- Everyday Alpha

- Posts

- From Bitcoin to AI: The High-Stakes Bet Shaking Up Two Explosive Industries

From Bitcoin to AI: The High-Stakes Bet Shaking Up Two Explosive Industries

This leading Bitcoin miner is making waves with a game-changing move into AI infrastructure, and it's just secured a multibillion-dollar, 10-year deal backed by one of the world’s biggest tech names.

Never Miss a Stock Alert Again!

We now send our daily picks via text too — so you’ll get the same high-conviction ideas, even if you miss the email.

TeraWulf, Inc.

August 15 – Pre‑market

Ticker: WULF | Sector: Financial Services | Market Cap: ~ $3.07B

30‑Second Take

Why now? A strong Q2 earnings report and a 10-year, multi-billion-dollar deal with Fluidstack, backed by a $1.8 billion lease guarantee from Google, have assured WULF of MVP status this month.

The earnings release confirmed a transformation has taken place, with the Q2 data beating analyst expectations after missing the mark last time around.

WULF has grown its BTC mining capacity by 45.5% year-over-year to 12.8 EH/s, while revenue was up from $35.6 million in Q2 2024 to $47.6 million.

The company also plans to add additional sites to increase capacity long-term.

Market Shift (Sponsored)

While most investors react to the noise, the smart ones stay focused on momentum building quietly in the background.

Our new report highlights seven stocks showing signs of strength — not based on speculation, but on underlying trends that matter in this environment of volatility, policy shifts, and global realignment.

These companies are positioned in sectors where demand is growing, and their fundamentals show potential for outperformance heading into the final stretch of 2025.

Don’t let uncertainty freeze your strategy.

The market never waits — and with the right guide, neither should you.

Get the full breakdown now — no cost, no catch.

[Download Your Free Report]

Trade Setup

Time frame: Swing to medium-term

Edge type: Momentum breakout

Snapshot Table

Metric | Value | Current Stance |

|---|---|---|

Price | $8.71 | Below average |

52‑week range | $2.06 - $9.30 | Below average |

Short interest | 31% | Above average |

Next catalyst | Q3 earnings |

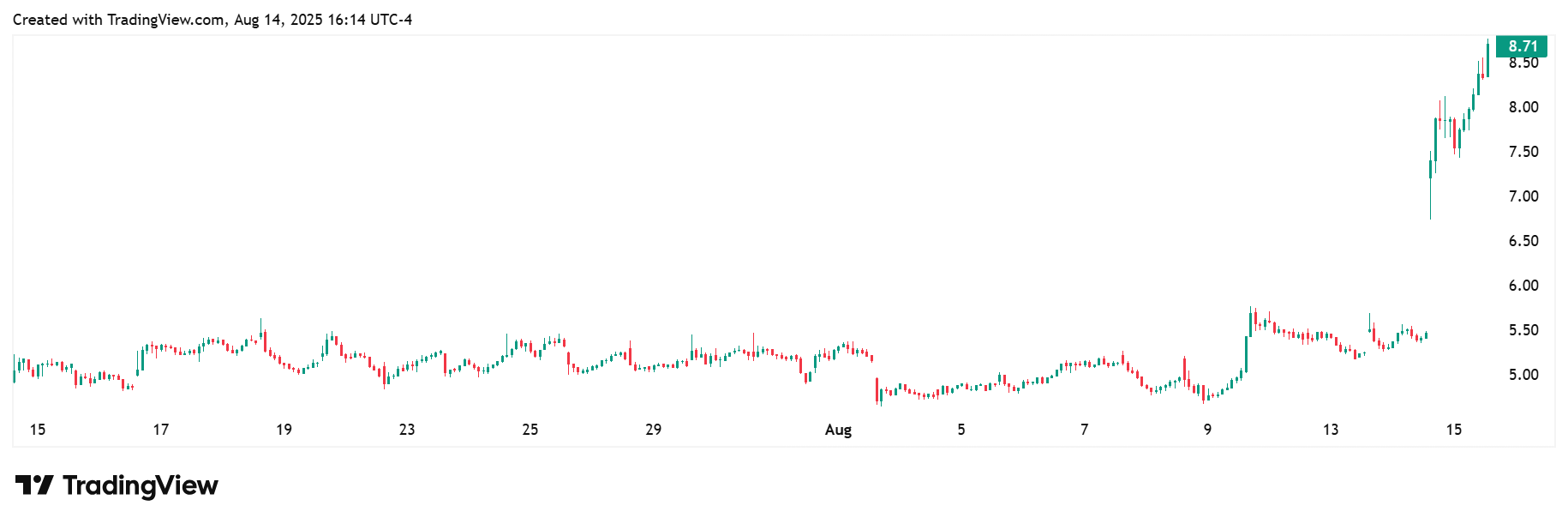

Chart

1-Month Synopsis: From mid-July to mid-August, WULF transitioned from sideways consolidation in the $6–$7 range to a breakout into the $8 territory – a gain of 53.23% for the month.

The shift was driven first by encouraging Q2 earnings, then dramatically accelerated by the transformative Fluidstack–Google deal.

This potent mix of operational improvement, strategic pivot to HPC, and Google’s implicit endorsement triggered a momentum surge and renewed institutional and retail interest.

