- Everyday Alpha

- Posts

- From Rare Disease to Breakthrough? This Under-the-Radar Biotech Could Be Pharma’s Next Big Winner

From Rare Disease to Breakthrough? This Under-the-Radar Biotech Could Be Pharma’s Next Big Winner

Hello and welcome to Everyday Alpha, the daily newsletter showcasing a different stock opportunity every day the market is open. We give you laser-focused content to save you time and energy so you can make educated investment decisions quickly.

Never Miss a Stock Alert Again!

We now send our daily picks via text too — so you’ll get the same high-conviction ideas, even if you miss the email.

Mirum Pharmaceuticals, Inc.

July 17 – Pre‑market

Ticker: MIRM | Sector: Biotechnology | Market Cap: ~ $2.6B

30‑Second Take

Why now? This California-headquartered biotech is hot property right now thanks to a compelling combination of rapid revenue growth.

It’s up 60% YoY, driven by strong uptake of its rare liver disease drug, LIVMARLI.

The company has also raised its full-year guidance, is pursuing several international expansion projects, and has multiple late-stage pipeline assets that could unlock new markets in the not-too-distant future.

With bullish analyst sentiment, a strong chart setup, and momentum from recent upgrades, MIRM offers high upside potential. Investors bullish on biotech should keep it firmly on their radar.

Steady Performers (Sponsored)

Every strong portfolio starts with a reliable core — and this new report may help investors build exactly that.

“7 Stocks to Buy and Hold Forever” highlights a group of companies with a track record of steady performance, strong fundamentals, and long-term growth potential.

These stocks were chosen for a reason — and could help lay the groundwork for a strategy built to outlast short-term swings.

