- Everyday Alpha

- Posts

- From Gaming to Growth: This Metaverse Giant Could Be the Next Big Win

From Gaming to Growth: This Metaverse Giant Could Be the Next Big Win

Hello and welcome to Everyday Alpha, the daily newsletter showcasing a different stock opportunity every day the market is open. We give you laser-focused content to save you time and energy so you can make educated investment decisions quickly.

Never Miss a Stock Alert Again!

We now send our daily picks via text too — so you’ll get the same high-conviction ideas, even if you miss the email.

Roblox Corporation

July 18 – Pre‑market

Ticker: RBLX | Sector: Electronic Gaming and Multimedia | Market Cap: ~ $80.73B

30‑Second Take

Why now? Thought you’d missed the boat for Robolox stock? It could be time to rethink that stance, especially if you’re an investor with an eye to the long term.

This gaming stock has been one of the runaway success stories of 2025.

Despite climbing 105.70% in the year-to-date, analysts are convinced that it has much more room to grow.

Its upward trajectory shows no signs of stopping amid a series of innovations, including new safety measures, a new licensing platform which is already attracting major streamers, and rapid user growth outside of its core market.

Fresh Insights (Sponsored)

As we dive into Q2 2025, the stock market is buzzing with opportunities, and I’ve got the insider scoop just for you.

I’ve handpicked the Top Seven Stocks for this quarter, offering you a clear roadmap for growth as the year progresses.

Here’s what makes this guide indispensable:

High-Growth Sectors: Key industries poised to boom this summer.

In-Depth Analysis: Simplified insights to make wise investment decisions.

Expert Picks: Data-driven, not just guesses, for reliable potential.

Profit-Boosting Opportunities: Position your portfolio for a strong finish in 2025.

This isn’t merely a list; it’s your chance to seize the market’s hottest opportunities before they pass you by.

