- Everyday Alpha

- Posts

- Buckle Up: This Travel Stock with a Head for Heights is Reaching New Altitudes

Buckle Up: This Travel Stock with a Head for Heights is Reaching New Altitudes

Hello and welcome to Everyday Alpha, the daily newsletter showcasing a different stock opportunity every day the market is open. We give you laser-focused content to save you time and energy so you can make educated investment decisions quickly.

Never Miss a Stock Alert Again!

We now send our daily picks via text too — so you’ll get the same high-conviction ideas, even if you miss the email.

Joby Aviation, Inc

July 20 – Pre‑market

Ticker: JOBY | Sector: Airports and Air Services | Market Cap: ~ $15.3B

30‑Second Take

Why now? Joby Aviation has been on quite a ride lately, and with momentum giving it wings (quite literally), now is the ideal time to consider this high-risk, high-reward daredevil.

We say daredevil because the electric air taxi maker is betting big on future commuting taking place in the skies rather than on the sidewalks.

It just announced plans to double the size of its facility in Monterey Bay, California, and boost production at its revamped manufacturing space in Dayton, Ohio.

The firm has also expanded its test flight program and will add new aircraft to its fleet. All this despite its commercial operations start date not scheduled to take off until Q1 2026.

Its gamble on airborne taxis is paying off with a 10.45% gain on a single day last week. Stock prices are taking off right now, but it’s not too late to add your name to the list.

Fresh Insights (Sponsored)

As we dive into Q2 2025, the stock market is buzzing with opportunities, and I’ve got the insider scoop just for you.

I’ve handpicked the Top Seven Stocks for this quarter, offering you a clear roadmap for growth as the year progresses.

Here’s what makes this guide indispensable:

High-Growth Sectors: Key industries poised to boom this summer.

In-Depth Analysis: Simplified insights to make wise investment decisions.

Expert Picks: Data-driven, not just guesses, for reliable potential.

Profit-Boosting Opportunities: Position your portfolio for a strong finish in 2025.

This isn’t merely a list; it’s your chance to seize the market’s hottest opportunities before they pass you by.