Trade Setup

Time frame: Swing to medium-term

Edge type: Momentum breakout

Snapshot Table

Metric | Value | Current Stance |

|---|---|---|

Price | $52.77 | Average |

52‑week range | $36.20 - $54.78 | Average |

Short interest | 15.35% | Average |

Next catalyst | Q2 earnings, expected August 06 |

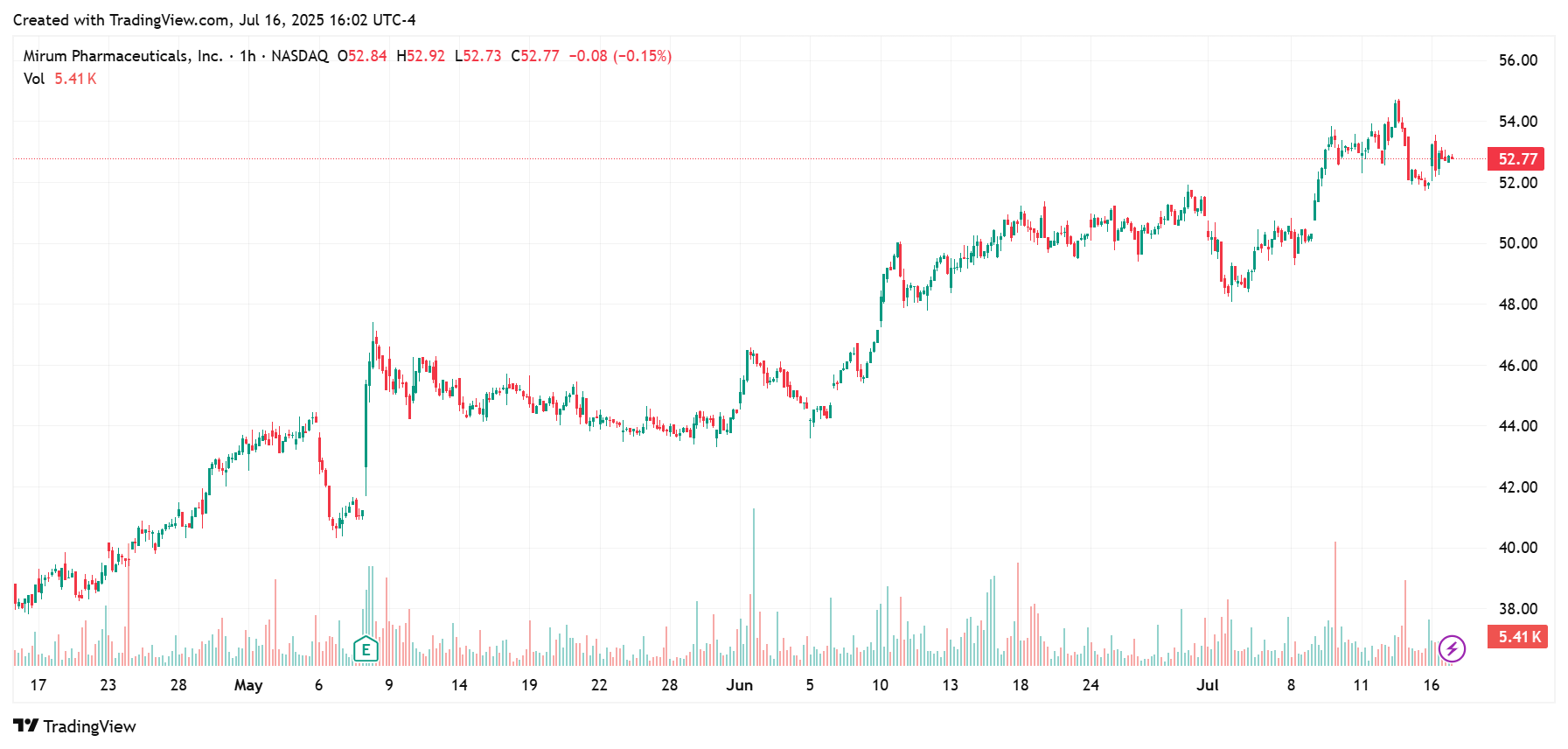

Chart

5-Day Synopsis: After the surge in momentum triggered by FDA approval in Q1, trading has levelled off with prices hovering around the top end of the 52-week range.

The last five sessions have been stable, with no significant gains or losses recorded at the end of any session.

MIRM has accrued a collective loss of 0.94% over the five days, with prices ranging from $51.98 to $54.62.

Bull Case

Core thesis: Founded in California in 2014, Mirum Pharmaceutical is a clinical biopharmaceutical company dedicated to developing safe and effective therapies for people with rare liver diseases.

It specializes in developing medications that address urgent, unmet needs and fill therapeutic voids.

Its current areas of focus are Cholestasis, Inborn Errors of Bile Acid Metabolism, and Cholesterol Metabolism.

It has developed three FDA-approved medicines: LIVMARLI, Cholbam and CTEXLI™. It maintains clinical trial sites in the United States, Europe, and Australia.

Catalysts: In Q1, Mirum secured FDA approval for an oral tablet formulation of LIVMARLI, which treats liver itch – a condition responsible for up to 82% of liver transplants.

Approval skyrocketed the pharma stock to a 236% year-to-date gain, with further gains expected upon commercial rollout.

Its sales also grew by 61% compared with the prior quarter, to $111.6 million.

Full-year guidance has also been lifted from $435 million to $450 million, reflecting growing sales expectations.

Valuation upside: Analyst price targets span a wide range, with the lowest just $53.00.

The high price target is $79.00, and the average price target is $68.60. MIRM is currently trading a few cents above the low-end target.

Technical tailwind: MIRM is showing technical strength and high levels of institutional demand.

It’s trading above the 20-, 30-, 50- and 100-day moving averages, with an RSI of 63.53.

This indicates that bullish momentum could be building ahead of next month’s Q2 earnings report.

AI Stocks (Sponsored)

While headlines focus on the same overhyped AI names, a bigger opportunity is taking shape — and it’s flying under the radar.

A new report reveals 9 AI companies with real U.S. operations, accelerating revenue, and deep AI integration. These aren’t speculative plays — they’re positioned to benefit from a massive shift in how and where AI is being built.

This free guide includes:

A chip supplier poised to fuel U.S. AI manufacturing

A cloud provider set to expand under new policy changes

A data firm with potential government contracts on deck

The early window on these opportunities may be closing — now’s the time to see what’s coming next.

Bear Case

Key risk: The primary risk for Mirum Pharmaceuticals (MIRM) stock stems from its heavy reliance on a narrow product portfolio, particularly its flagship drug, LIVMARLI.

It currently accounts for a significant majority of current revenues.

If uptake slows, competitors enter the space, or reimbursement issues arise, earnings could be sharply impacted.

Likewise, any negative safety, efficacy, or commercial news related to LIVMARLI would disproportionately hurt Mirum’s valuation.

Macro/sector headwinds: Biotech stocks are highly sensitive to clinical trial results. A failed or delayed trial would likely result in sharp losses.

Several pipeline programs are in mid-to-late-stage development. Mirum’s future growth is tied to positive trial results and FDA approvals from those programs.

Competitive threat: Mirum’s biggest direct competitor is Ipsen.

Its BYLVAY medication is approved for the treatment of liver itching in patients with Progressive Familial Intrahepatic Cholestasis (PFIC).

It has also gained approval for Alagille syndrome (ALGS) in the U.S. and EU, directly threatening LIVMARLI’s market share.

Ipsen has a more extensive global commercial infrastructure, enabling faster international rollout and deeper payer access.

Head-to-head comparisons could influence physician preference depending on safety, efficacy, and formulation differences.

Crowded-trade concern: International expansion and transitioning to new formulations (like tablet forms) present operational and regulatory hurdles.

Underperformance in any major market could undermine bullish revenue targets and result in substantial losses.

Quick Checklist

✅ Thesis still valid after today’s close

✅ Volume confirms move above key levels

✅ Catalyst date double-checked (July 16, 2025)

Deep‑Dive Links

That’s all for today’s Everyday Alpha. We’ll have a new pick for you every morning before the market opens, so stay tuned!

Best Regards,

—Noah Zelvis

Everyday Alpha