As of August 14, the stock is up mid-teens over one month and trading at its highest level since January—signaling strong short-term bullish sentiment.

However, investors should stay alert to execution risks related to IPO deployment of HPC assets and reliance on long-term project financing.

Bull Case

Core thesis: TerraWulf develops and operates integrated, sustainably powered data centers for energy-efficient, advanced digital applications.

It is heavily involved in the crypto space.

It calls upon advanced energy infrastructure experience to create modular, efficient, and sustainable future-proof data centers, specifically to meet the needs of Bitcoin mining, AI applications, and HPC applications.

TerraWulf occupies a lucrative, strategic position at the intersection of two explosive growth markets, namely Bitcoin mining and high-performance computing (HPC) for AI workloads.

This puts WULF stock in a powerful position to drive multi-year revenue expansion and margin enhancement.

The company’s proven ability to execute at scale is underscored by its Q2 2025 results, which showed a return to positive adjusted EBITDA, stable mining output of 485 BTC despite network difficulty increases, and disciplined cost management.

Catalysts: TerraWulf has just signed a $3.7 billion, 10-year HPC co-location agreement with Fluidstack, backed by a $1.8 billion lease guarantee from Google for an estimated 8% equity stake.

This landmark deal assures WULF of a significant recurring revenue stream and gives it validation from one of the world’s most respected technology companies.

Significantly, it also diversifies TeraWulf’s business model, reducing its dependence on Bitcoin’s volatility and allowing it to tap into the secular AI/HPC demand boom.

From a balance sheet perspective, the Google-backed contract enhances financing optionality, improves creditworthiness, and may lower the cost of capital.

On the operational side, WULF's existing low-cost, 100% zero-carbon energy infrastructure provides a competitive advantage in both crypto mining and HPC hosting, appealing to ESG-focused capital pools.

Valuation upside: Current analyst price targets run from a low of $6.00 to a high of $10.00.

The average is $7.18, with WULF currently trading above that level. 9 of 10 analysts give this stock a ‘Buy’ rating.

Technical tailwind: WULF’s recent breakout from the $6–$7 consolidation zone, on record volume, suggests substantial institutional accumulation and sets the stage for momentum-driven upside.

Stock Surge (Sponsored)

The new administration is already disrupting markets—and investors are watching closely.

A new report identifies 6 unexpected stocks that could surge as policy and spending shift.

These picks share traits with past winners like First Solar (+196%) and Amplify ETF (+277%) post-election.

The full list is available now, free

[Click here to access “Presidential Profits” instantly.]

Bear Case

Key risk: The primary risk to the WULF bull thesis is execution risk on the Fluidstack–Google HPC deal.

While the $3.7 billion, 10-year agreement promises transformative revenue, the business must rapidly scale HPC infrastructure—an undertaking that demands substantial capital expenditure, complex technical integration, and precise delivery timelines.

Any delays, cost overruns, or underperformance could erode the expected cash flows, potentially triggering contractual penalties or loss of client confidence.

Additionally, over-reliance on two volatile revenue streams—Bitcoin mining and AI/HPC hosting—introduces correlated downside risk.

A sharp decline in Bitcoin prices, increased network difficulty, or unexpected shifts in AI/HPC demand could materially compress margins.

The Google lease guarantee reduces counterparty risk but does not insulate the company from operational missteps, energy price spikes, or regulatory changes targeting crypto mining and data centre energy usage.

In a worst-case scenario, missed execution targets could force WULF into dilutive equity raises or higher-cost debt, undermining shareholder value.

Macro/sector headwinds: WULF’s two major markets – crypto mining and energy-intensive data centers – are increasingly subject to growing scrutiny around carbon emissions, water usage, and e-waste.

This could lead to more stringent regulations and increased costs. Trade tensions could also impact progress if data center and tech infrastructure growth is stemmed as a result.

Competitive threat: Crypto mining rivals such as Marathon Digital and Riot Platforms have much deeper pockets and broader reach, giving them greater resilience and preferential access to long-term, low-cost power agreements.

In the HPC/AI hosting space, hyperscalers such as Amazon Web Services and Microsoft Azure already dominate enterprise AI workloads.

These competitors benefit from strong brand recognition, global reach, and well-established enterprise sales pipelines, which could make it harder for TeraWulf to win and retain marquee HPC clients beyond the Google-backed deal.

Crowded-trade concern: Since early 2025, investors have been piling into Bitcoin miners with AI pivot stories creating a highly correlated sector where sentiment swings rapidly based on Bitcoin price moves, AI infrastructure headlines, or macro tech trends.

For WULF, the Google-backed HPC deal has turbocharged interest, but if multiple miners announce similar AI data-center partnerships, the perceived uniqueness could fade, eroding the premium currently baked into the share price.

Quick Checklist

✅ Thesis still valid after today’s close

✅ Volume confirms move above key levels

✅ Catalyst date double-checked (August 14, 2025)

Deep‑Dive Links

That’s all for today’s Everyday Alpha. We’ll have a new pick for you every morning before the market opens, so stay tuned!

Best Regards,

—Noah Zelvis

Everyday Alpha