Trade Setup

Time frame: Swing to long-term

Edge type: Momentum breakout

Snapshot Table

Metric | Value | Current Stance |

|---|---|---|

Price | $17.78 | Above average |

52‑week range | $4.66 - $18.33 | Above average |

Short interest | 14.24% | Average |

Next catalyst | Q2 earnings, expected early August |

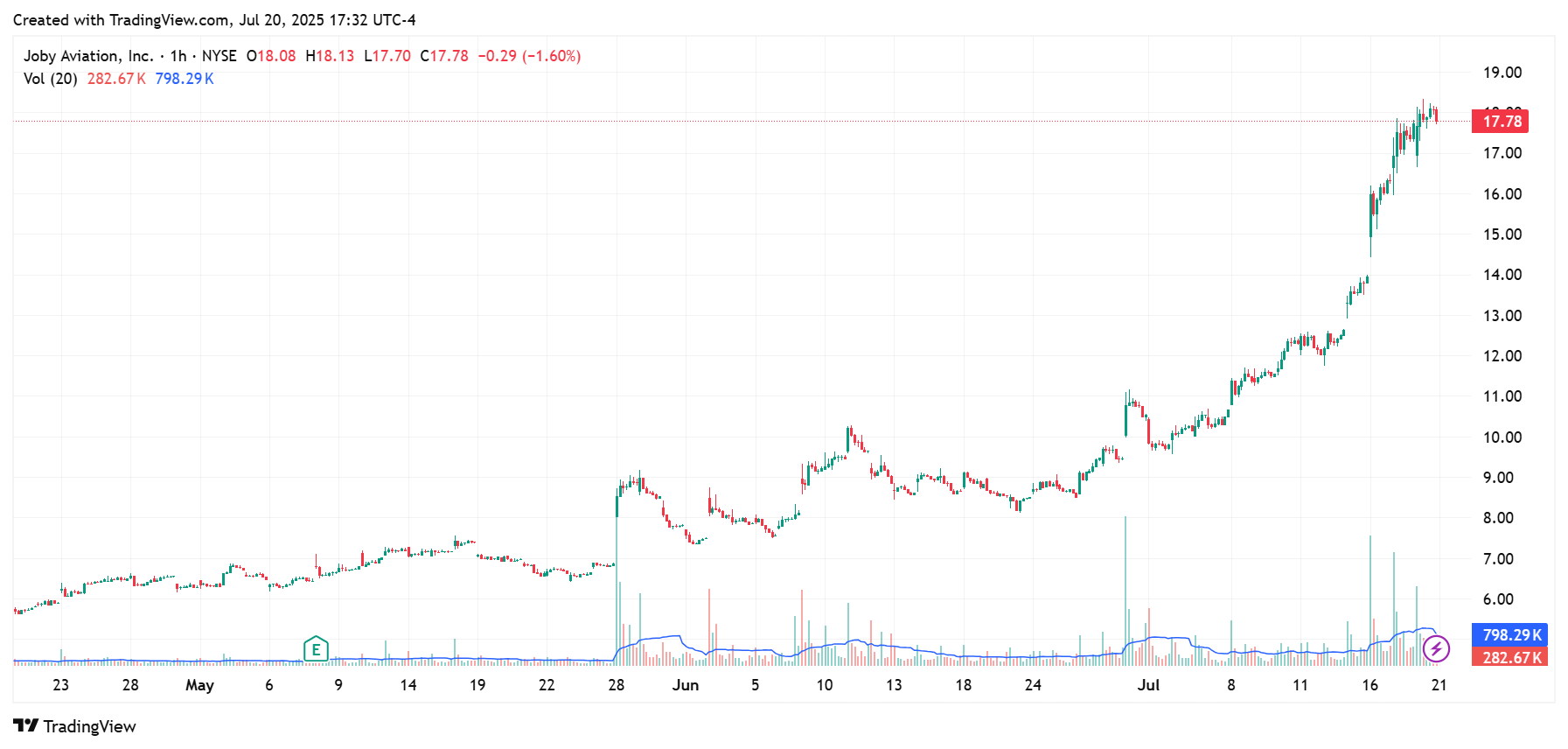

Chart

5-Day Synopsis: The most recent trading sessions have seen JOBY stock making significant forward progress.

It has added a staggering 50.62% to its value within the last five days, fueled by news of its manufacturing uplift.

The stock has quickly emerged as the darling of investors and Wall Street analysts, with substantial gains in the books as it invests heavily in an urban transport revolution.

Bull Case

Core thesis: Based in America’s tech heartland, this California firm is a forerunner in the air taxi space.

It is building a fleet of quiet, all-electric aircraft that can take off and land vertically, allowing for transit via air rather than congested freeways or city streets.

Its aircraft are designed with a range of 100 miles, allowing for short and medium-distance journeys, and it has already cemented partnerships with heavy hitters, including Toyota, Delta, and Uber.

In 2026, it will begin trials in Dubai in conjunction with the emirate’s Roads and Transport Authority.

It has already delivered its first aircraft to the UAE and has successfully completed multiple piloted, vertical-takeoff-and-landing wingborne flights as it gears up for a full launch.

Catalysts: JOBY stock prices have gone wild in recent days after the firm announced plans to expand its current manufacturing facilities.

Successful test flights in Dubai have also further buoyed investor sentiment.

While it may seem like a futuristic concept, urban air transport is gaining traction in many global cities as a means of achieving more sustainable urban mobility solutions for growing populations.

JOBY stock has gained more than 105% in the last month alone, with a growth exceeding 126% in the last six months.

Valuation upside: The accelerated pace of JOBY’s progress has caught analysts unaware. It is currently trading at $18.09, significantly higher than its most recent high price target of $13.00.

Technical tailwind: The major steps Jobs is taking towards full commercialization of its aircraft are indicative of the level of demand that exists for air taxis worldwide.

Technical signals are accordingly bullish, with the stock trading above the 20-, 30-, 50-, 100-, and 200-day moving averages.

Volumes are also around double the average, indicating high levels of interest and a high possibility of further moves to the upside.

Next AI Boom (Sponsored)

While headlines focus on the same overhyped AI names, a bigger opportunity is taking shape — and it’s flying under the radar.

A new report reveals 9 AI companies with real U.S. operations, accelerating revenue, and deep AI integration. These aren’t speculative plays — they’re positioned to benefit from a massive shift in how and where AI is being built.

This free guide includes:

A chip supplier poised to fuel U.S. AI manufacturing

A cloud provider set to expand under new policy changes

A data firm with potential government contracts on deck

The early window on these opportunities may be closing — now’s the time to see what’s coming next.

Bear Case

Key risk: While Joby is making exciting moves, cementing strategic partnerships, and succeeding in test flights, urban air travel is still very much in its early stages.

Although it has been operational since 2009, Joby hasn’t yet managed to generate substantial revenue and continues to burn cash due to necessary investments in development, testing, and manufacturing.

Its key risk comes from the infancy of the sector; FAA approval, infrastructure rollout, and market adoption aren’t a given, and any hiccup in those areas could delay revenue generation and elevate risk.

Macro/sector headwinds: Wider economic patterns such as high interest rates and the fallout from changing trade tariff policy could throw some turbulence in Joby’s direction.

Competitive threat: Joby is by no means the only company seeking to make waves in the air taxi space. Archer Aviation is a key competitor targeting the same market.

Its Midnight aircraft is designed to conduct rapid back-to-back flights, and it also plans to launch in Dubai next year.

Crowded-trade concern: The low-altitude air taxi sector is still unproven.

While it has won some regulatory battles and has been warmly received by many countries, it remains highly volatile and unproven.

Any teething issues, such as aircraft delays or failures, along with a slow pace of infrastructure development, could quickly undermine sentiment.

Quick Checklist

✅ Thesis still valid after today’s close

✅ Volume confirms move above key levels

✅ Catalyst date double-checked (July 19, 2025)

Deep‑Dive Links

That’s all for today’s Everyday Alpha. We’ll have a new pick for you every morning before the market opens, so stay tuned!

Best Regards,

—Noah Zelvis

Everyday Alpha