Trade Setup

Time frame: Swing to long-term

Edge type: Momentum breakout

Snapshot Table

Metric | Value | Current Stance |

|---|---|---|

Price | $122.17 | Below average |

52‑week range | $35.30 - $120.16 | Average |

Short interest | 4.07% | Above average |

Next catalyst | Q2 earnings, expected July 31 |

Chart

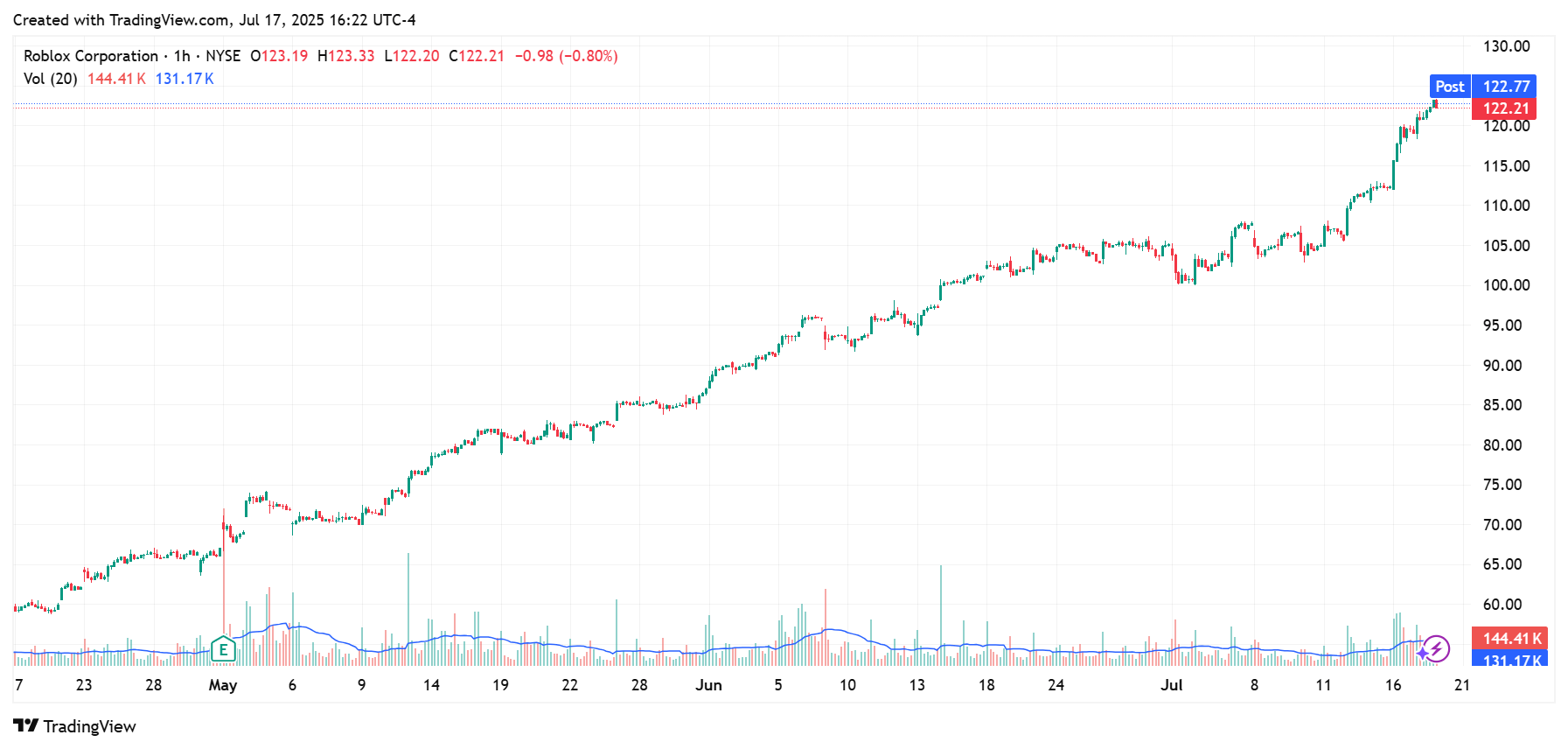

5-Day Synopsis: RBLX has gained 11.57% in the last five trading sessions, taking the stock price to the edge of its 52-week high of $121.49.

Trading received a double boost on Wednesday with the launch of a new licensing platform to unlock game and interactive media licensing at scale, as well as a new price target from JP Morgan.

Analysts there revised their expectations upwards from $120 to $125, simultaneously pushing stock prices in the same direction.

A prior update from Citigroup, which revised its expectations from a high of $120 to a high of $123, also helped to give prices a boost earlier in the week.

Bull Case

Core thesis: Roblox is an immersive gaming and creation platform that provides millions of users with a safe space to play, create, and connect through games and experiences.

The platform hosts user-generated content and virtual worlds. Users can create their own games and publish them on the platform using Roblox’s tools.

Players worldwide can discover those user-created games and play them alone or with friends via Roblox.

In-app purchases enable users to add equipment or change their avatar’s outfit, with revenue generated from game and experience monetization shared with creators.

Catalysts: Roblox’s first-quarter earnings included a 29% year-over-year revenue growth and a 26% increase in daily active users.

Other fundamentals, such as average monthly unique payers, bookings, and time spent on the platform, also grew by double digits.

Coupled with a fast pace of innovation, partnerships, and expansion projects, Roblox is yet to falter this year.

While stock prices have jumped 88.84% over the last six months, the pace of new user acquisition and monetization strategies suggest further growth.

What’s more, interest and investment in the metaverse are expected to continue expanding, with a projected metaverse market value of $507.8bn by 2030.

Valuation upside: Analyst price targets for RBLX range from a low of $38 to a high of $125. The average price target is $82.81.

Technical tailwind: Technical indicators confirm that RBLX is in the midst of a well-established bull cycle.

Current prices are comfortably ahead of the 20-, 50-, 100-, and 200-day EMAs and SMAs.

Next AI Boom (Sponsored)

While headlines focus on the same overhyped AI names, a bigger opportunity is taking shape — and it’s flying under the radar.

A new report reveals 9 AI companies with real U.S. operations, accelerating revenue, and deep AI integration. These aren’t speculative plays — they’re positioned to benefit from a massive shift in how and where AI is being built.

This free guide includes:

A chip supplier poised to fuel U.S. AI manufacturing

A cloud provider set to expand under new policy changes

A data firm with potential government contracts on deck

The early window on these opportunities may be closing — now’s the time to see what’s coming next.

Bear Case

Key risk: Despite its long-term metaverse ambitions and strong technical signals, Roblox isn’t without risk.

Significant net losses persist despite high revenue growth, in part due to necessary investment in research and development programs.

The path to profitability could be more challenging than usual due to the platform’s revenue-sharing model with creators.

Macro/sector headwinds: As a platform primarily used by children and teens, Roblox is subject to strict regulatory oversight and must be vigilant about content moderation to avoid lawsuits, sanctions, or worse.

Because it relies heavily on those users making in-app purchases to generate revenue, any economic downturn in its core markets worldwide could lead parents to curb this type of discretionary spending.

Competitive threat: Roblox faces competition from other game platforms such as Epic Games and Minecraft.

Each platform is targeting the same youthful user base.

Rivals who provide superior graphics or create a buzz with unique creator tools could surpass Roblox’s appeal within the older teen to young adult market.

Crowded-trade concern: RBLX has become a popular play among growth-focused hedge funds and retail investors.

Any bad press, poor earnings reports, or economic challenges could unwind interest, creating enormous selling pressure and a highly volatile environment for the stock.

Quick Checklist

✅ Thesis still valid after today’s close

✅ Volume confirms move above key levels

✅ Catalyst date double-checked (July 17, 2025)

Deep‑Dive Links

That’s all for today’s Everyday Alpha. We’ll have a new pick for you every morning before the market opens, so stay tuned!

Best Regards,

—Noah Zelvis

Everyday Alpha