- Everyday Alpha

- Posts

- Battery Breakthroughs and Big Gains: Could This Red Hot EV Stock Power Up Your Profits?

Battery Breakthroughs and Big Gains: Could This Red Hot EV Stock Power Up Your Profits?

Hello and welcome to Everyday Alpha, the daily newsletter showcasing a different stock opportunity every day the market is open. We give you laser-focused content to save you time and energy so you can make educated investment decisions quickly.

Never Miss a Stock Alert Again!

We now send our daily picks via text too — so you’ll get the same high-conviction ideas, even if you miss the email.

QuantumScape Corporation

July 22 – Pre‑market

Ticker: QS | Sector: Auto Parts | Market Cap: ~ $7B

30‑Second Take

Why now? QuantumScape is pushing the needle on electric vehicle (EV) technology with innovations that dial in improvements in areas such as safety, range, and charging speed.

It has secured lucrative industry partnerships and has been running red hot throughout July with a huge price rally and nine successive days of gains.

Until the last few hours, you may have been feeling like you’d missed the boat, as QS has been one of the hottest stocks.

Its nine-day bull run came to an end on Monday. In a tale as old as time the stock has become a victim of its own success, with profit-taking and overbought signals leading to a sharp pullback.

This depression is likely temporary, though, with the factors pushing this month’s nine-day hot streak almost certain to be a focal point of Wednesday’s eagerly awaited Q2 earnings call.

Positive results could well trigger another run to all-time highs, making right now a pivotal moment for your portfolio.

Fresh Insights (Sponsored)

As we dive into Q2 2025, the stock market is buzzing with opportunities, and I’ve got the insider scoop just for you.

I’ve handpicked the Top Seven Stocks for this quarter, offering you a clear roadmap for growth as the year progresses.

Here’s what makes this guide indispensable:

High-Growth Sectors: Key industries poised to boom this summer.

In-Depth Analysis: Simplified insights to make wise investment decisions.

Expert Picks: Data-driven, not just guesses, for reliable potential.

Profit-Boosting Opportunities: Position your portfolio for a strong finish in 2025.

This isn’t merely a list; it’s your chance to seize the market’s hottest opportunities before they pass you by.

