- Everyday Alpha

- Posts

- AI’s Healing Touch: Why This Healthcare Innovator’s Dip Could Be a Hidden Opportunity

AI’s Healing Touch: Why This Healthcare Innovator’s Dip Could Be a Hidden Opportunity

Sometimes the best trades are the quiet ones. While most eyes chase the next flashy tech rally, this health data story is quietly building something much more lasting.

Is your portfolio ready for this dose of growth?

Revealed Today (Sponsored)

Your gains could be solid—but why stop there?

Analysts just released a limited-time report uncovering 5 potential breakout opportunities showing massive upside this year.

Each one was handpicked for strength and momentum.

It’s free to download—but expires tonight at midnight.

[Get your free copy before it’s gone.]

*This free resource is being sent by Zacks. We identify investment resources you may choose to use in making your own decisions. Use of this resource is subject to the Zacks Terms of Service.

*Past performance is no guarantee of future results. Investing involves risk. This material does not constitute investment, legal, accounting, or tax advice. Zacks Investment Research is not a licensed dealer, broker, or investment adviser.

Never Miss a Stock Alert Again!

We now send our daily picks via text too — so you’ll get the same high-conviction ideas, even if you miss the email.

Tempus AI, Inc.

November 06 – Pre‑market

Ticker: TEM | Sector: Health Information Services/Healthcare | Market Cap: ~$14.3B

30‑Second Take

If you’ve ever wondered what happens when cutting-edge AI meets real-world healthcare, Tempus is the name to watch.

The company is on course to build one of the most powerful data engines in medicine, turning patient data into smarter, faster diagnostics and treatment decisions.

After its strong debut earlier this year, the stock’s been showing real signs of stabilising, and the story here isn’t about hype. It’s about impact.

With AI starting to prove its worth in the clinic, Tempus looks like a play on the future of precision medicine that’s finally becoming the present.

Trade Setup

Timeframe: Long-term

Edge Type: Growth through innovation

This setup here leans heavily on the idea that Tempus is still in the early innings of commercializing its vast health data platform.

The near-term ride might have some bumps, but the bigger opportunity lies in how Tempus scales.

Look out for it as it moves from promising AI models to indispensable tools for real-world clinical decisions.

Last Chance (Sponsored)

The crypto elite are buzzing behind closed doors — and for good reason.

Twenty-seven of the most powerful insiders say what’s forming now could dwarf every bull run before it.

These are the same names who called the biggest moves years before the headlines hit.

This time, they’re breaking their silence to reveal exactly what they see coming.

Access is free — but only if you move before the window slams shut.

[Claim Your Free Ticket Now]

P.S. The last time our experts gathered like this, their insights helped countless investors position themselves before historic moves. Free spots won't last long.

© 2025 Boardwalk Flock LLC. All Rights Reserved. 2382 Camino Vida Roble, Suite I Carlsbad, CA 92011, United States

*The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Readers acknowledge that the authors are not engaging in the rendering of legal, financial, medical, or professional advice. The reader agrees that under no circumstances Boardwalk Flock, LLC is responsible for any losses, direct or indirect, which are incurred as a result of the use of the information contained within this, including, but not limited to, errors, omissions, or inaccuracies.

*Results may not be typical and may vary from person to person. Making money trading digital currencies takes time and hard work. There are inherent risks involved with investing, including the loss of your investment. Past performance in the market is not indicative of future results. Any investment is at your own risk.

Poll: You’re given $10,000 but can only use it for something irrational. What do you do? |

