

The company’s disciplined expansion strategy—often via joint ventures—supports margin stability and geographic diversification.

In its most recent investor presentation (in June 2025), management revealed growth targets of 6 to 10 new facility openings per year, with the addition of 80 – 120 new bed spaces and an increase in discharge CAGR from 6% to 8%.

Despite recent reputational setbacks and sector-wide labour cost pressures, the company maintains a solid balance sheet and operational resilience.

Management’s consistent focus on clinical outcomes, efficiency, and capital returns adds to investor confidence.

While short-term volatility may persist due to regulatory risks and heightened media scrutiny, EHC’s position as a market leader in a non-cyclical healthcare segment offers durable growth potential.

For long-term investors seeking defensive exposure with upside from demographic trends, EHC remains a differentiated and fundamentally attractive opportunity in the healthcare services space.

Catalysts: Encompass has a consistent growth strategy, which allows it to increase its footprint within its target markets.

Just three days after opening a rehabilitation hospital in Daytona Beach, EHC confirmed plans to build a new 40-bed inpatient rehabilitation facility in Cleveland, Tennessee, on July 18.

In May, it announced preliminary plans for a new hospital in Florida and opened a rehab facility in Fort Myers.

Despite these expansions, the balance sheet shows healthy cash flow and prudent financial management.

Valuation upside: The high price target for EHC is $140, with a low of $125.

Technical tailwind: Encompass Health presents a compelling long-term investment case, driven by structural tailwinds in post-acute care and the aging U.S. population.

AI Surge (Sponsored)

The escalating U.S.-China trade tensions are reshaping the AI landscape.

Companies like Nvidia are facing significant revenue hits with the U.S. imposing new export restrictions on advanced AI chips to China.

This shift opens doors for U.S.-based AI companies poised to fill the gap.

I’ve identified 9 under-the-radar AI stocks with:

Deep AI integration across their core operations

Strong U.S. manufacturing capabilities

Infrastructure ready to capitalize on policy shifts

Access our FREE report, "Top 9 AI Stocks for This Month" to discover these opportunities before the broader market catches on.

Bear Case

Key risk: There’s no such thing as bad press, or so the saying goes. That’s not quite the case for the healthcare sector, where any hint of patient safety concerns can cast a long shadow.

This is a key risk for EHC, which is currently facing some negative sentiment due to media reports.

A recent New York Times article reported several incidents concerning incidents at Encompass Health-operated rehab centers with issues including carbon-monoxide poisoning, medication mistakes, and bed-alarm failures.

Macro/sector headwinds: The healthcare sector has struggled to find solid ground due to ongoing cost pressures and pricing policy uncertainty.

Competitive threat: Select Medical Holding poses the primary direct threat to Encompass, given its aggressive growth strategy and significant overlap in core competencies.

Select Medical has one of the largest networks of post-acute care hospitals and outpatient clinics in the U.S., directly challenging EHC’s hospital footprint and referral base.

The similarity of services means Encompass must be at the top of its game with a continual cadence of new partnerships and facilities, high patient discharge percentages, and elevated cost competitiveness.

Negative press, such as the recent patient safety concerns, could be the single metric that tips the scales in favor of Select Medical when pitching for new business.

Crowded-trade concern: The recent NY Times exposé on patient safety at EHC facilities opened the door to regulatory investigations, reputation damage, and even class-action lawsuits - all of which could hit the immediate growth trajectory.

Further developments could easily spook investors, leading to a broader sell-off.

Quick Checklist

✅ Thesis still valid after today’s close

✅ Volume confirms move above key levels

✅ Catalyst date double-checked (July 23, 2025)

Deep‑Dive Links

That’s all for today’s Everyday Alpha. We’ll have a new pick for you every morning before the market opens, so stay tuned!

Best Regards,

—Noah Zelvis

Everyday Alpha