- Everyday Alpha

- Posts

- Flying Under the Radar with Room to Climb

Flying Under the Radar with Room to Climb

South America's biggest carrier is finally flying with clearer skies and a steadier hand at the controls.

Demand is strong, margins are improving, and the stock's climb still feels early rather than overdone. Do you have a reservation?

Upgrade Today (Sponsored)

From extended trading windows to advanced screening tools and low-cost order execution, today’s brokers offer far more than the basics.

The gap between “entry level” and “next level” has never been smaller.

If you’re hungry for more flexibility and better tools, this is where the edge starts.

SEE HOW THEY STACK UP

Never Miss a Stock Alert Again!

We now send our daily picks via text too — so you’ll get the same high-conviction ideas, even if you miss the email.

LATAM Airlines Group S.A.

December 11 – Pre‑market

Ticker: LTM | Sector: Airlines/Industrials | Market Cap: ~$15.8B

30‑Second Take

LATAM is finally flying with clearer skies after years of turbulence.

Passenger demand across South America is humming, international routes are filling up, and the carrier’s post-restructuring discipline is starting to show up in the numbers.

With costs stabilizing and travel appetite across the region looking surprisingly resilient, LATAM feels like an airline that has quietly upgraded from basic economy to something much closer to premium.

Investors are beginning to notice the smoother ride, but there’s still space in the overhead bins for early believers.

Trade Setup

Timeframe: Long-term, allowing LATAM's post-restructuring efficiencies, network expansion, and regional demand strength to play out fully.

Edge type: Fundamental re-rating driven by improving margins, disciplined capacity management, and a healthier balance sheet that still feels underappreciated by the market.

Early Advantage (Sponsored)

A rapid acceleration in AI deployment across the U.S. is creating fresh opportunities for forward-looking investors.

A free breakdown uncovers 9 companies demonstrating measurable growth and deep alignment with this next wave of AI demand.

These aren’t speculative plays—they are firms with proven traction and expanding AI footprints.

Early movers may see the greatest advantage.