Trade Setup

Time frame: Swing to medium-term

Edge type: Momentum breakout

Snapshot Table

Metric | Value | Current Stance |

|---|---|---|

Price | $12.52 | Above average |

52‑week range | $3.40 - $15.03 | Above average |

Short interest | 14.33% | Average |

Next catalyst | Q2 earnings, due Wednesday July 23. |

Chart

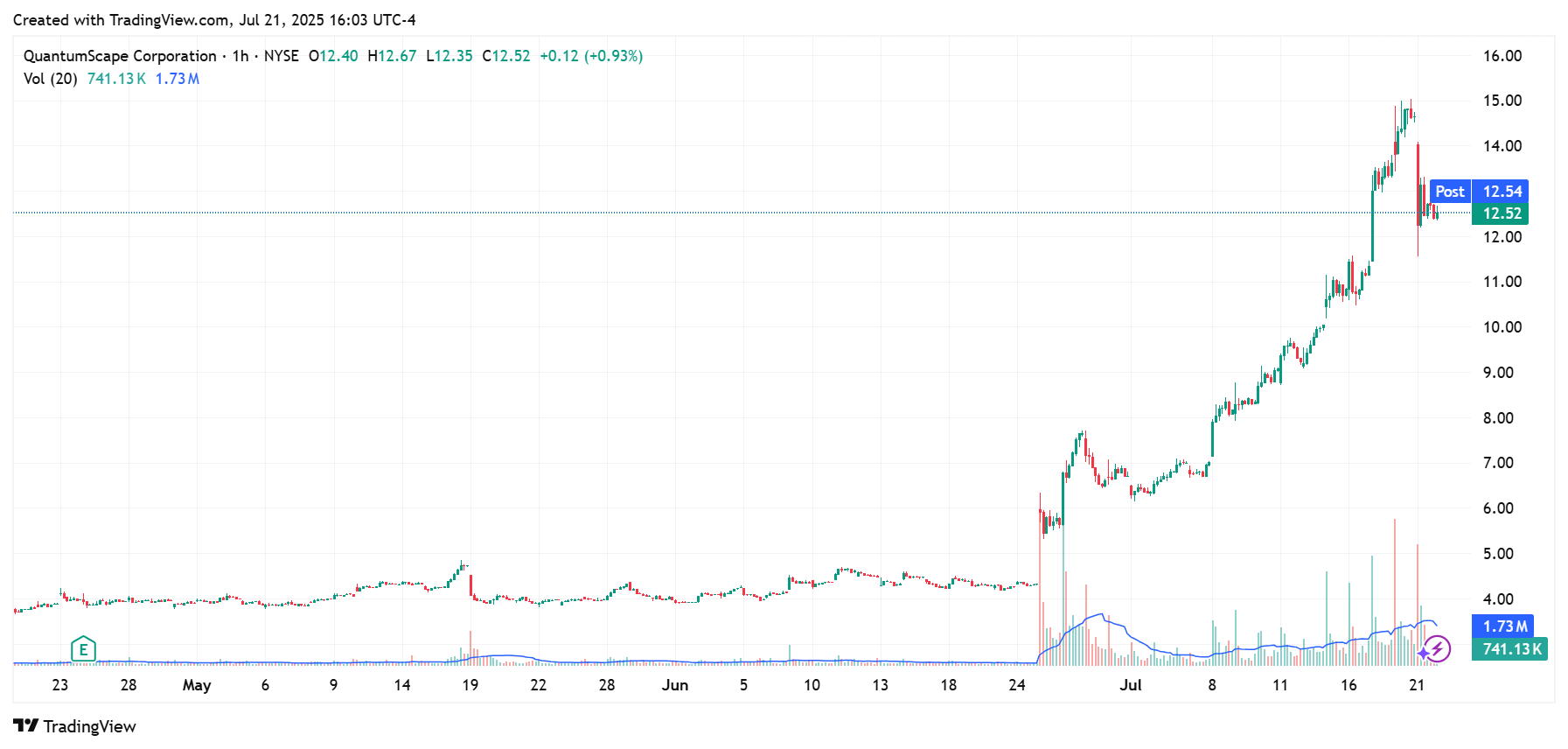

5-Day Synopsis: Rollercoaster ride seems a little inadequate when it comes to explaining how the last five trading sessions have played out for QuantumScape.

The EV battery maker started the week on an incredible run of gains. It had sustained a bull rally for nine consecutive days before collapsing on Monday with losses of 13.08%.

The fact that the five-day gains still stand at 25.32% in the green even after the price correction gives you some indication of just how in demand QS stock has been.

After hitting a new all-time high on Friday, Monday saw the dream become a nightmare. The rapid gains triggered overbought signals, prompting short-term investors to cash in.

With volumes almost four times higher than the average and Q2 results due in a matter of hours, QuantumScape is still the name on everyone’s lips.

Bull Case

Core thesis: QuantumScape has created a bold vision for the future of electric vehicles through its pioneering work in solid-state battery technology.

Unlike conventional lithium-ion batteries, QuantumScape’s solid-state cells promise greater energy density, faster charging, improved safety, and longer lifespan.

Each of these promises is a critical factor for the next generation of EVs.

Backed by Volkswagen and boasting a portfolio of proprietary innovations, QuantumScape is positioning itself as a foundational player in the EV supply chain.

While still pre-revenue, the company is making steady progress toward commercialisation, with its prototype cells already demonstrating significant technical milestones.

Catalysts: QuantumScape may be pre-revenue, but it has ambition and capability by the truckload.

Last month, the San Jose-based startup revealed that its new “Cobra” ceramic separator process had reached baseline cell production.

This innovation marks a major step forward, delivering a 25x increase in heat-treatment speed compared to its earlier “Raptor” method, while also requiring significantly less space for production.

This milestone demonstrates that QuantumScape is successfully moving its solid-state battery technology from lab-based research and development toward a new era of scalable, commercial manufacturing.

For long-term investors with a high-risk tolerance, QS represents a potential ground-floor opportunity in a battery revolution that could redefine global transportation.

If QuantumScape can scale production and deliver on its promise, the payoff could be transformative, not just for the company, but for early shareholders who have bet on the future of clean energy mobility.

Valuation upside: This surging EV stock’s progress has caught analysts on the back foot with the current high price target set at a modest $8.00, more than $4.00 below current price levels.

The minimum target is $2.50.

Technical tailwind: Q2 earnings are set to be released on Wednesday and could power the battery maker into another bull rally.

Next AI Boom (Sponsored)

While headlines focus on the same overhyped AI names, a bigger opportunity is taking shape — and it’s flying under the radar.

A new report reveals 9 AI companies with real U.S. operations, accelerating revenue, and deep AI integration. These aren’t speculative plays — they’re positioned to benefit from a massive shift in how and where AI is being built.

This free guide includes:

A chip supplier poised to fuel U.S. AI manufacturing

A cloud provider set to expand under new policy changes

A data firm with potential government contracts on deck

The early window on these opportunities may be closing — now’s the time to see what’s coming next.

Bear Case

Key risk: As with any startup, especially in the tech space, the key risk lies in execution.

While QuantumScape has shown promising lab results and achieved limited prototype success, it is yet to produce batteries at commercial volume.

Scaling from single-layer or small-cell demos to multi-layer, auto-grade cells is technically and operationally complex, with no guarantee of success.

Macro/sector headwinds: There’s a fair degree of policy uncertainty surrounding EVs in general.

It’s unclear if driver incentives will be phased out, but if incentives to switch are removed, EV demand could soften.

There are already signs that adoption is slowing, and trade tariffs on battery-critical minerals like graphite, nickel, and cobalt could make EVs even less attractive to motorists if prices rise.

Competitive threat: Companies like Toyota, CATL, and Solid Power are also chasing solid-state breakthroughs, and some may have deeper pockets or faster go-to-market paths.

If competitors launch first, QS could lose its technological edge or key partnerships.

Crowded-trade concern: Execution is critical to success, and the lack of real-world products, long runway to monetisation, and fierce competition all suggest the stock could underperform or collapse if execution falters.

Traditionally highly volatile, just one missed target, manufacturing issue, or technical failure could send stock prices spiralling.

Quick Checklist

✅ Thesis still valid after today’s close

✅ Volume confirms move above key levels

✅ Catalyst date double-checked (July 21, 2025)

Deep‑Dive Links

That’s all for today’s Everyday Alpha. We’ll have a new pick for you every morning before the market opens, so stay tuned!

Best Regards,

—Noah Zelvis

Everyday Alpha