Snapshot Table

Metric | Value | Current Stance |

|---|---|---|

Price | $82.26 | Below average |

52‑week range | $31.36 - $104.32 | Below average |

Short interest | 22.99% | Above average |

Next catalyst | New hospital or pharma partnerships |

Chart

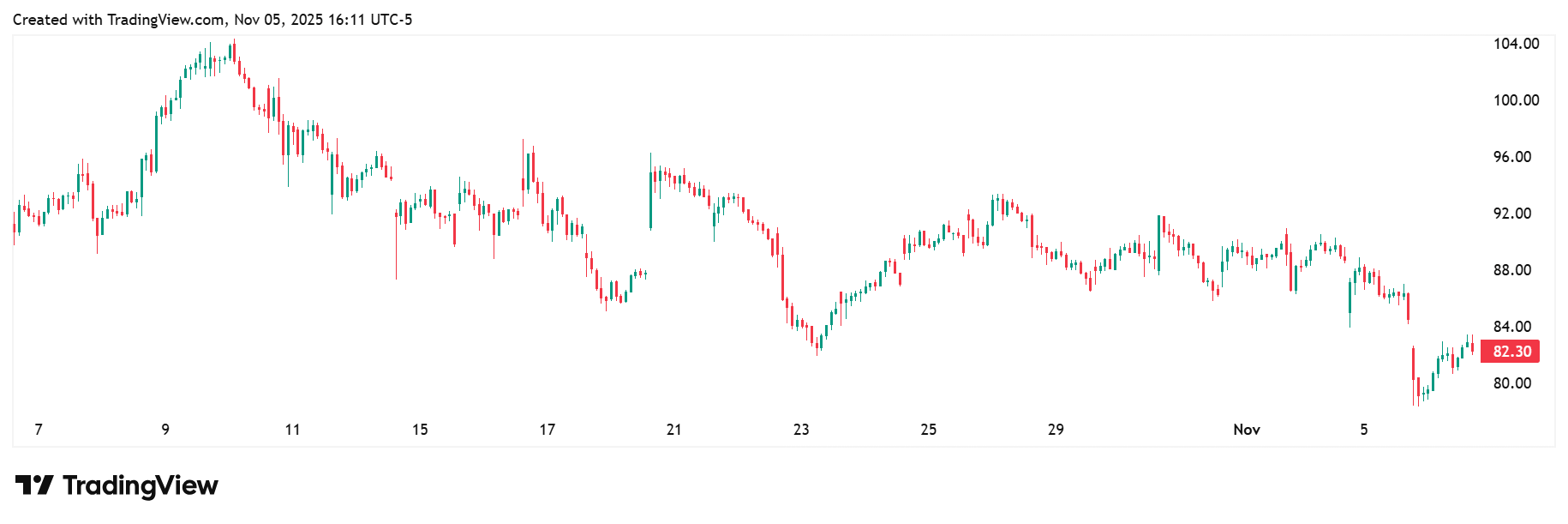

1-month trading summary: The last month has seen TEM stock drift lower by 11.4%, but that isn't entirely unexpected.

The stock is up over 141% in the year to date, so it has been running red hot for months.

A pullback was overdue, but we can take heart that the drop wasn’t about missed numbers (Q3 results actually beat expectations); the guidance was a touch cautious, as management flagged rising costs tied to the Paige AI acquisition.

That spooked a few short-term holders who had priced in perfection.

Layer on a broader tech sell-off and a little profit-taking after the summer rally, and you've got a healthy pullback rather than a broken story.

Bull Case

A data ecosystem for doctors that could save lives: Here’s the thing. Tempus isn't just another AI company with a flashy ticker. It's building a living, breathing data ecosystem that doctors actually use.

Every test, scan, and genomic sequence added to its system makes the model smarter, helping clinicians spot patterns that could literally save lives.

That kind of flywheel effect is rare in healthcare tech.

The bull case rests on scale and trust. Tempus already partners with thousands of hospitals, and each partnership deepens its moat.

More data means better models, better models attract more clients. It’s a virtuous loop that big tech can’t easily replicate.

As AI becomes more embedded in clinical decision-making, Tempus has a real shot at becoming the go-to intelligence layer for modern medicine.

A trio of catalysts is all lined up: If you're looking for reasons to stay patient here, a few good ones are brewing.

First, all eyes are on how Tempus integrates Paige AI, the digital pathology firm it just acquired.

If that rollout clicks, it could expand Tempus beyond data analytics into actual diagnostics — a move that opens the door to a much larger market.

Next up, revenue momentum. Management keeps hinting at strong enterprise demand from hospitals and pharma partners who want faster, AI-driven insights.

As those contracts turn into recurring revenue, the financial story should start to look sturdier.

And then there’s the regulatory tailwind. The FDA is slowly warming up to AI-assisted diagnostics, which could unlock a wave of approvals and adoption.

If you’ve been waiting for proof that AI in healthcare is more than a headline trend, the next few quarters could be that proof.

A mixed bag of price targets: Analysts are divided on TEM. The low sits at $60.00, but the high is almost double that at $110.00.

Gearing up for a leg higher: Tempus is starting to look ready for a bounce. The $78.00 –$80.00 range has acted like a trampoline before, and momentum indicators suggest the pullback could be losing steam.

A push above $85.00 could easily spark a fresh leg higher toward the $90s.

Bear Case

Growth above all else? The big risk here is that growth might come at the cost of profitability.

Tempus is investing heavily in data infrastructure, acquisitions, and AI model development, all of which burn cash in the short term.

If hospital spending tightens or those new platforms take longer to monetise, the market could lose patience before the payoff arrives.

Add in a still-rich valuation, and any stumble could draw a sharper sell-off than the fundamentals really deserve.

Big names chasing a bigger share of the pie: Tempus doesn’t live in a vacuum. It’s sharing the field with names like Guardant Health, Invitae, and Illumina — all chasing different slices of the precision medicine pie.

What sets Tempus apart is its focus on real-world clinical data, not just genomic sequencing.

That integration with hospitals gives it a daily feedback loop that competitors can't easily match.

Still, if larger players like Google Health or Microsoft push harder into medical AI, the competitive gap could tighten fast.

Results over hype: The broader tech and healthcare space has been on a rollercoaster. Rising rates and talk of tighter healthcare budgets are making investors jumpy about growth names.

On top of that, AI hype fatigue means the market's demanding real results, not just big visions, so Tempus will need to keep proving it can turn data into dollars quarter after quarter.

Could a hot crowd become a crowded trade? AI stocks have been a hot corner of the market, and plenty of traders have already piled in.

If sentiment turns or funds start rotating out of growth, even good stories like Tempus can get caught in the downdraft.

Quick Checklist

✅ Thesis still valid after today’s close

✅ Volume confirms move above key levels

✅ Catalyst date double-checked (November 05, 2025)

Deep‑Dive Links

That’s all for today’s Everyday Alpha. We’ll have a new pick for you every morning before the market opens, so stay tuned!

Best Regards,

—Noah Zelvis

Everyday Alpha