Download the Free Report

Trivia: Which commodity is most traded by volume globally? |

Snapshot Table

Metric | Value | Current Stance |

|---|---|---|

Price | $52.12 | Below average |

52‑week range | $26.18 - $52.72 | Below average |

Short interest | 0.88% | Below average |

Next catalyst | Route expansion plans |

Chart

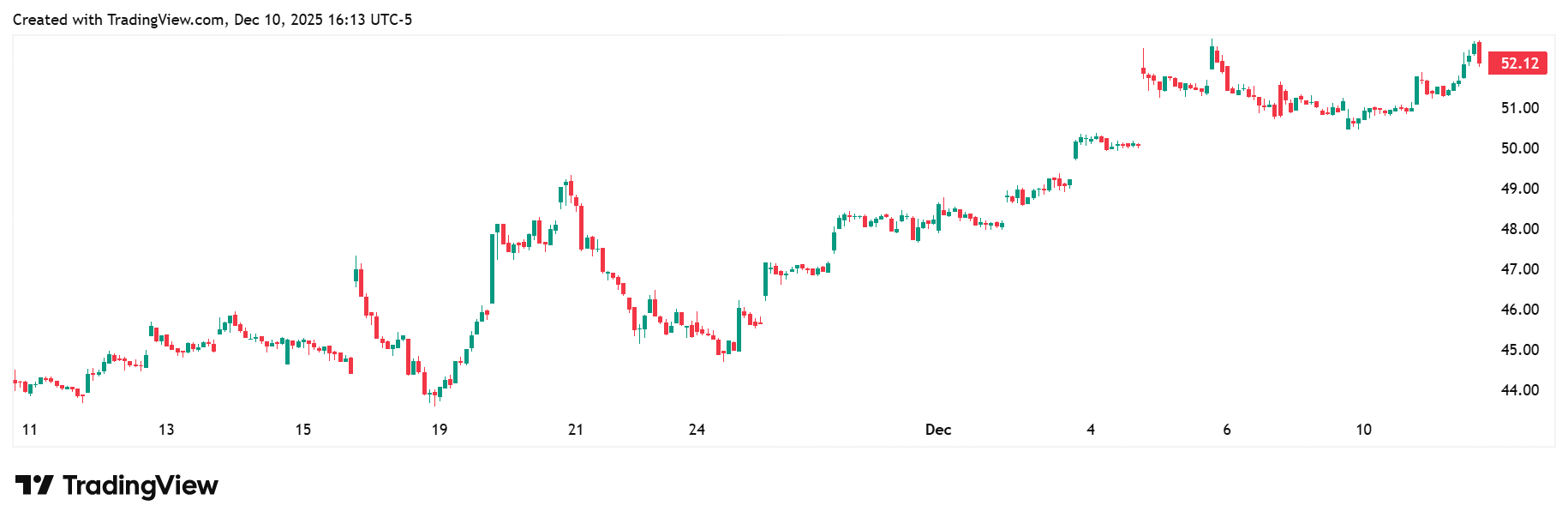

1-month trading summary: LATAM has been cruising at a steady climb this past month. It's up more than 17 and comfortably holding altitude near the top of its 52-week range.

After a brief mid-month turbulence patch, the stock found its wings again and has been gliding higher into December.

Momentum looks healthy, buyers are stepping in on dips, and the share price is now flirting with fresh highs as we taxi toward earnings in late January.

This is an airline chart that finally feels like it's flying with a tailwind rather than fighting crosswinds.

Bull Case

A regional giant finally getting paid for its miles: LATAM is taking shape as the airline that figured out how to turn South America’s booming travel appetite into real, repeatable profitability.

Passenger demand across the region is strong, premium cabins are filling up faster than expected, and the company's post-restructuring discipline is showing up in healthier margins and a tighter, smarter network.

Add in steady international recovery, improving yields, and a balance sheet that no longer feels like a storm threat, and you get a carrier with real operating leverage.

LATAM doesn’t need heroic assumptions to work.

It just needs to keep flying the plan it has been quietly executing, and the market may realize it has been underpricing this turnaround’s altitude.

Now boarding for sunnier skies: International travel into and out of South America keeps gaining altitude, and LATAM is one of the best-positioned carriers to capture that traffic.

Capacity discipline, combined with strong load factors, can drive margin upside if demand holds through the Southern Hemisphere summer.

Fuel prices easing off their highs offer another welcome assist. Partnership momentum, especially on long-haul routes, should continue to boost connectivity and yields.

And with earnings landing in late January, even a modest beat or confident outlook could give the stock another bump up the jet bridge.

Price targets: There’s a range of targets on deck, running from a low of $39.00 to a high of $70.00.

A chart that’s boarding early: LATAM is trading near the top of its 52-week range with a clean, steady uptrend over the past month.

Buyers are stepping in on soft days, momentum indicators are leaning positive, and the stock is holding above short-term support.

It's the kind of setup that suggests the path of least resistance is still higher.

Bear Case

Execution hiccups at cruising altitude: LATAM's turnaround depends on disciplined capacity management, steady margin improvement, and keeping costs on a tight leash.

Any stumble, whether from integration challenges, operational disruptions, or softer-than-expected yields, could quickly shake investor confidence.

With expectations quietly rising, even minor missteps could feel like hitting unexpected turbulence.

A busy regional runway: LATAM shares the skies with a lively mix of rivals. Azul brings agile domestic strength in Brazil, Avianca is sharpening its regional footprint, and Gol remains scrappy despite balance sheet baggage.

Internationally, the US majors and European carriers continue to lean into long-haul traffic.

LATAM still feels like the most significant and most coordinated player in the departure hall, but it’s flying in a crowded airspace where every carrier is chasing the same surge in demand.

When the weather turns: Airlines are still at the mercy of macro crosswinds. A spike in fuel costs, a slowdown in regional demand, or currency volatility across South America could quickly pinch margins.

LATAM's recovery story is real, but it's also fragile and exposed to variables the company can't fully control.

Not quite an overbooked flight: LATAM's rally has caught some attention, but positioning still feels far from packed.

The story remains more quietly appreciated than a fan-favorite.

If momentum traders pile in after the next earnings print, the trade could get busier, but for now, this still looks like an aisle seat with room to stretch.

Quick Checklist

✅ Thesis still valid after today’s close

✅ Volume confirms move above key levels

✅ Catalyst date double-checked (December 10, 2025)

Deep‑Dive Links

That’s all for today’s Everyday Alpha. We’ll have a new pick for you every morning before the market opens, so stay tuned!

Best Regards,

—Noah Zelvis

Everyday Alpha